Filter

How to Trade Cryptocurrency

Cryptocurrency is a marvel of the digital world. It has revolutionized online payments for millions and captivated investors’ interest with how rapidly it can grow in value. Learn how to trade cryptocurrency in this guide.

WHAT IS CRYPTOCURRENCY?

Cryptocurrency is a non-physical currency that facilitates financial transactions – you can use it to make online payments for goods and services. Also known simply as ‘crypto’, types of cryptocurrency include Bitcoin and Ether.

All cryptocurrencies are decentralized as they operate on blockchain technology. So, they’re not backed by the government or any other central authority. This means increased efficiency through factors such as cutting costs, e.g. overhead costs and transaction fees.

Cryptocurrency has been around for over ten years and has seen a general spike in value – to the delight of investors. The record of ownership of cryptocurrency is stored on a blockchain, where transactions between users’ digital crypto wallets are added.

While crypto is almost in its teen years, it’s safe to say that it’s far more volatile than the average adolescent. This means more opportunities to trade these types of financial assets.

CRYPTOCURRENCY TRADING STEPS

1. UNDERSTAND HOW CRYPTOCURRENCY TRADING WORKS

Getting a solid understanding of how cryptocurrency works is fundamental to enhancing your probability of success when trading it. Early investors had the last laugh as the value of crypto surged through the roof over the years. The grass may have been greener, but it’s important to consider current market conditions, along with possible impacting factors when making trading decisions as any cryptocurrency could always go either way.

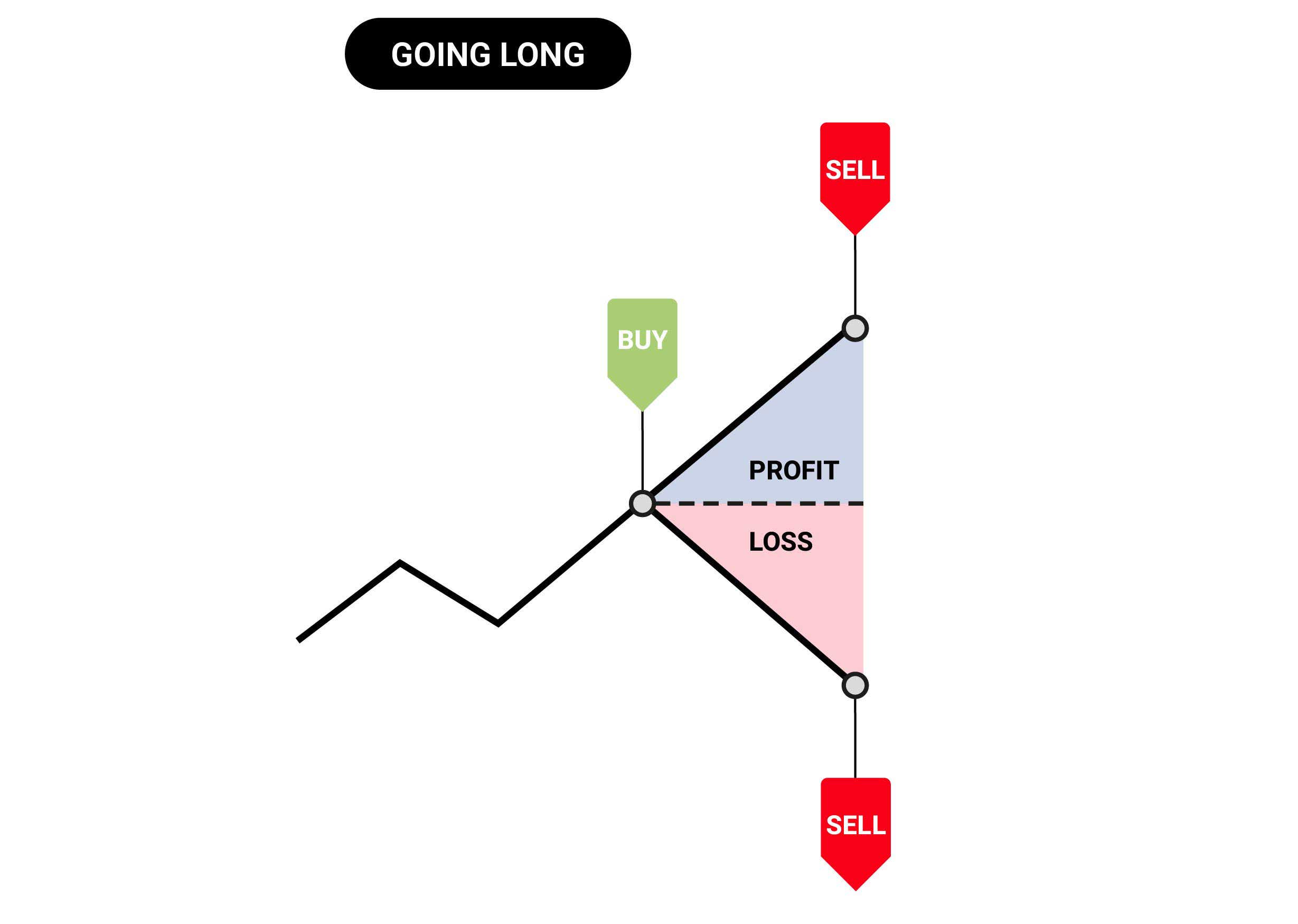

Trading cryptocurrency means that you’re speculating on the price movements of non-physical currencies. As a trader, you can go long on cryptocurrency if you think that the price will go up. You’d make a profit if you predicted the price movement correctly. But if the price moves against your position, you’d incur a loss.

Alert! If you're brand new to crypto, it may help to first have an understanding of blockchain. Learn how blockchain technology works here!

Trading Crypto

2. PICK A CRYPTOCURRENCY TO TRADE

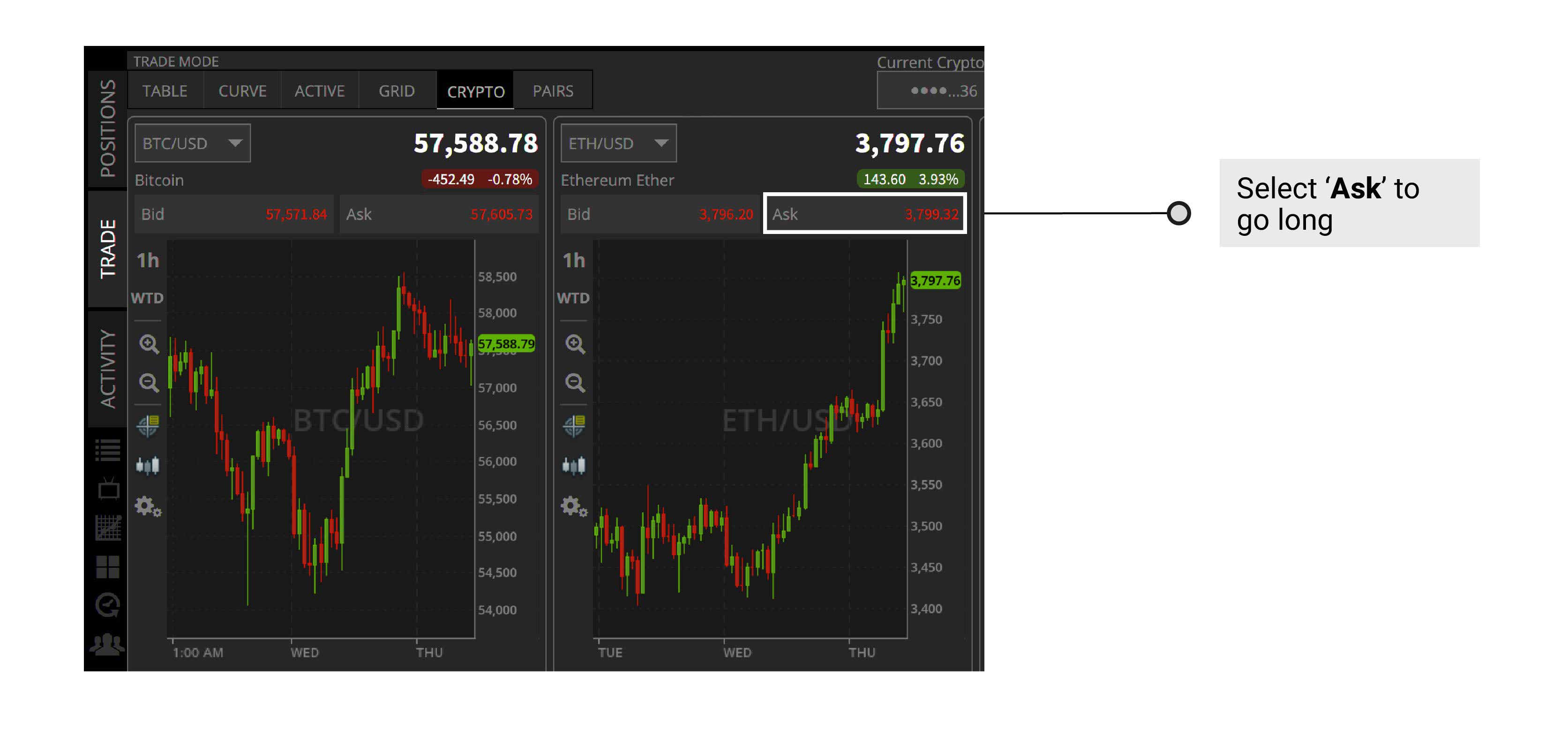

Once you’ve done your research, you can take your pick from tastytrade’s selection of non-physical currencies to speculate on its future price.

With a tastytrade account, you can get exposure to these cryptos.*

- BTC/USD - Bitcoin

- BCH/USD - Bitcoin Cash

- ADA/USD - Cardano

- DOGE/USD - Dogecoin

- ETH/USD - Ethereum

- LTC/USD - Litecoin

- DOT/USD - Polkadot

- SOL/USD - Solana

* You can trade the CME Bitcoin and Micro Bitcoin futures contracts with tastytrade – the other cryptocurrencies listed here are the actual coin.

3. OPEN A TRADING ACCOUNT

- Trade cryptocurrency with the best Enjoy your non-physical currency trading journey with America’s best online broker1

- Make your capital go further Have your commission capped at $10 when trading cryptocurrency2

- Choose your preferred interface Use desktop, browser or mobile on the fast, reliable and safe tastytrade platform

4. CREATE A TRADING PLAN

Creating a trading plan is a must for anyone taking positions on the markets. You can document precisely what you hope to achieve and how you’ll do it using a trading plan. When thinking about this, there are some essential aspects to bear in mind.

Considerations For Crypto Trading Plans:

- Choosing an asset, e.g. cryptocurrency, and looking at the types of the instruments you’re interested in. In this case, you could consider non-physical currencies such as Bitcoin, ether and Litecoin

- Considering trading styles, e.g. day trading, and deciding on strategies to employ, such as trend trading or scalping

- Planning your position sizes carefully based on the capital in your account means you can boost your capital efficiency while limiting your risk

- Knowing what the various futures product price ranges are means that you can allocate money to trades more accurately, also boosting capital efficiency

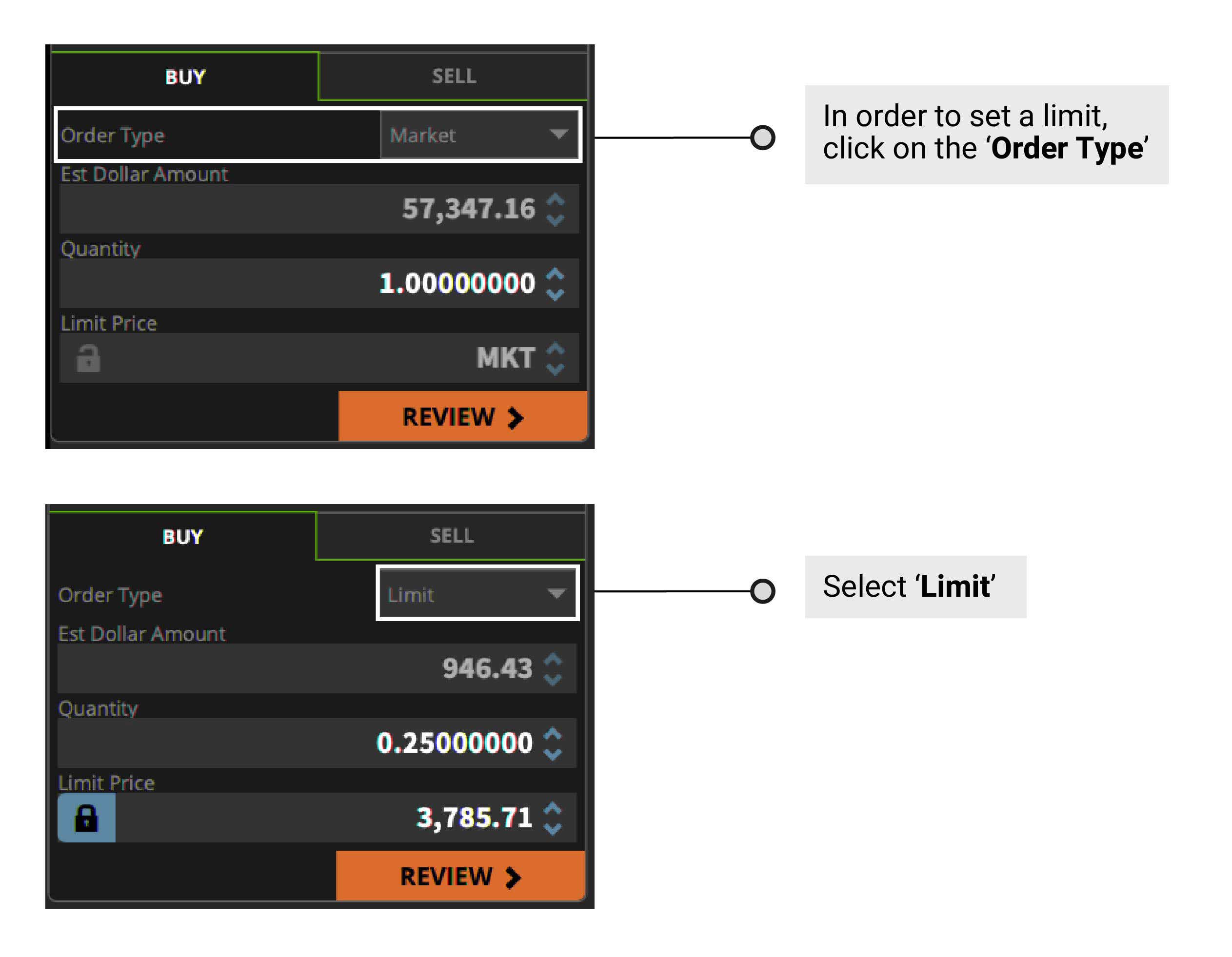

- Aligning with your risk appetite using tools such stop orders and limit orders as well as adjusting your position size

- Taking advantage of binary events through news trading, taking positions based on occurrences and related developments that might affect the markets

- Thoroughly checking whether the relative price movements of a product are slow-moving or rapid, regardless of volatility generally being high in the crypto market

- Limiting losses in case of correlated positions by deciding on ways to hedge them

- Sticking to your specifications on when to enter or exit a trade affects the affordability of other trades as well as how much of your capital you’re risking

- Frequently monitoring your positions and your overall portfolio, and finding your ideal time intervals to do this; plus, you can supplement this with automated orders

5. OPEN, MONITOR AND CLOSE YOUR FIRST POSITION

Cryptocurrency Trading Examples3

The outcome of a trade is everything - let's look at some cryptocurrency trading examples and how direction makes all the difference.

SCENARIO A

Suppose the price of Bitcoin is $45,000. You’re bullish – so, you take a long position on 2 coins. The price rises to $50,000, at which point you close your position. Since your prediction was correct, you’d make a profit. The price went up by $5,000 – for 2 coins, that’s a profit of $10,000.

SCENARIO B

Now imagine you’re bullish on ether and its price is currently at $4,000. You take a long position on 3 coins. You close the position when the price drops to $3,500. As your prediction was incorrect, you’d incur a loss. In this case you’d lose $500 per coin, which means $1,500 in total.

CRYPTOCURRENCY INVESTING VS TRADING: WHAT’S THE DIFFERENCE?

Cryptocurrency investing and trading differ in a number of ways, e.g. you cannot hedge your portfolio with an investment, but you can with trading.

Let’s look at some of the key differences between the two.

Investing In Cryptocurrency

Fewer longer-term investments

Subject to introductory limits, maximum deposits as well as additional costs like deposit and withdrawal fees

Have to buy the coins (taking ownership of the underlying asset) and hold them in digital wallets

Fundamental analysis

Trading Cryptocurrency

Many shorter-term positions

Not subject to introductory limits, maximum deposits, and deposit and withdrawal fees

Trading the spot price of the coin itself (not buying actual coins and holding them in digital wallets)

Technical and fundamental analysis

How To Trade Cryptocurrencies Summed Up

- Cryptocurrency, also known as 'crypto', is a non-physical currency that enables you to make financial transactions online, e.g. paying for goods and services – you can also trade or invest in it

- Cryptocurrencies operate on blockchain technology, where ownership and all transactions are recorded

- Cryptocurrency was invented over a decade ago – it’s a volatile market that has seen a general spike in value

- Creating a trading plan helps you pinpoint precisely what you hope to achieve and how you’ll do it

- Investing and trading are both ways of getting exposure to the cryptocurrency market, but they differ in a number of ways

FAQS

How do I start trading cryptocurrency?

Once you’ve done your research, you can get started with cryptocurrency trading by opening a tastytrade account, or logging in.

Then you need to enable cryptocurrency trading.

Is crypto trading profitable?

Crypto trading can be profitable. It depends on how market movements and your predictions come together. If your prediction of the price movement is correct, you’d make a profit. If not, you’d incur a loss.

Having a good trading plan and sticking to it can help you enhance your probability of locking in profits and cutting losses. It should include the trading style and strategies you’re planning on utilizing, as well as risk management measures.

Is crypto trading safe?

Crypto trading is safe if you understand how it works and manage your risk according to your threshold. Like any other trading activity, there’s the possibility of losing money when trading cryptocurrency. But by building up knowledge on products, following a comprehensive trading plan and using risk management tools, e.g. keeping your position size in check, losses can be minimized and profits can be maximized effectively.

What is the best way to trade crypto?

You do you… The best way to trade crypto is what works for you. That’s why it’s important to get a good understanding of how crypto trading works before getting started. You can then draw up a trading plan to guide your decisions throughout your crypto trading journey. As you go along, you’ll find what works for you and what doesn’t – you can then review and update your trading plan accordingly.

Crypto trading gives you the freedom to speculate on the price of a non-physical currency without having to own the asset itself. Owning the underlying asset comes with some additional fees, and it can be time-consuming.

What is the best coin to day trade?

Since the cryptocurrency market is so volatile, most digital coins are ideal for day trading. Even the largest cryptocurrency, Bitcoin – that’s worth around $1 trillion, has daily price swings that usually makes it suitable for day trading.

In addition to Bitcoin, you can choose from some of the most popular coins at tastytrade.

How much money do I need to start trading cryptocurrency?

Non-physical currencies aren’t subject to pattern day trader (PDT) rules, meaning that the minimum account balance requirement doesn’t apply to crypto.

With tastytrade, the minimum crypto order size is $1 – the maximum is $75,000. Your money becomes available five business days after depositing it for crypto trading. Cryptocurrencies are non-marginable –without leverage, you have to commit the value of your trade in full and upfront.

Is cryptocurrency real money?

Yes – cryptocurrency is the real deal. Just over a decade old, it’s still young compared to traditional ways of carrying out financial transactions – through cold hard cash and other methods such as cheques and credit cards. It has revolutionized the way money works and how it can be used – it’s estimated to be used by around 300 million people.

Is trading cryptocurrency illegal?

Trading cryptocurrency is legal and regulated in the United States – of course, much can still change as non-physical currencies are so young and still evolving themselves.

The legal status of cryptocurrencies vary internationally. While some nations have restricted or banned it, others have regulations that set out the guidelines for its use.

1 Named the Best Online Broker by Investor’s Business Daily (IBD) in its ninth annual survey.

2Commission on smalls futures is $0.25 per contract. Some additional applicable commissions are capped at $10 per leg on equity option trades and $10 per opening and closing cryptocurrency trades. See tastytrade full commission fees.

3 The cryptocurrency trading examples exclude additional fees.

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

tastytrade, Inc. provides its brokerage customers with access to cryptocurrency trading with Zero Hash Liquidity Services LLC, MSB # 31000181510564, and Zero Hash LLC NMLS # 169937. Zero Hash LLC is licensed to engage in Virtual Currency Business Activity by the New York State Department of Financial Services. tastytrade, Inc. is a separate company and isn’t an affiliate company of Zero Hash Liquidity Services LLC or Zero Hash LLC. Cryptocurrency accounts aren’t protected by SIPC coverage. Cryptocurrencies aren’t covered by the FDIC, which covers fiat currency. Cryptocurrency trading isn’t suitable for all investors due to the number of risks involved, including volatile market prices, illiquid market conditions, lack of regulatory oversight, market manipulation, and other risks. You’re solely responsible for evaluating your financial circumstances and determining whether or not trading cryptocurrencies is appropriate for you. Only the following cryptocurrencies are currently available for customers who reside in New York: AAVE, BAT, BTC, BCH, LINK, ETH, LTC, PAXG, and MATIC. Cryptocurrency trading isn’t yet available for customers who reside in Hawaii.

TASTYTRADE, INC. IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.