Filter

ZEBRA Stock Replacement Strategy

Overview

The ZEBRA (zero extrinsic value back ratio spread) is a near-100 delta stock replacement strategy with all of the upside profit potential with a fraction of the risk compared to owning 100 shares of stock.

Put ZEBRA

DEFINITION

A bearish back-ratio spread, where we are buying two ITM puts and selling one ATM put to remove all extrinsic value and achieve 100 negative deltas. This strategy acts like a married call, since the most we can lose is the debit paid, and we have 100 shares of short stock profit potential.

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

PROFIT/LOSS CHART

Call ZEBRA

DEFINITION

A bullish back-ratio spread, where we are buying two ITM calls and selling one ATM call to remove all extrinsic value and achieve 100 positive deltas. This strategy is like a married put, the most we can lose is the debit paid, and we have 100 shares of long stock profit potential.

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

PROFIT/LOSS CHART

SETUP

Put ZEBRA

When setting up a put zebra, we are purchasing two ITM put options above the stock price and selling one ATM option to offset all extrinsic value associated with the long options. The resulting trade is a near -100 delta bearish trade that replicates 100 shares of short stock with an embedded stop-loss similar to a married call.

Call ZEBRA

When setting up a call zebra, we are purchasing two ITM call options below the stock price and selling one ATM option to offset all extrinsic value associated with the long options. The resulting trade is a near 100 delta bullish trade that replicates 100 shares of long stock with an embedded stop-loss similar to a married put.

The result is a similar setup to a married put or married call, where you are protecting your risk on 100 shares of stock by purchasing an OTM protective put or call against the shares, but the huge benefit with the ZEBRA is that you’re not paying any extrinsic value to do so:

In the example above, we obtain 97.80 deltas for $3126, compared to 100 deltas for around $54,000 if we were to buy 100 shares of SPY.

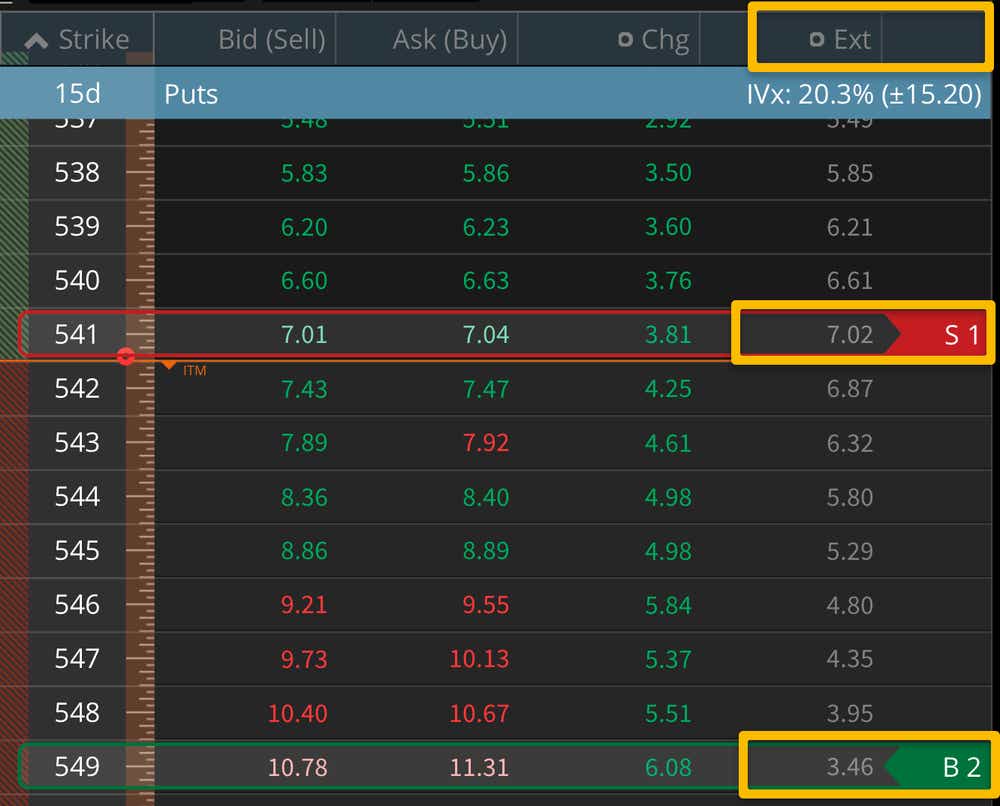

We have an embedded stop loss below the 526 call for the duration of the trade since the most we can lose on this trade is the debit paid. We pay zero extrinsic value for this stop loss with the ZEBRA if we ensure that our short option offsets the extrinsic value cost of the two long options completely as you see here with EXT being a collection of 22 cents.

With this trade, we realize all of the upside of 100 shares of stock, and we avoid disaster if the market were to meltdown.

What is a Married Put?

A married put consists of owning 100 shares of stock and “marrying” that position with a long put below the stock price. This results in a stop-loss on your shares below the put strike price, since the long put appreciates in value equivalent to 100 shares of short stock below the strike price at expiration.

The problem with this strategy long term is that you are consistently paying extrinsic value to buy the long put, where the call ZEBRA offers a similar risk profile without paying for that extrinsic value cost of the long put itself:

In the married put example above, we are putting up $27,332 to own 100 shares of stock, and we are purchasing the put to protect our risk below 526 just like the ZEBRA example. The difference here is that we are paying $2.89 in extrinsic value for that protection, and that means if the stock doesn’t move we are losing that value.

Additionally, the delta is significantly lower than 100 at 77.13, because we are paying so much for that long put option. On a rally, the put option will lose value, which temporarily eats away at our profit on the 100 shares of stock.

With the ZEBRA, we have no extrinsic value to lose if the trade is set up correctly, which is why the delta is much closer to 100.

What is a Married Call?

A married call is constructed with 100 short shares of stock and a long OTM call to protect the risk in the short shares above the long call strike:

In the example above, we are shorting 100 shares of SPY, which requires around $27,000 in buying power, and we are purchasing a call for $4.76 to protect our upside risk above 548.

Just like the call ZEBRA and married put, we can replicate the married call risk profile with a put ZEBRA, without paying for the extrinsic value associated with the long call purchase:

In this put zebra example, we are obtaining -85.49 deltas in SPY for the next 15 days, with $1527 in risk, which stops above the 548 strike. In other words, if we see a $30 move to the upside, we only realize the risk of about half that move. If we see a $30 move to the downside within 15 days, we would make about $3000 on this trade.

SKEW & ZEBRA Implications

When setting up a ZEBRA, we want to focus on the most important aspect of the trade - removing extrinsic value from the equation. When we do this, we get as close to 100 deltas as possible, and we don’t limit ourselves in profitability if we are directionally right.

If our ZEBRA slides deeper ITM on a directional move in our favor and we paid $500 in extrinsic value on the setup because we wanted a cheaper trader, we would lose that $500 in extrinsic value as we slide deeper ITM and it would dampen our profit potential. Also, if the stock doesn’t move at all, we still lose that $500 over time as extrinsic value decays to zero.

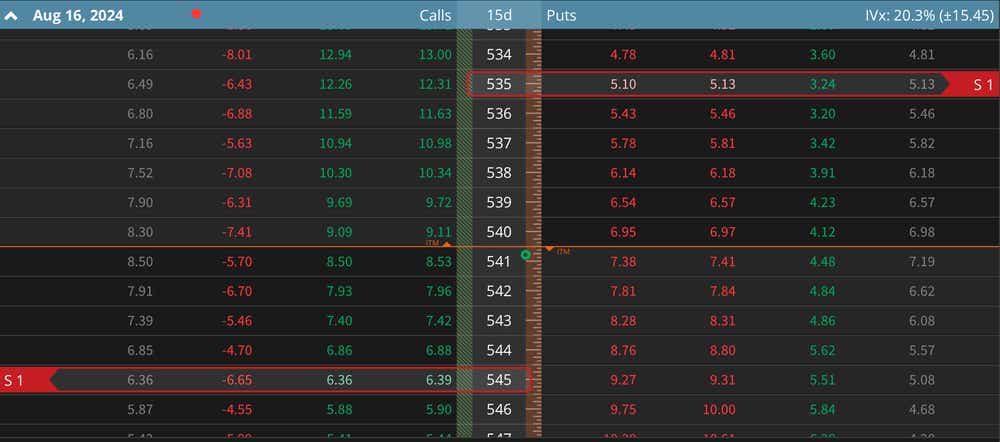

It’s important to note that SKEW will affect the entry price of the ZEBRA since we are working with extrinsic value in the options we’re trading. SKEW represents a difference in extrinsic value with equidistant OTM options and tells us where the market perceives a potential high velocity move to be. Due to heightened interest rates, SPY exhibits call skew where equidistant OTM calls are trading for a premium relative to OTM puts near the stock price. This means that call ZEBRA strategies will be more expensive to set up than put ZEBRA strategies:

As you can see in the example above, you can see that the 545 call is trading for around $6.40, where the 535 put is only trading for $5.10. Both of these options are 5 points OTM, but the call is trading for a bit more extrinsic value.

If I’m placing a call ZEBRA, I’m going to have to slide my long option deeper ITM to remove extrinsic value from the trade, which will result in a more expensive setup.

If I’m placing a put ZEBRA, I won’t have to slide my long option as deep ITM to remove the extrinsic value.

To remove extrinsic value from a ZEBRA on the setup, just ensure that the extrinsic value you’re collecting from selling the ATM option is equivalent to the TOTAL extrinsic value you’re paying for in the 2x long options you’re buying ITM. In other words, ensure the extrinsic value associated with your long strike is ½ the premium associated with the ATM option you’re selling.

HOW TO CALCULATE MAX PROFIT / BREAKEVEN(S)

MAX PROFIT

PUT ZEBRA

Unlimited

CALL ZEBRA

Unlimited

BREAKEVEN(S)

PUT ZEBRA

Short Put Strike - Any Extrinsic Value Paid

CALL ZEBRA

Short Call Strike + Any Extrinsic Value Paid

Long-Term vs Short-Term ZEBRAs

One of the big grey areas with ZEBRA stock replacement trades comes down to the expiration choice for the strategy.

The more near-term we go, the lower debit we will have to pay, and the closer our strikes will be to the stock price due to the lack of extrinsic value in near-term cycles. We don’t have to go very far ITM at all to remove all extrinsic value from the trade, and we still achieve that near 100 delta trade.

The tradeoff here is that we realize max loss much closer to the stock price, although our TOTAL max loss per trade will be significantly lower than a longer-term cycle. The more time associated with the expiration, the more the trade will feel like long stock because our debit paid upfront will be higher, the max loss will be higher, but our time to be right will be much longer than a short-term ZEBRA.

Ultimately, if the goal is to try to capture short-term movement with very limited risk, maybe a short-term ZEBRA would be our choice.

If we are trying to capture long-term taxation, or are trading a low-priced product where there isn’t much extrinsic value a few points ITM anyways, a longer-term ZEBRA may be our choice.

Supplemental Content

EPISODES ON ZEBRA

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.