Filter

Contents

What is a Candlestick Chart and How to Read it?

Contents

What is a candlestick chart?

A candlestick chart is a type of financial chart used by traders to visualize price movements over a specific time period, such as a minute, hour, day, or week.They originated in 18th-century Japan, and have since become one of the most widely used tools in technical analysis.

By reading the size, shape, and color of each candlestick, investors and traders can interpret market sentiment—whether buyers or sellers are in control—and predict potential future price movements. Candlestick charts are favored by traders because they pack detailed price data into a simple, visually intuitive format making it easier to see patterns and trends at a glance.

Popular ways to utilize candlestick charts

Candlestick charts are a powerful tool in technical analysis, allowing traders to assess market sentiment, identify potential price reversals, and make informed trading decisions.

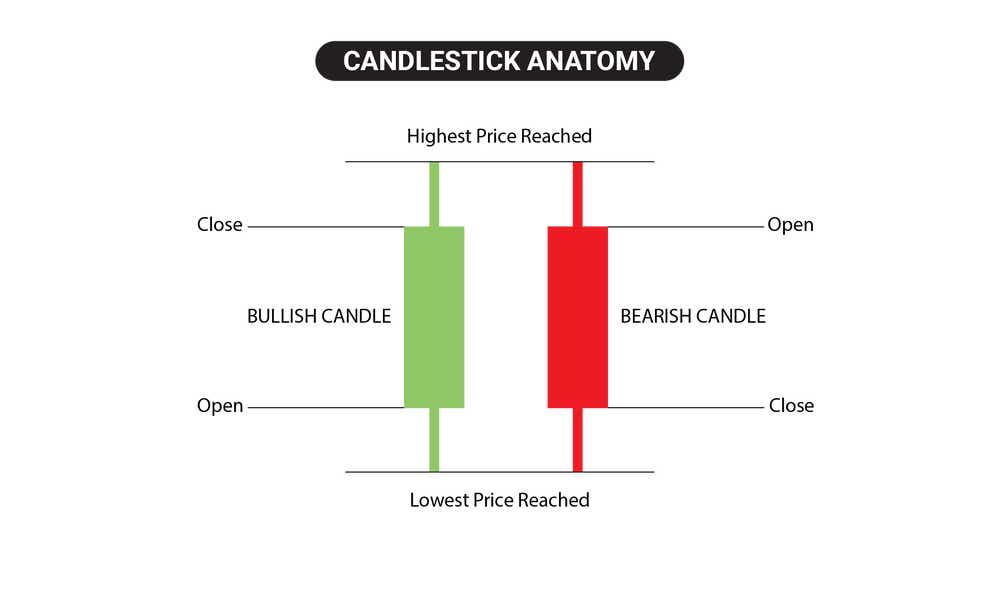

Each candlestick on the chart represents four key pieces of information: the opening price, the highest price, the lowest price, and the closing price during that time frame. The rectangular body of the candlestick indicates the range between the open and close prices, while the wicks (or shadows) extend from the body to show the high and low prices reached within the period.

If the close is higher than the open, the candlestick body is usually colored green or white (bullish), indicating upward momentum. Conversely, if the close is lower than the open, the body is typically colored red or black (bearish), signifying downward momentum.

Listed below are the primary ways that investors and traders use candlestick charts in technical analysis.

1) Identifying Market Sentiment

The color and size of each candlestick reveal whether buyers (bullish) or sellers (bearish) are in control of the market. For example, a long green (or white) candlestick indicates strong buying pressure, while a long red (or black) candlestick signals strong selling pressure

2) Spotting Reversal Patterns

Candlestick patterns are most effective for identifying potential reversals in the market. For example, the hammer pattern (bullish) signals that buyers are taking control after a period of selling pressure, while the shooting star pattern (bearish) suggests that a current uptrend might reverse as sellers push the price back down

3) Combining with Other Indicators

While candlestick patterns can signal market reversals or continuations, they are most effective when combined with other technical indicators like moving averages, RSI (Relative Strength Index), or support/resistance levels. This additional context can help confirm the validity of the candlestick signals in question.

When analyzing a candlestick chart, there are several key components that traders need to understand in order to interpret market movements effectively:

Real Body: The real body of the candlestick represents the difference between the opening and closing prices during a specific time period. A long body indicates strong buying or selling pressure, while a short body reflects more indecision or minimal price movement.

Wicks: The wicks, also known as shadows, extend from the top and bottom of the body and show the highest and lowest prices reached during the period. The length of the wicks is usually significant to the candlestick analysis.

Open and Close Prices: The open price is where the asset starts trading during the selected period, and the close price is where it finishes. The relationship between the open and close is fundamental in understanding whether the market is bullish or bearish.

High and Low Prices: The high price represents the maximum price reached during the period, while the low price reflects the minimum. These points are crucial for identifying the range of price fluctuations during that time.

Color of the Candlestick: The color of the candlestick (often green or white for bullish and red or black for bearish) visually differentiates the direction of the market movement. It makes it easier for traders to quickly assess the general trend of the market at a glance.

Key considerations when utilizing candlesticks charts/patterns

When analyzing and utilizing candlestick patterns, there are several key considerations that market participants should keep in mind, as highlighted below:

Volume: Volume is an essential factor in candlestick analysis. Patterns accompanied by higher-than-average volume are typically viewed as more likely to be significant. For example, a bullish engulfing pattern with strong volume suggests more conviction behind the move.

Support and Resistance: Candlestick patterns that form near key levels of support or resistance are often viewed as more significant. For example, a bullish pattern forming near a key support level could indicate that the level is more likely to hold, leading to a potential price increase.

Trend Context: Candlestick patterns are more reliable when analyzed in the context of the overall trend. For instance, bullish patterns are more meaningful at the end of a downtrend or during a pullback in an uptrend.

Trend Confirmation: A pattern should ideally be confirmed by subsequent price action. For example, a bullish pattern is more reliable if it is followed by a higher close in the next session. Waiting for confirmation reduces the risk of false signals.

Pattern Length: Not all candlestick patterns necessarily carry the same weight. Patterns that develop over multiple periods (e.g., three white soldiers) tend to be more reliable than single-candle patterns (e.g., hammer), as they show sustained buying or selling pressure.

Leveraging Multiple Indicators: Candlestick analysis can be more effective when integrated with additional technical indicators, such as moving averages and/or the Relative Strength Index (RSI). Combining these tools provides a more comprehensive view of the market, helping to confirm trends and reduce the likelihood of false signals. When multiple indicators align, it theoretically strengthens the validity of the trend, and enhances the reliability of the analysis.

How to read a candlestick chart

A candlestick visually represents price movements over a specific time period, showing four critical data points: the open, high, low, and close. To read a candlestick effectively, you must first understand these components:

Open: The price at which the asset began trading during the time period.

Close: The price at which the asset finished trading for that period. The relationship between the open and close dictates whether the candlestick is bullish (green/white) or bearish (red/black).

High: The highest price reached during the trading period, represented by the top of the upper wick.

Low: The lowest price reached during the period, represented by the bottom of the lower wick.

Providing more context on the above, the body of the candlestick represents the difference between the opening and closing prices, while the wicks (or shadows) extend from the body to indicate the high and low prices during that period. The color or shading of the candlestick body typically reflects whether the price closed higher (bullish) or lower (bearish) than it opened.

For instance, if the closing price is higher than the opening price, the body is typically colored or shaded in a way that indicates bullish movement, often in green or white. Conversely, if the closing price is lower than the opening price, the body is usually colored to signify a bearish movement, often in red or black.

By examining the size and position of the body and wicks, traders can glean insights into market sentiment. For example, a long body indicates strong buying or selling pressure, while long wicks suggest market indecision or a potential reversal. Reading candlestick patterns involves recognizing these elements and understanding how their variations combine to form patterns that suggest potential future price movements.

Interpreting candlestick charts/patterns

Candlestick charts are more than just a collection of price points; they tell a story about the ongoing battle between buyers and sellers within a given time frame. By understanding the size of the candlestick's body, the length of its wicks, and the relationship between the open and close, traders can interpret shifts in market momentum, spot potential reversals, and make informed decisions.

Outlined below are some key factors investors and traders can consider when assessing candlestick charts.

1) Size of the Body

The size of the real body shows how strongly buyers or sellers are dominating.

Large Body: Strong buying (bullish) or selling (bearish) pressure.

Small Body: Indecision or a weak price movement, often signaling a potential reversal or consolidation

2) Wicks (Shadows)

The length of the wicks provides insight into the volatility within the period examined.

Long Upper Wick: Indicates that buyers drove prices higher, but sellers pushed the price back down before the close, suggesting potential selling pressure

. Long Lower Wick: Suggests that sellers forced prices lower, but buyers regained control, potentially signaling an upward reversal

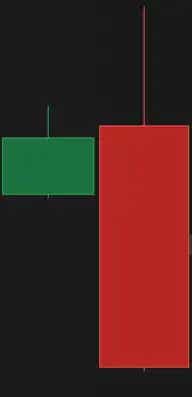

3) Engulfing Patterns

These patterns involve one candle "engulfing" the previous one and can be powerful reversal signals.

Bullish Engulfing: A large green/white candle that completely covers the previous red/black candle, signaling a potential reversal upward.

Bearish Engulfing: A large red/black candle that engulfs the previous green/white candle, indicating potential downward momentum.

4) Trend Context

Candlesticks are most effective when analyzed in the context of the overall trend.

In an Uptrend: A bullish candlestick can reinforce the existing momentum, while a bearish candlestick may suggest a potential reversal.

In a Downtrend: A bearish candlestick strengthens the trend, but a bullish candlestick may signal a reversal

5) Doji Candlestick

This is a special candlestick pattern where the open and close are nearly equal, resulting in a very small body. A doji often represents indecision and can signal a reversal or continuation depending on the surrounding candles.

Indecision in the Market: A doji candlestick often indicates that the market is undecided, because the open and close prices are almost the same. As such, neither buyers or sellers were able to take control during the session.

Potential Reversal Signal: While a doji by itself doesn’t guarantee a reversal, when it appears after a strong trend (either bullish or bearish), it may indicate that momentum is weakening and a reversal may be approaching. The confirmation of this often comes from the subsequent candles.

Candlestick charts vs. bar charts: what is the difference?

Candlestick charts and bar charts are both used to visualize price movements in the financial markets, but they present data in distinct ways that can influence how traders interpret trends.

Candlestick charts offer a visually intuitive format by displaying the open, high, low, and close (OHLC) prices through colored bodies and wicks. In contrast, bar charts also display the OHLC prices but in a more minimalistic way. A vertical line represents the high and low prices, with horizontal ticks indicating the open (on the left) and close (on the right). While bar charts provide the same essential data, some market participants believe they lack the visual cues associated with candlestick charts, making it harder to interpret market sentiment at a glance

Candlestick charts are often favored by market participants who focus on technical analysis because their colors and body shapes provide a clearer sense of market sentiment and momentum. Moreover, patterns like the engulfing or doji candlesticks can help traders identify potential reversals. Bar charts, on the other hand, can be more suited to those who prefer a cleaner, raw display of price data. Both chart types arguably have a place in the investment world, as some market participants favor one over the other.

Candlestick patterns are typically divided into two main categories:

1) Bullish

2) Bearish

Bullish patterns signal potential upward price movements and are usually found at the end of a downtrend, suggesting that the market may be ready to reverse and move higher. Bearish patterns, on the other hand, indicate potential downward price movements, often appearing after an uptrend, signaling that the market may be preparing for a downturn.

Common bullish candlestick patterns

Bullish candlestick patterns are formations that suggest the price of a security may rise. As such, bullish candlestick patterns are commonly used to identify potential entry points for long positions

Some of the most common bullish patterns include:

Hammer: A single candlestick with a small body and a long lower shadow, indicating that buyers are stepping in after a period of selling pressure.

Bullish Engulfing: A two-candlestick pattern where a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous candle's body.

Morning Star: A three-candlestick pattern that starts with a long bearish candlestick, followed by a small-bodied candlestick (indicating indecision), and then a long bullish candlestick, signaling the start of an uptrend.

Piercing Line: A two-candlestick pattern where a bearish candle is followed by a bullish candle that opens lower but closes more than halfway up the previous candle, suggesting a potential reversal.

Three White Soldiers: A pattern consisting of three consecutive long-bodied bullish candlesticks, each closing higher than the previous one, indicating strong buying momentum.

Discover more bullish candlestick patterns.

Common bearish candlestick patterns

Bearish candlestick patterns are formations that suggest the price of a security may fall. As such, these patterns are commonly used to identify potential entry points for short positions or to signal the exit of long positions.

Some of the most common bearish patterns include:

Shooting Star: A single candlestick with a small body and a long upper shadow, indicating that sellers have taken control after an initial buying surge, potentially signaling a reversal at the top of an uptrend.

Bearish Engulfing: A two-candlestick pattern where a small bullish candlestick is followed by a larger bearish candlestick that completely engulfs the previous candle's body, suggesting a shift in momentum to the downside.

Evening Star: A three-candlestick pattern that begins with a long bullish candlestick, followed by a small-bodied candlestick (indicating indecision), and then a long bearish candlestick, signaling the potential start of a downtrend.

Dark Cloud Cover: A two-candlestick pattern where a bullish candle is followed by a bearish candle that opens higher but closes more than halfway down the previous candle, indicating that sellers are beginning to dominate.

Three Black Crows: A pattern consisting of three consecutive long-bodied bearish candlesticks, each closing lower than the previous one, indicating strong selling momentum and a potential reversal of an uptrend.

Discover the top bearish candlestick patterns.

Candlestick pattern examples

Example 1: Bullish Engulfing Pattern

The bullish engulfing pattern occurs during a downtrend and can be a strong signal that the market may reverse upward. This pattern consists of two candlesticks: a smaller bearish candlestick followed by a larger bullish candlestick that completely engulfs the body of the previous one. The shift from a smaller bearish candle to a large bullish one often indicates that buyers have stepped in forcefully, overpowering the sellers.

For investors and traders, this pattern can signal that the market sentiment is shifting from negative to positive, providing an opportunity to enter a long position. Confirmation of the bullish reversal often comes if the next candlestick continues the upward movement. The bullish engulfing pattern is considered more powerful when accompanied by strong trading volume, as this reinforces the conviction behind the emerging bullish trend, indicating that the shift in market sentiment has significant backing from buyers

Example 2: Bearish Engulfing Pattern

The bearish engulfing pattern appears at the top of an uptrend and can be a strong signal that the market could reverse downward. This two-candlestick pattern starts with a small bullish candle, followed by a large bearish candle that fully engulfs the body of the prior candle. This shift suggests that sellers have regained control of the market after a bullish period, and that the price may drop further.

Investors and traders sometimes use the bearish engulfing pattern to exit long positions, or to initiate short positions. The strength of this signal is reinforced if the next candle closes lower, or if the pattern occurs near a key level of resistance. Robust trading volume can enhance the significance of this signal, indicating the strong conviction in the market shift, and potentially raising the likelihood of a sustained trend reversal.

Benefits and limitations of using candlestick charts/patterns

Candlestick charts offer several key benefits for traders, primarily due to their visual clarity and ability to reveal market sentiment at a glance. They are especially effective for identifying potential trend reversals or continuations, making them popular among short-term traders who rely on quick market shifts. By analyzing patterns like the bullish engulfing or shooting star, traders can make informed decisions on when to enter or exit trades.

However, candlestick patterns also have limitations. Since they rely on historical price data, they don’t always accurately predict future movements, particularly in volatile or low-volume markets. Additionally, candlestick patterns can sometimes generate false signals, making them less reliable without the context of broader market trends and additional technical indicators like moving averages or RSI.

Therefore, while candlestick charts are a valuable tool, they should be used in conjunction with other analysis methods to provide a more comprehensive view of market conditions.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.