Filter

Contents

Poor Man's Covered Call - What is it?

Contents

What is a poor man’s covered call?

A poor man’s covered call (PMCC) is a long call diagonal debit spread that is used to replicate a covered call position.

A traditional covered call uses long stock to “cover” the risk in the short call, while a PMCC uses a long-term call option instead. The PMCC is therefore a more capital-efficient way to simulate the covered call strategy without actually owning the stock.

The PMCC is often utilized by investors that wish to deploy a neutral to bullish outlook. A PMCC might therefore be used to express a bullish outlook on a stock or ETF, or in a case where the investor or trader is seeking to generate additional income from a neutral outlook.

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

PROFIT/LOSS CHART

How does a poor man’s covered call work?

A poor man’s covered call mimics the dynamics of the covered call strategy but at a fraction of the capital requirement.

When you own a long-term in-the-money (ITM) call, the directional exposure is similar to owning 100 shares of stock. With that said, the call is still cheaper to buy than 100 shares outright. When you own a long call, you can sell a call against it to reduce the cost basis of the option while capping the upside profit potential of the long call itself.

Structure of a Poor Man's Covered Call (PMCC)

Buy an Out-Month ITM Call Option: Instead of owning the stock, you buy a back-month call option (this may be a deep in-the-money LEAP).

Sell a Near-Term OTM Call Option: You sell a shorter-term out-of-the-money call option on the same stock.

In the above structure, the long-term call option acts as a substitute for owning the actual stock.

The “poor man’s covered call” gets its name because it requires less capital than buying the stock outright.

If the stock price rises above the strike price of the short-term call you sold, you benefit from the difference in premiums and the price appreciation of the long-term call. Most traders just trade the difference between the entry and exit price for this strategy, rather than intending to obtain shares with the long call, but that is certainly possible as well.

Ideally, the short call option will expire worthless, allowing the investor or trader to collect and retain the option’s premium, while the underlying stock's price gradually rises, boosting the value of the long back-month call option.

Poor man’s covered call vs covered call

A poor man’s covered call mimics the dynamics of the covered call strategy but at a fraction of the capital requirement.

A traditional covered call uses long stock to cover the risk in the short call, while a PMCC uses a back-month long call option as its coverage. The PMCC is a more capital-efficient way to simulate the covered call strategy without actually owning the stock.

Structure of a Traditional Covered Call

Long Stock: You own 100 shares of the underlying stock.

Short Near-Term OTM Call: You sell (or "write") a call option on that same stock.

With a traditional covered call, the investor or trader uses the long stock position as "coverage" or "collateral" for the sold call option. If the stock price rises above the strike price of the call you sold, you're obligated to sell your 100 shares at that strike price. If it stays below, you keep your shares and the premium you received from selling the call.

Structure of a Poor Man's Covered Call (PMCC)

Long Back-Month ITM Call Option: Instead of owning the stock, you buy a long-term call option (often a deep in-the-money LEAP).

Short Near-Term OTM Call Option : You sell a shorter-term call option on the same stock.

In the above PMCC structure, the out-month call option acts as a substitute for owning the actual stock. It's "poor man's" because it requires less capital than buying the stock outright.

Ideally, the short call option will expire worthless, allowing the investor or trader to collect and retain the short call option premium, while the underlying stock's price gradually rises, boosting the value of the long, out-month call option.

Close / Manage

WHEN TO CLOSE

In the best case scenario, a PMCC will be closed for a winner if the stock price increases significantly in one expiration cycle. This is because the call options will trade close to intrinsic value and the profit potential for the trade will diminish.

WHEN TO MANAGE

For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit.

How to use a poor man’s covered call

Deploying a poor man's covered call (PMCC) involves purchasing a deep in-the-money (ITM), back-month call option, while selling a shorter-term out-of-the-money (OTM) call option on the same stock.

How to Deploy a PMCC

Identify the Underlying: Choose a stock or ETF that you have a moderately bullish or neutral outlook on for the long term.

Buy a back-Month Call Option: Purchase a deep in-the-money (ITM) call option with an expiration that's several months to years out. Ensure it has a high delta, so that the price of the call will move closely with the underlying stock price.

Sell a Shorter-Term Call Option: Select a call option on the same stock with a shorter expiration, typically 30 to 60 days out. This option should be out-of-the-money (OTM), meaning its strike price is higher than the current stock price.

Manage the Position: Monitor the position. As expiration nears for the short-term call, decide whether to let it expire, buy it back, or roll it to a later date or a different strike. Be aware of the risk of early assignment. If the stock moves significantly above the strike of the short-term call, there's a chance of assignment.

It’s important to keep in mind that while the PMCC uses less capital than a traditional covered call, it still requires active management, especially if the underlying stock price approaches or exceeds the strike of the short call.

Poor Man's Covered Call: tastylive Approach

A poor man’s covered call is a fantastic alternative to trading a covered call. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call.

The setup of a poor man’s covered call is very important. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. The deeper ITM our long option is, the easier this setup is to obtain. We also ensure that the total debit paid is not more than 75% of the width of the strikes.

We never route poor man’s covered calls in volatility instruments. Each expiration acts as its own underlying, so our max loss is not defined.

Max profit potential with PMCC

Estimating the maximum potential profit for a Poor Man's Covered Call (PMCC) is fairly straightforward

The maximum profit of a PMCC is realized if the underlying stock closes right at the strike price of the short call option at its expiration. The profit will therefore be a combination of:

The premium received from selling the short call.

The appreciation in the value of the LEAP option (long-term call) from the time you established the PMCC up to the strike price of the short call.

Max Profit Formula

Maximum Profit = (Strike of Short Call − Strike of Long LEAP − Price of Long LEAP + Premium Received from Short Call) × 100

(Multiply by 100 since each standard options contract typically represents 100 shares)

It’s important to note that if estimating max profit prior to the expiration of the long call, it’s difficult to get an accurate number as the long call will still have extrinsic value - this means the max profit could be more than the value of the long call at expiration, since the long call would have more than just the intrinsic value.

Max Profit Example

Suppose you have a bullish outlook on stock XYZ, currently trading at $100:

You buy a back-month call option with a strike of $90 for a cost of $15.00 (remember, this is per share, so the actual cost is $1,500 for the contract). This is deep in-the-money.

You then sell a 30-day call option with a strike of $105 for a premium of $2.00 (or $200 for the contract).

To calculate the maximum potential profit:

Maximum Profit = (105 − 90 − 15 + 2) × 100

Maximum Profit = $200

In this scenario, your maximum potential profit is $200, which you'd achieve if XYZ closes right at $105 at the expiration of the short call.

This example assumes that the back-month option's price moves one-to-one with the stock's price (i.e., a delta of 1), which may not always be the case, especially for options that aren't deeply in-the-money.

Max loss potential with PMCC

The maximum loss potential in a poor man's covered call is predominantly associated with the long back-month call option that is purchased. In the worst-case scenario, the value of this call option drops to zero.

This is similar to a traditional covered call, where the maximum loss potential is associated with the long stock position. In the worst case-scenario, the value of the underlying stock drops to zero.

Max Loss Formula

Maximum Loss = Cost of Long Call − Premium Received from Short Call

Essentially, you could lose the entire premium you paid for the back-month long call option, less the premium you received from selling the short call.

Max Loss Example

Max Loss Example

Suppose you're looking at stock XYZ, currently trading at $100.

You buy a back-month call option with a strike of $90, paying a premium of $15.00 per share (or $1,500 for the contract).

You then sell a 30-day call option with a strike of $105, receiving a premium of $2.00 per share (or $200 for the contract).

To calculate the maximum potential loss:

Maximum Loss = ($15.00 − $2.00) × 100

In this scenario, the maximum potential loss is $1,300.

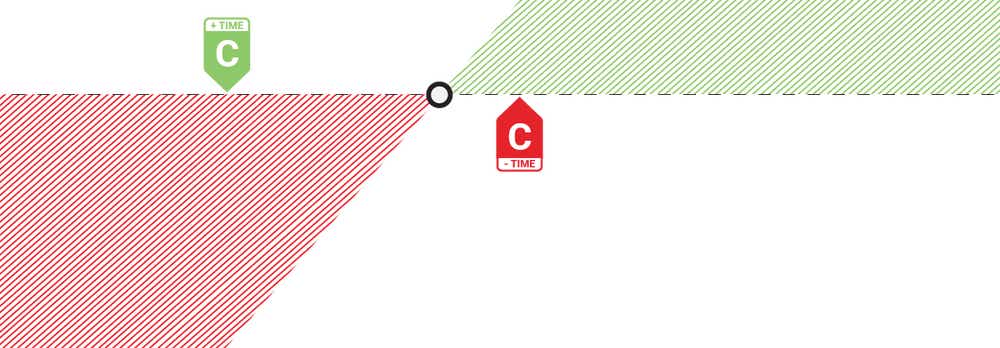

HOW TO CALCULATE MAX PROFIT / BREAKEVEN(S)

The exact maximum profit potential & breakeven cannot be calculated due to the differing expiration cycles used. However, the profit potential & breakeven area can be estimated with the following formulas.

MAX PROFIT

Width of Call Strikes - Net Debit Paid

BREAKEVEN(S)

Long Call Strike Price + Net Debit Paid

What happens when a poor man’s covered call gets assigned?

When a Poor Man's Covered Call (PMCC) gets assigned, it specifically refers to the short call option being exercised by its holder.

When you have a short call that moves in-the-money (ITM), early assignment is possible where the counterparty exercises their right to execute the contract and convert it to 100 long shares for them, and 100 short shares for you. Since you don't actually own the stock in a PMCC, the assignment process is slightly different than with a traditional covered call:

Exercise the Back-Month Call Option: If your long call option is deep in-the-money, you can exercise it to convert to 100 shares of stock, which would offset your 100 short stock position

Buy 100 Shares and Sell the Long Call: You can buy 100 shares of the stock in the open market at the current price to offset your 100 short shares. You can then sell out of the remaining long call to close the position

Can you ever lose money on a covered call?

Yes, there’s a chance that the poor man’s covered call can lose money.

A poor man’s covered call strategy involves owning the underlying stock and selling a call option on that stock. While this strategy can generate additional income from the option premium, there are several ways you can still experience losses:

Decline in Stock Value: The most significant risk with a poor man’s covered call strategy is if the underlying stock declines in value. Even though you receive a premium from selling the call, that premium might not be enough to offset a significant drop in the stock's underlying price and the long call that you own.

Opportunity Loss: If the stock price rises significantly above the strike price of the call option you sold, you'll miss out on any potential gains above that strike price because you're obligated to sell the stock at the strike price if the option buyer chooses to exercise the option.

Early Assignment: There's always a possibility of early assignment (before expiration) with American-style options. If the option is in-the-money and there are dividends expected or other factors at play, the call option might be exercised earlier than you anticipate, leading to early exercise of the short call and a shift in the position itself.

POOR MAN’S COVERED CALL STRATEGY SUMMED UP

- A poor man’s covered call (PMCC) is a long call diagonal debit spread that is used to replicate a covered call position

- A traditional covered call uses long stock to back up (or "cover") the short call’s risk, while a PMCC uses a back-month call option for coverage. The PMCC is therefore a more capital-efficient way to simulate the covered call strategy without actually owning the stock

- The PMCC is often utilized by investors that wish to deploy a neutral to bullish outlook on a stock or ETF, reducing the cost basis on their long call by the sale of the short

- Ideally, the short call option will expire worthless, allowing the investor or trader to collect and retain the short call option premium, while the underlying stock's price gradually rises, boosting the value of the long, out-month call option

FAQ

What is a poor man’s covered call?

A poor man’s covered call (PMCC) is a long call diagonal debit spread that is used to replicate a covered call position.

A traditional covered call uses long stock to back up (or "cover") the short call, while a PMCC uses a back-month call option for coverage. The PMCC is therefore a more capital-efficient way to simulate the covered call strategy without actually owning the stock.

The PMCC is often utilized by investors that wish to deploy a neutral to bullish outlook. A PMCC might therefore be used to express a bullish outlook on a stock or ETF, or in a case where the investor or trader is seeking to generate additional income with the short call option from a neutral outlook.

Ideally, the short call option will expire worthless, allowing the investor or trader to collect and retain the short call option premium, while the underlying stock's price gradually rises, boosting the value of the long, out-month call option.

Are poor man’s covered calls worth it?

Depending on one’s outlook, risk profile, and capital position, a poor man’s covered call may be a suitable strategy.

The PMCC is often utilized by investors that wish to deploy a neutral to bullish outlook. This strategy is constructed using a short near-term OTM call and a long out-month ITM call.

The PMCC performs optimally when the short call expires worthless, with the long call benefiting from an increase in the underlying stock, which in turn makes the long call more valuable.

How risky is a poor man’s covered call?

The maximum loss potential in a poor man's covered call is predominantly associated with the long back-month call option that is purchased. In the worst-case scenario, the value of this call option drops to zero.

This is similar to a traditional covered call, where the maximum loss potential is associated with the long stock position. In the worst case-scenario, the value of the underlying stock drops to zero.

SUPPLEMENTAL CONTENT

Episodes on Poor Man Covered Call

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.