Filter

Contents

Iron Condor: Everything You Need To Know

Contents

What is an Iron Condor?

Overview & Setup

DEFINITION

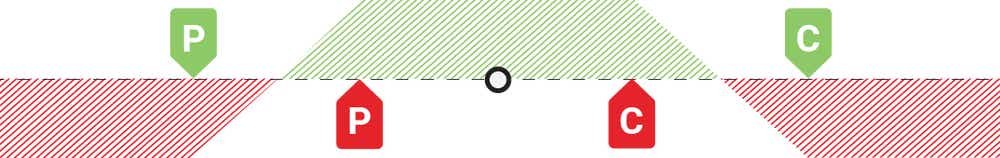

An iron condor is a directionally neutral, defined risk strategy that profits from a stock trading in a range through the expiration of the options. It benefits from the passage of time and any decreases in implied volatility.

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

PROFIT/LOSS CHART

Iron Condor Options Strategy: How Does It Work?

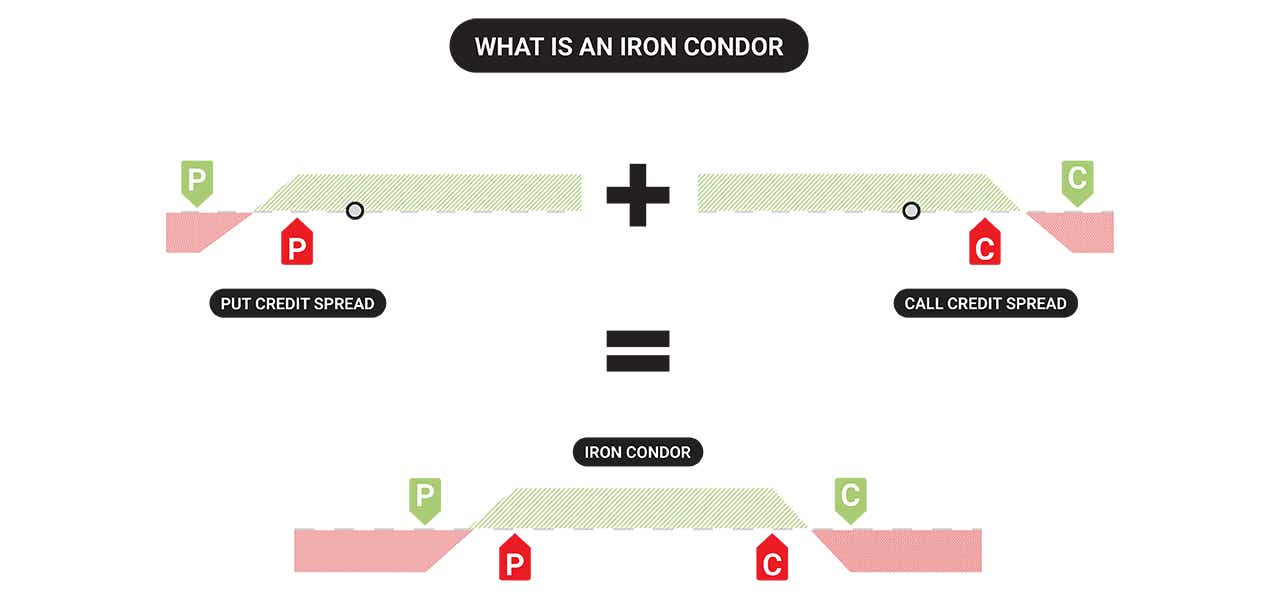

An iron condor options strategy is nothing more than an OTM short put credit spread combined with an OTM short call credit spread sold at the same time and in the same expiration cycle. Iron condors are neutral strategies because the bullish nature of our short put spread is offset by the bearish nature of our short call spread. Both hedge each other, and benefit from expiring OTM.

How an Iron Condor Works

An iron condor works just like a strangle. A short strangle is a position that is a neutral strategy that profits when the stock stays between the short strikes as time passes, as well as any decreases in implied volatility.

- It involves the sale of a bullish spread (short put spread) and a bearish spread (short call spread) at the same time

- The position profits from the stock landing between the strikes at expiration

- Since the trade position is a spread, the risk and reward are both defined on entry

- The credit received for selling the position up front is the max potential profit

- The width of the largest spread (if spread widths are different), less credit received is the max loss

- Since we are collecting a credit up front and we want our options to expire worthless, we are betting against the underlying moving past either spread by the expiration of our contracts

An iron condor uses four options at different strikes, making it a defined risk strangle:

Iron Condor Example

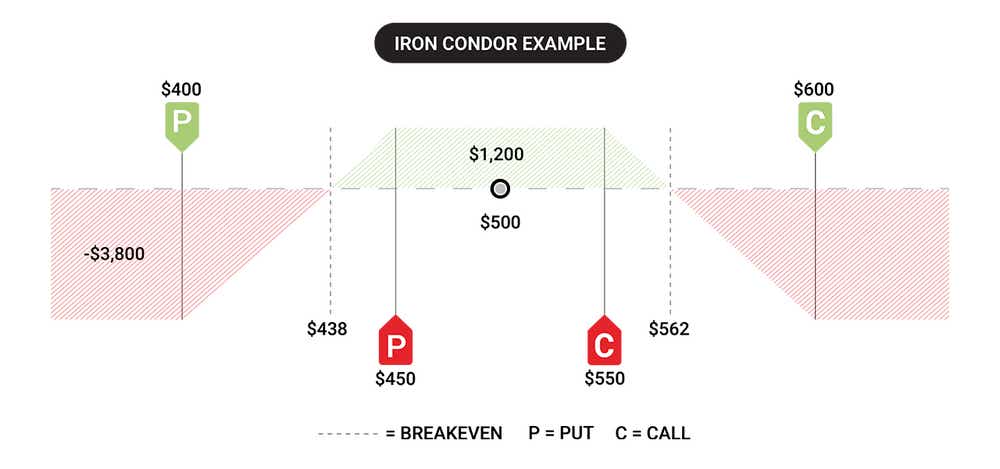

Iron condor examples are a practical way to help you grasp their setup and see exactly how the strategy performs in various scenarios. Let’s have a look at an iron condor example. Let’s say the stock price is at $500.00 and there’s 60 days till expiration. The width of the put and call spread are $50.00 wide.

To set up the iron condor position, you’ll:

- Sell the 550 call option and collect $8.00

- Buy the 600 call option for $2.00

- Sell the 450 put option and collect $9.00

- Buy the 400 put option for $3.00

The total option premium collected is $17.00 for selling the 450 put and the 550 call. While the total premium paid is $5.00 for buying the 600 call and 400 put. The net premium collected is $12.00; since you’ll collect $17.00 for the short options and paid $5.00 for the long options.

With this example, more option premium was collected from the short options than paid for the long options. This leaves you with a $12.00 net credit. ($17.00 - $5.00).

You’ll get a maximum profit if all options expire worthless and the iron condor’s value is $0.00 at expiration, which will happen if all options expire OTM. The maximum profit potential occurs at any price between $450.00 and $550.00, which is ±10% from the stock price at entry. The maximum profit potential is $1,200.00. This is calculated by the $12.00 net credit you’ll collect for selling the iron condor x 100 = $1,200.00 per iron condor sold if the value is $0.00.

The maximum loss for this trade is $3,800.00. This is calculated by the $50.00 wide max spread width (put and call spreads are the same width) - $12.00 net credit x 100 = $3,800.00 per iron condor sold.

The maximum loss potential will happen if the price is below $400.00 or above $600.00 at expiration, in 60 days (±20% stock price movement).

The lower breakeven price for this trade is $438.00. ($450.00 put strike - $11.38 iron condor credit = $438.62). The short $450.00 put will have $12.00 of intrinsic value at expiration, while all of the other iron condor options will have expired worthless. Leaving you with a trade of $12.00, the same amount you sold the iron condor for at the time of entering the trade, thus no profits or losses.

The upper breakeven price for this iron condor is $562.00. ($550.00 short call strike + $12.00 iron condor credit = $562.00). The $550.00 call option will have $12.00 of intrinsic value at expiration, while the put side will also expire worthless, exactly like with the lower breakeven.

tastylive Approach

We approach iron condors with similar entry tactics. We shoot for collecting 1/3rd the width of the strikes in premium upon trade entry. For example, if we have an iron condor with three point wide spreads, we will look to collect $1.00 for the trade. This gives us a probability of success around 67%, which is acceptable to us.

Close/Manage

WHEN TO CLOSE

Much like other standard premium selling strategies, we close iron condors when we reach 50% of our max profit. This can increase our win rate over time, as we are taking risk off the table and locking in profits.

WHEN TO MANAGE

We manage iron condors by adjusting the untested side, or profitable side of the spread. We look to roll the untested spread closer to the stock price to collect more premium. We can go as far as rolling our untested spread to the same short strike as our tested spread, which creates an iron fly.

Iron Condor Profit and Loss

Iron condors are defined risk trades where the maximum loss and profit potential are capped. Max profit is capped at the credit received up front, and max loss is limited to the width of the widest spread being ITM at expiration, less the credit received, since our long options protect the risk in our short options if the spread moves ITM.

Iron Condor Max Profit

The maximum profit potential for an iron condor is the net credit received when constructing the four-leg options positions. Maximum profit is realized when the underlying settles between the short strikes of the trade at expiration, where all options expire worthless. Iron condor traders don’t need to hold the strategy to expiration though – if they see a 50% profit where the spread is trading for 50% of the credit received up front for example, they can close the trade by simply routing the opposite order or “buying back” the iron condor using the same strikes and same expiration cycle.

Net Credit Received

Maximum profit is realized when the underlying settles between the short strikes of the trade at expiration.

How to Calculate Breakevens

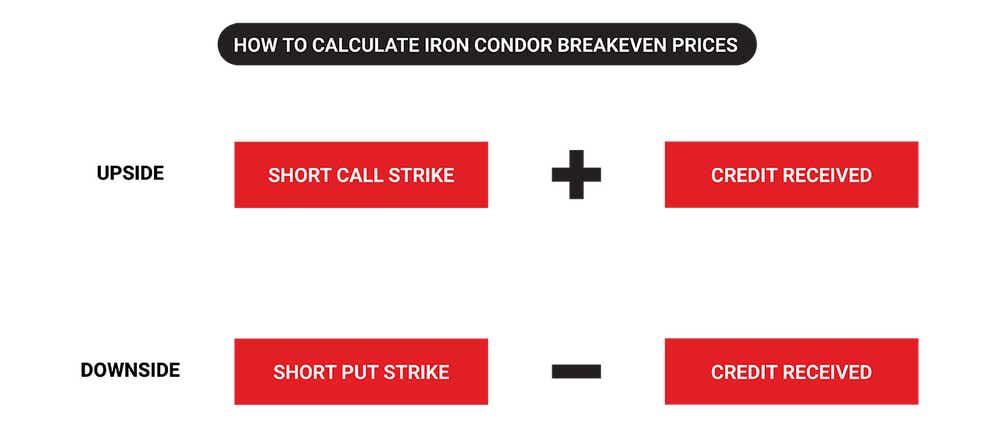

When selling options, you can use the credit received on trade entry to improve your breakevens. See the example above and how even if the short option moves ITM and takes on intrinsic value, we can offset that with the extrinsic value premium we collected up front to enter the trade and take the risk of being in it.

See how to calculate your breakevens with short options using the formula below:

Upside:

Short Call Strike + Credit Received

Downside:

Short Put Strike - Credit Received

Iron Condor Max Loss

Widest Spread - Credit Received

Maximum loss is realized when one credit spread is fully ITM at expiration - this results in the spread trading for maximum value against us (spread width), less the credit received up front.

What is a Reverse Iron Condor?

A reverse iron condor, also known as a long iron condor, is a limited risk options strategy that is entered for a net debit. You can expect a profit when there’s volatility, and the price moves significantly in either direction. It’s the exact inverse of a regular iron condor where we collect a credit up front and we are betting against the movement of a stock, where we want our strikes to expire OTM. With a reverse iron condor, we pay a debit up front and we need one of the spreads to move ITM at expiration to potentially profit by selling out of the spread for a greater value than we paid for it up front

How to construct a reverse iron condor:

- Buy 1 lower OTM put than the stock price (+1 OTM put)

- Sell an even lower strike to reduce the cost basis on the long put (-1 OTM put)

- Buy a higher OTM call strike than the stock price (+ 1 OTM call)

- Sell an even higher call strike to reduce the cost basis on the long call (-1 OTM call)

Iron Condor vs Iron Butterfly: What Are The Differences?

Even though the iron butterfly may look like the cherry on top due to the fact that it collects more extrinsic value premium upfront, it comes with a greater risk than iron condor since the breakevens are worse, and one option will almost always be ITM, meaning we should not expect to keep 100% of the credit we collected up front.

Let’s take a look at some of the main differences and similarities between the iron condor and iron butterfly:

Iron Condor

- Uses four different strike prices

- Maximum profit is the net credit received, and we will realize max profit if the stock is between our strikes at expiration

- Maximum loss is the difference between the long call and short call strikes, or the long put and short put strikes – whichever spread is wider if that applies – less the premium collected up front

- Lower risk of max loss with less profit potential

- The wings are set far OTM and this offers protection against significant moves in either direction

Iron Butterfly

- Uses three different strike prices

(short put and call share the same strike price) - Maximum profit is the net credit received, but the expectation is that this will not happen, since one short strike is almost always ITM

- Maximum loss is the difference between the long call and short call strikes, or the long put and short put strikes – whichever spread is wider if that applies – less the premium collected up front

- Higher profit potential and higher risk of max loss

- Position set closer to stock’s current price, and we assume one strike will always be ITM

Iron Condor Options Strategy Summed Up

- An iron condor is the defined risk version of a strangle with a capped max profit and loss

- An iron condor benefits from the passage of time and the options expiring OTM

- This options strategy is directionally unbiased

- An iron butterfly has more potential for profit, but it comes at higher risk with the strikes being right at the stock price

- A reverse iron condor will profit when there’s significant movement in the stock price – it’s the exact inverse of what a regular iron condor aims to achieve

FAQs

Are iron condors profitable?

Find out more about iron condor profits

How successful is an iron condor?

An iron condor is considered a strategy that can enhance your probability of success due to the fact that you can limit your risk, and you don’t need an underlying to move anywhere. It’s a high probability trading strategy and the likelihood of making money when selling an iron condor is typically greater than 50% when we sell spreads far OTM.

When would you use an iron condor?

You’d use iron condor in a neutral bias stock market, where you think the implied volatility of the market is higher than the realized volatility you may see. When selling an iron condor, you are betting against the underlying moving past your short put or short call spread.

Can I lose money on iron condor?

More info about max loss

Should I let an iron condor expire?

You can let an iron condor expire if all your options are OTM and worthless. You’ll keep all of the extrinsic value you collected upfront (minus commission) when selling the iron condor. If one of the strikes is close to moving ITM, we close the iron condor prior to expiration to avoid unwanted shares – if one strike slides ITM after the market closes, the short strike can be assigned, and you can be left with 100 shares or – 100 shares of stock. To avoid this, just close the trade prior to expiration.

When should I take profit on an iron condor?

You should take profit on an iron condor when you reach a profit target that you are shooting for. At tastylive, we shoot for 50% of max profit for OTM credit trades like iron condors, since the more profit we see, the less we can make moving forward but we hold all the risk of the initial position plus the unrealized profit on the table. Closing winners early will increase your win rate over time, as you are taking risk off the table and locking in profits.

What’s the difference between an iron condor and an iron butterfly?

An iron condor is a lower risk options trading strategy than an iron butterfly because all strikes are far OTM with lower potential reward, while the iron butterfly is higher risk with higher reward due to the ATM nature of the strikes.

Is the iron condor a safe strategy?

There is always risk with options trading, but an iron condor is one of the safer strategies since risk is defined upfront, and you control what that risk is on trade entry.

What is a reverse iron condor?

A reverse iron condor is a limited risk, limited profit options trading strategy that benefits from significant movement in the stocks’ price in any direction. You are betting on the stock moving past one of your put or call debit spreads by the expiration of the contracts:

It’s made up of:

- Buy 1 OTM put

- Sell 1 further OTM put (lower strike)

- Buy 1 OTM call

- Sell 1 further OTM call (higher strike)

How to build an iron condor?

Find out how an iron condor works

How do I roll an iron condor?

- Head to the positions tab

- Locate the credit spread legs you want to roll, left click to highlight each leg, and right-click on the highlighted position. A menu will appear, mouseover to roll strikes and select up (short puts) or down (short calls)

- You’ll be sent to the trade tab, and rolling order ticket will populate below

- Rolling up or roll down will create an order to roll into the next available strike within the same expiration cycle. You may adjust your strikes by clicking and dragging

- Adjust the price as you see fit and send the order

Supplemental Content

Episodes on Iron Condor

No episodes available at this time. Check back later!