Filter

Contents

What Are the Different Types of Cryptocurrencies?

Contents

- There are more than 10,000 cryptocurrencies in 2022.

- A crypto coin is native to a network; there is only one coin per network.

- A crypto token is built under a crypto coin’s network: there can be an infinite number of tokens per network.

- The four types of blockchains are: public, private, consortium and permissioned.

- Bitcoin and Ethereum are the world’s most popular crypto coins.

- ERC-20 is the standard token type issued on the Ethereum network.

- Stablecoins peg their price to a referenced asset such as a fiat currency or a commodity.

Blockchain is the underlying technology that allows cryptocurrencies to exist. These digital assets use cryptography to verify and validate transactions.

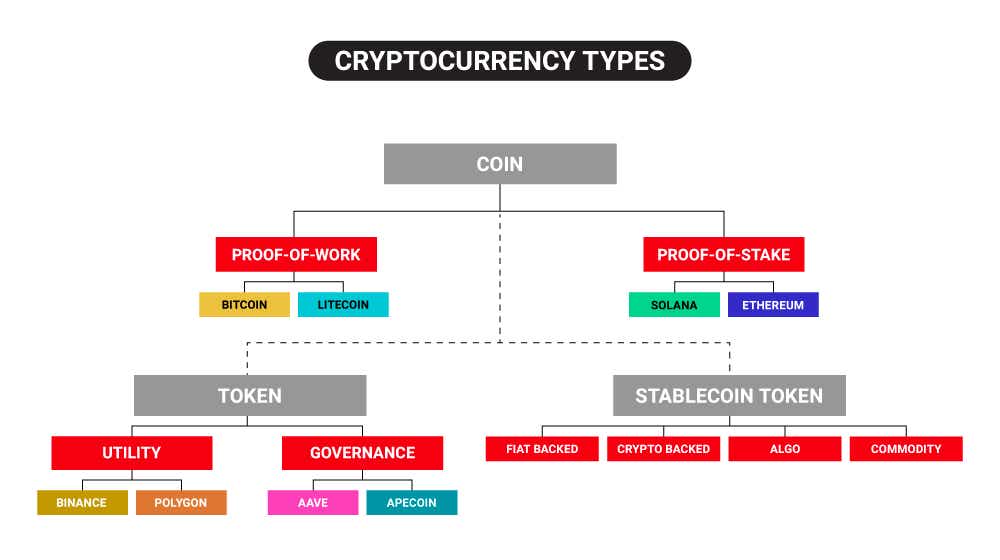

Cryptocurrencies can be divided and subdivided into numerous categories. To best understand the cryptocurrency ecosystem, let’s start by looking at a top-down visual.

How Many Different Cryptocurrencies Are There?

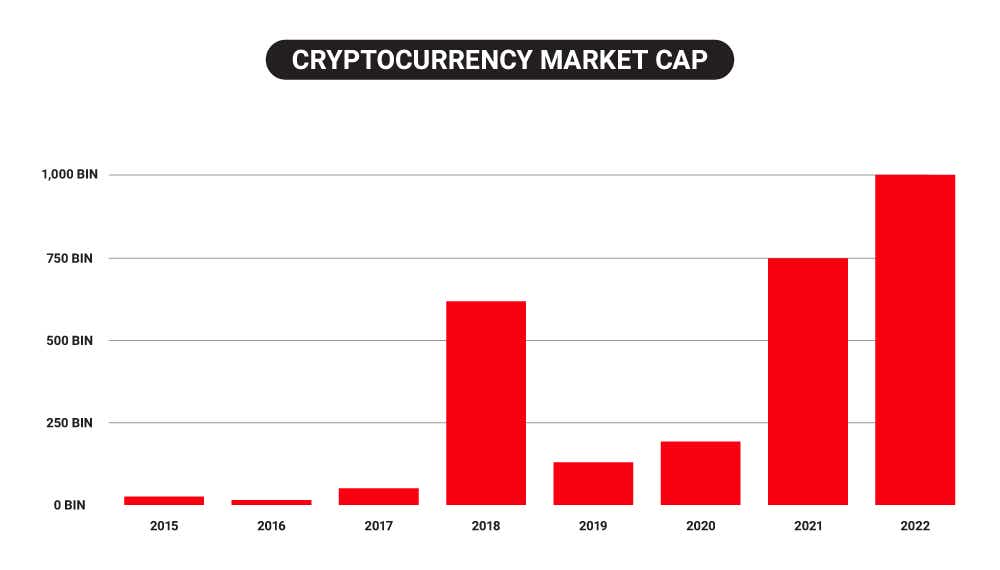

Cryptocurrencies fall into numerous categories, including native coins, tokens, and stablecoins. The current market cap of all cryptocurrencies is currently over 1 trillion dollars.

So how many cryptocurrencies are there?

There are currently more than 10,000 cryptocurrencies in existence. Of these 10,000, only about 2,700 have any measurable market cap. Of these 2,700 coins/tokens, only about half have a market cap of over one million.

It is important to note that most cryptocurrencies have no value at all. Before investing, it is therefore vital to understand what utility your coin has if any.

The majority of cryptocurrencies fall into the “token” category. So, what are cryptocurrency tokens, and how do they differ from coins? Let’s find out next!

New to cryptocurrency? Read our new crypto glossary here!

Learn how to trade cryptocurrency in our guide for beginners!

The ongoing rise of cryptocurrency has been marked by high volatility, which makes it ideal for trading. As a trader, you can get exposure to these cryptocurrencies:*

|

|

|

* You can trade the CME Bitcoin and Micro Bitcoin futures contract with tastytrade – the other cryptocurrencies listed here are the actual coin.

Crypto Coins vs Tokens: What’s the Difference?

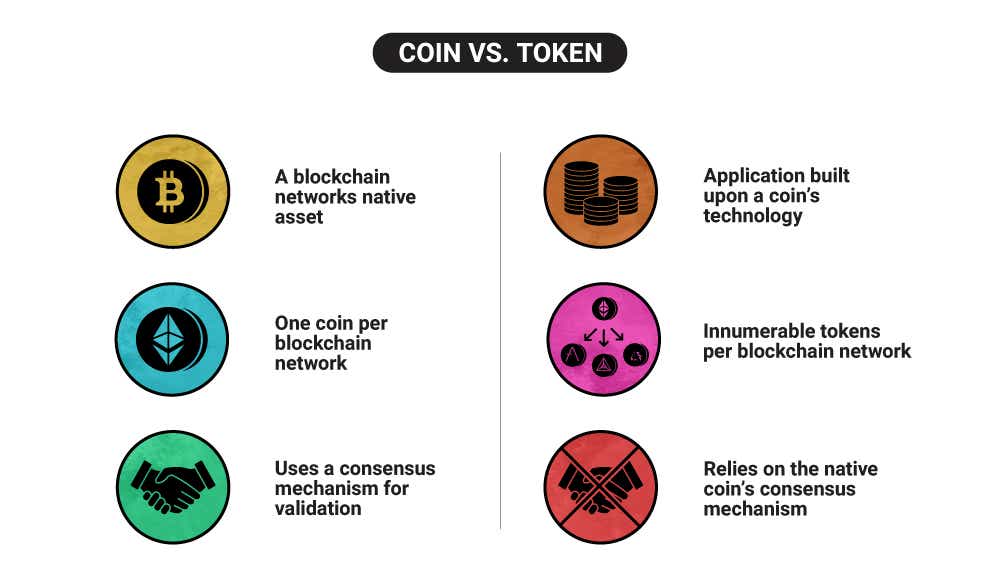

The nomenclature in the crypto community can often be confusing. It is not uncommon for all cryptocurrencies to be referred to as “coins”. Technically, this is not true. There are fundamental differences that separate coins from tokens:

CRYPTO COINS

| CRYPTO TOKENS

|

What Are ERC-20 Tokens & How Do They Work?

The most popular protocol for creating tokens is the Ethereum network. Tokens created on the Ethereum network are called “ERC-20” tokens.

The ERC-20 token is the standard because these types of tokens allow interoperability within the Ethereum ecosystem - all ERC-20 tokens can easily be exchanged for one another, which greatly improves liquidity.

ERC-20 tokens are fungible. This means that they are not unique and can be interchanged freely, sort of like how one US dollar is as good as the next. This contrasts with an ERC-721 token (NFT), which is not interchangeable.

Utility vs Governance Tokens

The two most popular types of ERC-20 tokens include utility and governance tokens.

In decentralized finance (DeFi), utility tokens are issued to finance a new protocol. The issuance of a new utility token is called an "ICO", or an initial coin offering. Perhaps a less confusing term for this would be “ITO”, initial token offering.

A governance token is a special kind of utility token. These tokens allow their owners to vote on proposed changes to a network, sort of like how a proxy allows shareholders to vote on corporate changes.

4 Types of Blockchains

In 2022, there are hundreds of different blockchain networks. Blockchain networks generally fall into one of four categories:

Most of the blockchains you have heard of (Bitcoin and Ethereum) fall into the public category. Public means decentralized, and decentralized means transparent.

Let’s now explore five popular public cryptocurrency coins. We will look at 5 popular tokens after this.

5 Popular Cryptocurrency Coins

BITCOIN (BTC)

- Market Cap: $400bln

- 1 Year Performance: -53%

Bitcoin was the world’s first cryptocurrency. It is also currently the world’s largest cryptocurrency by market cap. Because of bitcoin’s high fees and low transaction throughout, this proof-of-work digital asset is viewed by many as a store of value akin to digital gold.

ETHEREUM (ETH)

- Market Cap: $195bln

- 1 Year Performance: -15%

Ethereum is currently the world’s second-largest cryptocurrency. In addition to storing transactions (like Bitcoin), Ethereum can store code, aka “smart contracts”, which power Web3. Ethereum is currently shifting from a proof-of-work coin to proof-of-stake via an upgrade called the Merge. This shift will open the door to sharding, which will lower fees and increase transaction throughput on the network. Additionally, proof-of-stake coins like ETH allow investors to earn a yield on their crypto by staking them.

Read: Bitcoin vs Ethereum – Who Will Win Post Merge?

RIPPLE (XRP)

- Market Cap: $16bln

- 1 Year Performance: -60%

Ripple is a decentralized public blockchain. This network is known for its low transaction fees, almost instantaneous settlement speed, and incredible energy efficiency. Because of these attributes, XRP is mostly used for financial transactions. Transactions in this network are validated by bank-owned servers.

CARDANO (ADA)

- Market Cap: $16bln

- 1 Year Performance: -80%

Cardano is a proof-of-stake blockchain network that operates with very high efficiency. Cardano’s native coin, ADA, is a viable alternative to Ethereum, but it currently lacks Ethereum’s vast network.

SOLANA (SOL)

- Market Cap: $12.5bln

- 1 Year Performance: -79%

Solana is a peer-to-peer driven blockchain that is helping to build Web3 and DeFi. Because of its proof-of-stake consensus mechanism, Solana runs with much greater efficiency than Ethereum. However, like Carado, SOL currently lacks Ethereum's network breadth.

5 Popular Cryptocurrency Tokens

POLYGON (MATIC)

- Market Cap: $400bln

- 1 Year Performance: -53%

The MATIC token is the utility token behind the Polygon network. This Network helps to scale Ethereum by introducing Layer 2 proof-of-stake side chains which parallel the main Ethereum network. Polygon helps to increase Ethereum’s efficiency by reducing costs and increasing transaction throughput.

UNISWAP (UNI)

- Market Cap: $4.8bln

- 1 Year Performance: -72%

Uniswap is a decentralized cryptocurrency exchange (DEX). This exchange provides liquidity via automated market makers. Uniswap helps to democratize the market-making business by allowing anyone with certain cryptocurrencies to become market makers simply by allocating 2 digital assets to a pool. UNI is a governance token that gives its owners the right to vote on changes in the Uniswap protocol.

CHAINLINK (LINK)

- Market Cap: $3.5bln

- 1 Year Performance: -73%

ChainLink serves as an oracle in the crypto space. Oracles help to connect blockchains to the outside world. An example of this would be a token that represents a share of stock - in order to make sure the tokens accurately track the stock, an oracle would track its price via multiple real-world sources. LINK is the token used within ChainLink to pay for services.

APECOIN (APE)

- Market Cap: $1.6bln

- 1 Year Performance: -35%

Ape is the governance/utility token of the ApeCoin network. In addition to giving its owners the right to vote on changes in the ApeCoin ecosystem, APE will allow its owners access to games and services offered by the network.

SANDBOX (SAND)

- Market Cap: $1.4bln

- 1 Year Performance: +21%

The Sandbox is a gaming ecosystem that is powered by the Ethereum network. SAND is a utility token that allows users to both interact and transact within the Sandbox community.

What Are Stablecoins and How Do They Work?

Stablecoins are a rather unique type of cryptocurrency. Though they are called stable “coins”, they are in reality tokens. A stablecoin pegs its price to a referenced asset. There are four predominant types of stablecoins:

FIAT-BACKED

Fiat-backed stablecoins peg their price to the value of a fiat currency. The most popular fiat-backed stablecoins are pegged to the US dollar. Issuers of stablecoins generally hold an equivalent amount of US reserves in a vault. If $1 million worth of US dollars is held in a vault, that issuer can mint $1 million worth of stablecoins. These tokens are growing in popularity because of their high-yield nature when compared to traditional savings accounts.

CRYPTO-BACKED

Crypto-backed stablecoins are backed by - you guessed it - cryptocurrency. Instead of relying on a central issuer (like fiat-backed stablecoins), crypto-backed stablecoins secure their reserves via smart contracts. Crypto-backed stablecoins are generally overcollateralized to make up for the volatility in cryptocurrencies.

COMMODITY-BACKED

Commodity-backed stablecoins are collateralized with actual commodities. Gold, oil, and real estate are three popular varieties of commodity-backed stablecoins. These types of stablecoins help to democratize commodity investing.

ALGORITHMIC

Algorithmic (algo) stablecoins are backed by algorithms or simple math. Not holding 1:1 actual reserves introduces many risks to algo coins. The collapse of the Terra blockchain showed the inherent risks in these types of coins.

Let’s next look at five of the most popular stablecoins. All of these coins are fiat-backed US dollar stablecoins.

5 Popular Stablecoins

Tether (USDT)

- Market Cap: $67bln

- Current Price: $1

USD COIN (USDC)

- Market Cap $51bln

- Current Price: $1

Binance USD (BUSD)

- Market Cap $20bln

- Current Price: $1

DAI (DAI)

- Market Cap: $6.8bln

- Current Price: $0.9978

TrueUSD (TUSD)

- Market Cap: $1bln

- Current Price: $1

What Are Meme Coins and How Do They Work?

A meme coin is a cryptocurrency that has its origin in a meme. A meme is basically a humorous video or image shared on the internet. Meme coins started as a joke with Dogecoin, but they have since exploded in popularity. Meme coins have little to no value.

5 Popular Meme Coins

Dogecoin

Shiba Inu

Dogelon Mars

Baby Doge Coin

MonaCoin

How to Trade Cryptocurrency

- Learn how cryptocurrency markets work

- Create a tastytrade account or log in

- Enable cryptocurrency trading

- Create a trading plan and manage your risk

- Pick a type of cryptocurrency to trade

- Open, monitor, and close your first position

Types of Cryptocurrencies Summed Up

- Only about a quarter of all cryptocurrencies have and true market cap.

- A crypto coin acts as the native currency for a blockchain.

- A crypto token operates under a blockchain.

- Two popular token types are utility and government.

- The most popular stablecoins track the US dollar and hold reserves in a vault.

- Most meme coins have no value at all.

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

tastytrade, Inc. provides its brokerage customers with access to cryptocurrency trading with Zero Hash Liquidity Services LLC, MSB # 31000181510564, and Zero Hash LLC NMLS # 169937. Zero Hash LLC is licensed to engage in Virtual Currency Business Activity by the New York State Department of Financial Services. tastytrade, Inc. is a separate company and isn’t an affiliate company of Zero Hash Liquidity Services LLC or Zero Hash LLC. Cryptocurrency accounts aren’t protected by SIPC coverage. Cryptocurrencies aren’t covered by the FDIC, which covers fiat currency. Cryptocurrency trading isn’t suitable for all investors due to the number of risks involved, including volatile market prices, illiquid market conditions, lack of regulatory oversight, market manipulation, and other risks. You’re solely responsible for evaluating your financial circumstances and determining whether or not trading cryptocurrencies is appropriate for you. Only the following cryptocurrencies are currently available for customers who reside in New York: AAVE, BAT, BTC, BCH, LINK, ETH, LTC, PAXG, and MATIC. Cryptocurrency trading isn’t yet available for customers who reside in Hawaii.

TASTYTRADE, INC. IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.