Filter

Contents

Day Trading Strategies for Beginners

Contents

What Is Day Trading?

Day trading is the opening and closing of your trading positions within a short period, typically the same day. Also known as intraday trading, the goal of using this trading style is usually to take small profits which eventually add up to bigger gains over time.

Naturally, the aim is to rake in profits – but the possibility of incurring losses is perpetual. However, if things don’t add up for you, you could limit your losses through the signature same-day exit.

Day trading can also help you dodge costs required to keep your position open into the next day and any unfavorable overnight market movements. So, calling it a day might just mean that time is not money.

Day Trading And Overnight Positions

As per its definition, day trading means you’re holding positions for the day, ie within the same trading day or market session. But, there’s an exception; if you decide to add to a position you held overnight, keep in mind that if you decide to close any of that position the same day, it will count as a day trade.

So, why not sleep on it if you don’t want to start entirely fresh the next day?

How Does Day Trading Work?

Day trading works, ordinarily, by capitalizing on small market movements. Rapid market fluctuations, when the level of volatility is high, present more opportunities for this. With more trades per day, come increased potential for profit. But, this is also the case for possible losses.

Indeed, if the rewards are high, so are the risks.

Another aspect that affects both the profits and losses of day traders is leverage, which refers to getting full exposure while only committing a fraction of the amount. This is called margin trading. You get to open your position using only an initial deposit, but both profits and losses are increased to reflect the full value of the trade.

While day trading equities is particularly popular, you can also buy and short-sell across markets at certain brokerage firms. Further, the time limit means certain trader characteristics and skills are needed to better the chances of success. Increasing the likelihood of profiting and – in the cases where it’s a successful trade – the amount earned, a trader would need focus, dedication, fast but careful decision-making, to name a few.

Day trading is often considered to be the opposite of investment strategies, where the aim is to make profits from the sale of assets that were owned over a long time.

How To Start Day Trading

- Do your research on day trading – you can access our countless resources with research-based content for free

- Create a tastytrade account or log in (learn more about opening an account at tastytrade)

- Select the market and asset you want to trade

- Create a trading plan and manage your risk

- Open and monitor your first position

- Close your position

Best Day Trading Strategies For Beginners

Finding some of the best day trading strategies for beginners can make a world of a difference in your long-term success. So, what better way to kick off and follow through on your day trading journey than with a strategy that can guide you to success? Some popular day trading strategies include:

1. Trend Trading

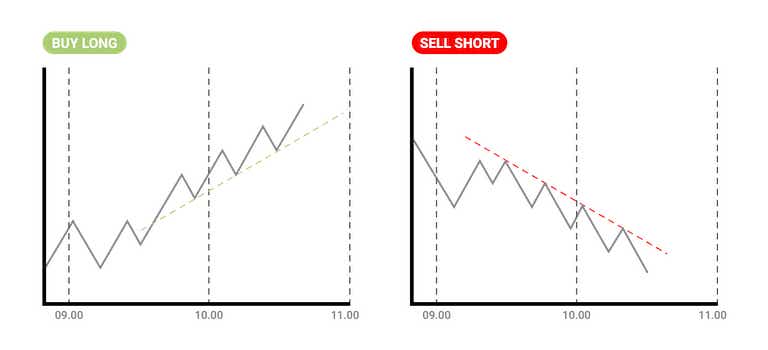

Trend trading relies on the mantra ‘the trend is your friend.’ Trend traders focus on directional price movements and take a position according to the prevailing trend. If you choose this strategy, you’d go long when there’s a general upward movement in price, and sell if it’s the opposite.

Bull markets and bear markets can present the perfect opportunity to ride the wave of the trend. While bull markets can be characterized by higher highs and lower lows over a prolonged period of time, a bear market is typically indicated by a 20% drop in price following recent highs.

But these might not affect price movements when put into context – within the space of one day. In fact, the day might fall within a market correction stage, which would mean a loss for day traders who are trying to ride the trend wave.

The good news, though, is that the trend doesn’t have to be classified as a bull or a bear market. Shorter trends could also benefit day traders.

2. News Trading

As its name suggests, news trading involves taking positions based on news stories that are likely to affect the financial markets. These often include binary events such as inventory reports, Federal Open Market Committee (FOMC) meetings, earnings announcements and elections.

Whichever market is making the headlines, any publicity is good publicity – at least for traders. If sentiments are bullish due to good news, traders can go long. Conversely, if they are bearish as a result of bad news, traders have the opportunity to go short.

News runs round the clock across various mediums such as TV channels, websites, radio stations and different social media platforms. So, day traders who opt for the news trading strategy will have no problem finding an information source of their preference.

Remember, while it’s likely for news broadcasts to have a certain impact on the markets, there’s still a chance that market performance doesn’t measure up to the expectations.

3. Scalping

Like day trading, it’s focused on the short term. Further, while it’s not a defining factor for day trading, in the case of profits, they’re also often small and come at regular intervals.

When employing this strategy it’s important to have a strict exit plan in order to cut any losses that might counteract profits. For example, one big loss can offset tens or even hundreds of small profits.

4. Mean Reversion

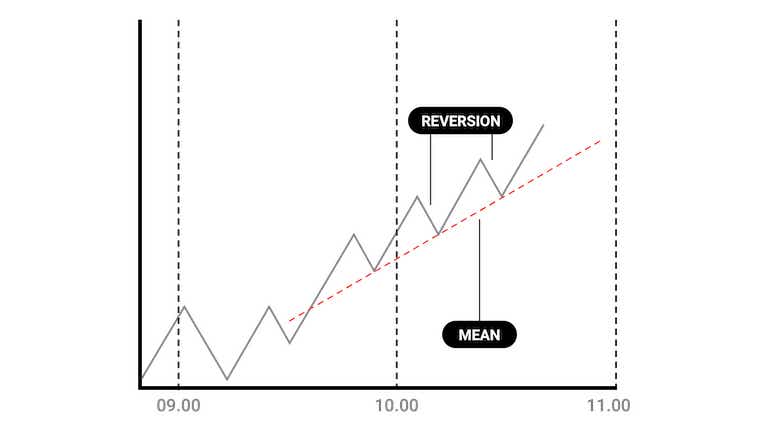

Mean reversion is focused on the theory that the price of an asset will eventually return to its historical average level. So, the trader will make decisions based on the speculation that prices will go back to that average.

Not to worry – you don’t have to be a mathematician to find the mean of an asset’s price. Technical analysis tools such moving average (MA) can be used for this – from there, you can determine how far off, whether higher or lower, the price is from the mean.

5. Money Flows

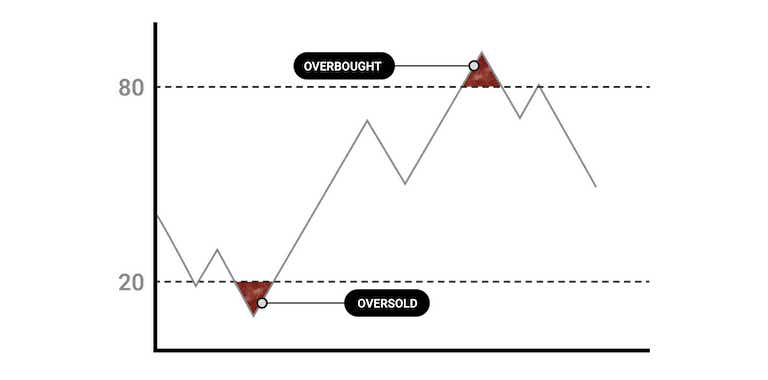

This strategy is based on the money flow index (MFI), a technical indicator that shows whether an asset is currently overbought or oversold. Instead of looking at price alone, the money flow indicator considers volume too, based on the previous day’s number of trades.

The indicator signals an asset as overbought with a reading of at least 80 – traders using the money flows strategy will sell in this case. On the other hand, an oversold market condition is reflected by a reading of 20 and below – a signal to buy.

Day Trading vs Swing Trading: What Are The Differences?

Day trading and swing trading have some notable differences, even though traders often use a technical analysis to identify patterns, trends and key price points in both.

Here are some of the differences between day trading and swing trading:

Day Trading

- Opening and closing a position, typically, on the same day

- Many positions with smaller gains or losses

- Aim to profit from small price movements

- No overnight risk where it’s a typical day trade that’s closed on the same day it was opened

- Required the same level of attention as a full-time job

- Likely to be affected by the news

Swing Trading

- A position can remain open for days or weeks

- Fewer positions with profits and losses that are bigger

- Capitalize on bigger changes in price movements

- Subject to costs for holding your position open into the next day and the risk unfavorable of market movements

- Positions can be monitored regularly or intermittently

- Impact of the news is typically less significant

Let’s take a closer look at swing trading…

SWING TRADING

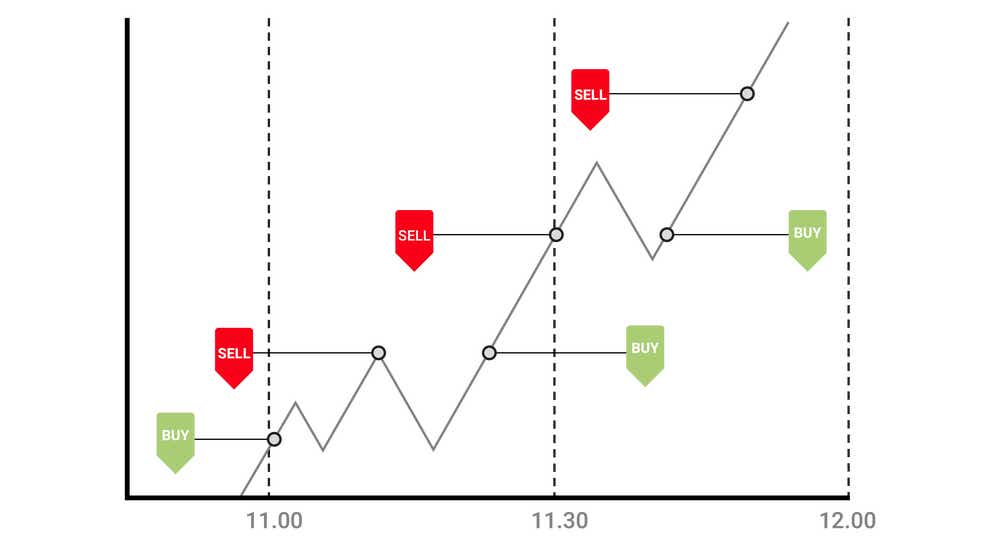

Swing trading involves holding a position for days, or weeks, in an effort to lock in profits from short- and medium-term market movements.

The assumption that an asset’s price rarely has consistent movement in the same direction at any given time rings true in most instances. Swing traders use this as their basis for decision-making – they aim to spot a pattern, watching the swings closely to choose their entry and exit points.

All this can happen in the space of a day. Even though it’s typical for traders to use this style over several days or weeks, trends can also occur within minutes or hours – making it possible to swing trade and day trade simultaneously.

Day Trading Rules

Day trading rules have been created by the Financial Industry Regulatory Authority (FINRA). In addition to regulating the practice, the rules also serve to educate traders on the significant risk that’s involved. They are called pattern day trader (PDT) rules.

PATTERN DAY TRADER RULES

It’s important to know the day trading requirements before you get started. This will depend on your account type as well as the brokerage firm where your account is held, so it's always best to confirm based on your specific situation. While cash account rules are based on good faith violations (GFV), margin accounts are subject to PDT rules. For margin accounts, these include:

- PDT applies to you if you perform over 3 trades in a rolling 5-business day period

- You need to have a minimum of $25,000 in your account before starting to day trade on any given day

- PDT rules don’t apply to futures trading or crypto trading, but both can affect whether your account meets the net liquidation requirements for PDT rules

Learn more about the pattern day trader rules (PDT)

These rules will differ from GFVs. For instance, you aren’t limited to a number of trades when using a cash account, but you can’t trade with unsettled funds.

Day Trading Summed Up

- While the definition of day trading is opening and closing positions within the same trading day, there are exceptions

- The aim of day trading is usually to make small, frequent gains through multiple positions

- This trading style can help in avoiding unfavorable overnight market movements and costs required to keep your position open into the next day

- While trading strategies can be a guide to profitability, the possibility of losses still exist

- Day trading typically occurs within the same day, whereas swing trading happens over several days or weeks – but there are instances where swing trading can be applied to day trading

- Day trading rules are in place to regulate the practice and inform traders of significant losses that can occur

Day Trading FAQs

How much money do you need to day trade?

It's always best to double check requirements at your personal brokerage firm.

As a rule of thumb, you will need enough funds in your account to cover the cost of the position plus the opening commission fee.

How do I day trade options?

You’d day trade options by opening and closing positions within the same trading day. If the predetermined price point to buy or sell an options contract is reached, you can exercise your right to take your position. If the price is not reached, you can let the option expire.

What are the rules for day trading?

The rules for day trading have been set by FINRA to ensure that the space is regulated and traders are informed of the inherent risk.

Is day trading illegal?

Nope. Day trading is legal, though it's important to keep in mind that intraday trading is regulated with a set of rules as there’s significant risk of losses involved.

Is day trading like gambling?

Day trading isn’t like gambling. Trading and investing in general requires skill and knowledge – the same applies to day trading. For example, spotting trends and finding the moving average through technical analysis can be of big help to a day trader.

But we don’t leave it to traders to find their feet and their way around trading on their own.

Can day trading make you rich?

The truth is that you can make a profit or a loss when day trading. In both cases, it can be small or big. Remember to always manage your risk appropriately.

Supplemental Content

Episodes on Day Trading

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.