Filter

What is a Covered Call and How Does it Work?

What is a Covered Call?

A covered call combines a long stock position with a short call position, and is a common strategy deployed by both investors and traders.

A covered call means that a trader or investor is short calls, but owns enough stock against them to "cover" any potential assignment. In that regard, the use of covered calls can reduce the upside potential of a long position, which is why they aren't often utilized when a trader/investor is super bullish.

Investors and traders generally deploy covered calls when they are slightly bullish but expect the underlying stock to trade sideways for the foreseeable future. To capitalize on this outlook, the investor or trader sells call options against an existing long stock position to generate income from the option premium.

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

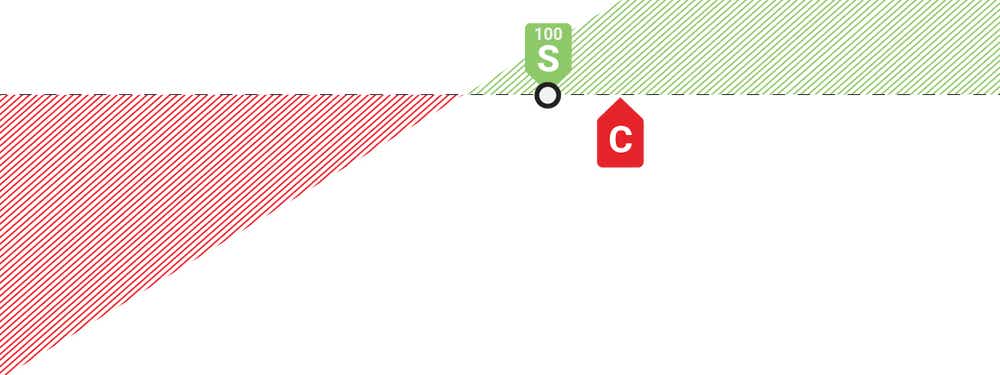

PROFIT/LOSS CHART

SETUP

Covered Call Examples

A practical example involving the covered call strategy can help illustrate the mechanics of the position and its associated risk profile.

Imagine a hypothetical investor bought 1,000 shares of ABC for $21/share and is playing the stock for a rebound. The investor has also targeted $25 as the level in which he/she wants to close the long stock trade.

The investor notices that ABC earnings aren’t for three months, and believes the stock will trade sideways until its earnings release. In this scenario, the investor might decide to sell covered calls in order to generate extra income on the position prior to its earnings date.

A single options contract equates to 100 shares of stock, which means buying and exercising 1 call contract will result in ownership of 100 shares of stock. So if the investor sells one call contract, and it gets exercised, he/she will have to sell 100 shares (of the total 1,000 share position) to the call buyer.

The investor has targeted the $25-strike price call options in ABC with one month until expiration because he/she doesn’t believe the stock will rise above that level during the next 30 days.

The investor can put his/her entire ABC stock position at risk by selling 10 contracts (10 contracts x 100 shares/contract = 1000 shares) of the $25-strike calls. However, the investor could also elect to sell fewer calls. Each contract represents 100 shares at risk from exercise.

The current price for a $25-strike call in the first expiration month of ABC is $0.36. If an investor sells 10 contracts, he/she will receive $360 from the call sale (10 x $0.36 x 100 = $360).

Altogether that means the investor is long 1,000 shares of ABC with a cost basis of $21/share and is short 10 of the $25-strike calls at $0.36 with 30 days until expiration for which he/she has received $360.

Now let's look at two hypothetical scenarios, one is which ABC stock falls to $20/share and another in which ABC stock rises to $25/share. It’s assumed that the investor has held the short call position until the day the options expire.

Scenario #1, ABC Drops to $20/share

If ABC stock were to drop to $20, the investor would lose money on his/her long stock position. However, the short call will expire worthless, and the investor gets to keep the entire $360 he/she received from selling the 10 option contracts. The investor also gets to maintain his/her 1,000 share position in ABC, because the call options aren’t exercised.

Assuming the stock is exactly $20 at expiration the profit and loss calculation for the combined position is as follows:

Opening stock value: $21,000

Closing stock value: $20,000

Loss on stock position: ($1,000)

Credit from sale of call options: $360

Total profit and loss from the combined position: ($1,000) - $360 = ($640)

As you can see from the above, instead of losing $1,000 from holding the stock, the investor was able to mitigate those losses through the sale of the covered calls. Although the investor has still taken a hit on the long stock position, he/she still owns the ABC stock and collected an extra $360.

SCENARIO #2, ABC RISES TO $25/SHARE

Now let's look at the second hypothetical scenario—the one in which ABC rises to $25/share at expiration:

Opening stock value: $21,000

Closing stock value: $25,000

Gain on stock position: $4,000

Credit from sale of call options: $360

Total profit and loss from the combined position: $4,000 + $360 = $4,360

ABC has moved up to $25/share and the investor is short 10 contracts of the $25-strike call, which means the call options expire worthless. The investor gets to keep all gains from $21 to $25 in the stock, as well as the $360 in income from the short call position.

Moreover, the investor still owns 1,000 shares of ABC with a cost basis of $21/share. At this juncture, the investor can either sell the stock position for a profit, or hold the shares for a longer period of time—depending on his/her outlook in the stock.

Had the investor not sold any call options, the he/she would have made $4,000 from the long stock position, but not collected the extra income from the short options position.

How to Sell a Covered Call

In order to sell a covered call, the investor or trader will first need to own the underlying in question.

For example, the investor/trader might already own 1,000 shares of hypothetical stock XYZ. Or the investor/trader might decide to initiate a new position in hypothetical stock DEF, and purchases 1,000 shares of DEF.

Once the long stock position is established, the investor/trader can then filter for a potential call to sell using the following steps:

- Identify the call option you want to sell You can use the trading platform to assist with this process.

- Determine the strike price and expiration date: Once you have identified the call option, you need to determine the strike price and expiration date. The strike price is the price at which the option holder can buy the shares from you, while the expiration date is the date on which the option expires.

- Sell the call option(s): Finally, you can sell the call option(s). When you sell the call option(s), you receive a premium (the price of the option), which is credited to your account. In exchange, you give the option buyer the right to buy the shares from you at the strike price before the expiration date.

If the price of the underlying stock rises above the strike price of the call option, the option buyer may exercise their option and buy the shares from you at the strike price. That means the investor/trader will miss out on any further gains above the strike price.

On the other hand, if the price of the asset doesn't increase above the strike price, the investor/trader will keep the premium from selling the call option, and you can repeat the process again, if so desired.

Maximum Profit/Loss for a Covered Call

The maximum profit potential of a covered call is achieved if the stock price is at-or-above the strike price of the call at expiration. The maximum profit potential is calculated by adding the call premium to the difference between the strike price and the stock price.

The worst potential outcome for a covered call is if the underlying stock drops to zero, however, in that case the bulk of the losses come from the long stock position (which the investor theoretically would have been holding anyway).

This loss occurs because the investor/trader still owns the underlying asset, which has decreased in value. But he/she also received a fixed amount from selling the call option. The short call actually helps to reduce one’s total losses in the maximum loss scenario.

HOW TO CALCULATE MAX PROFIT / BREAKEVEN(S)

MAX PROFIT

Distance Between Stock Purchase Price & Short Call + Credit Received

BREAKEVEN(S)

Stock Purchase Price - Credit Received

Covered Calls Benefits: Why Use a Covered Call?

The covered call strategy has several benefits, including:

Income generation: Selling covered calls allows investors and traders to generate income from the premiums received for selling the options. This can be particularly useful when one expects sideways movement in the underlying stock.

- Limited risk: Because the investor/trader owns the underlying stock, the covered call strategy has limited risk. In the disaster scenario, the losses are attributable to the long stock position, not the short call position. And even if the underlying stock falls, the investor/trader still owns the stock and can either sell it at a lower price or hold it for potential future gains.

- Upside potential: The covered call strategy can provide some upside potential if the price of the underlying stock trades sideways or increases slightly. If the price of the underlying stock remains below the strike price of the call option, the option will expire worthless, and the investor/trader gets to keep the premium generated by selling the option(s).

- Flexibility: The covered call strategy can be used in a variety of market conditions and tailored to meet an individual investor/trader’s investment goals and risk tolerance. For example, one can adjust the strike price and expiration date of the call option to increase or decrease the income potential, or the overall risk exposure of the strategy.

- Diversification: The covered call strategy can be used to diversify one’s investment portfolio by adding exposure to a different asset class, while generating income at the same time.

Overall, the covered call strategy can be a useful tool for investors and traders who are looking for income generation, limited risk, upside potential, flexibility, and/or diversification in their investments. However, it's important to understand the risks and limitations of thecovered call strategy.

When to Use a Covered Call

The covered call strategy works particularly well when the underlying stock moves sideways or slightly higher during the life of the call option. However, the covered call strategy can be useful in a variety of market conditions and for a range of investment objectives, including:

- Generating income: The primary use of the covered call strategy is to generate income. If an investor/tradre own an asset, such as stocks or ETFs, that he/she is willing to sell at a certain price (i.e. the strike price of the call option), then selling a covered call can help generate additional income.

- Neutral or slightly bullish market: The covered call strategy can be effective in a neutral or slightly bullish market. If an investor/trader expects the price of an asset to remain relatively stable or increase slightly, selling a covered call can allow the investor/trader to generate income while still owning the asset and benefiting from any modest price increases.

- Reducing risk/hedging: By selling a call option, investors and traders can theoretically limit downside risk if the price of the underlying stock falls. If the price of the stock falls below the strike price of the call option, the option will expire worthless, and the investor/trader will still own the underlying stock, which can be sold or held for potential future gains.

As outlined above, the covered call strategy can be used in a variety of market conditions and for a range of investment objectives, including income generation, risk reduction and hedging.

However, it's important to understand the risks and limitations of the covered call strategy before deploying it in the market. That’s why many investors choose to mock trade (i.e. paper trade) covered call options before entering into a live trade.

Mock trading allows investors and traders to better understand how a covered call position behaves without the potential for capital losses. When trading an unfamiliar market, product or strategy, it’s can be prudent to mock trade that market/product/strategy before deploying a live trade.

tastylive Approach

We almost always prefer covered calls to naked stock because it allows us to profit when the stock doesn’t move at all, and it also reduces our max loss if the stock goes down. It’s important to consider the credit received from the call when deploying this strategy. If we can only collect $0.10 by selling the call, we may consider another strategy or hold off on selling the call until we can find more premium.

We look to deploy this bullish strategy in low priced stocks with high volatility. Based on our studies, entering this trade with roughly 45 days to expiration is ideal. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor.

CLOSE / MANAGE

WHEN TO CLOSE

We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit. We may also consider closing a covered call if the stock price drops significantly and our assumption changes.

WHEN TO MANAGE

We roll a covered call when our assumption remains the same (that the price of the stock will continue to rise). We look to roll the short call when there is little to no extrinsic value left. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. We will also roll our call down if the stock price drops. This allows us to collect more premium, and reduce our max loss & breakeven point. We are always cognizant of our current breakeven point, and we do not roll our call down further than that. Doing so can lock in a loss if the stock price actually comes back up and leaves our call ITM.

Covered Calls Summed Up

A covered call combines a long stock position with a short call position, and is a common strategy deployed by both investors and traders.

Investors and traders generally deploy covered calls when they are slightly bullish but expect the underlying stock to trade sideways for the foreseeable future. To capitalize on this outlook, the investor or trader sells call options against an existing long stock position to generate income from the option premium.

The maximum profit potential of a covered call is achieved if the stock price is at or above the strike price of the call at expiration.

The worst potential outcome for a covered call is if the underlying stock drops to zero, however, in that case the bulk of the losses come from the long stock position (which the investor theoretically would have been holding anyway).

Overall, the covered call strategy can be a useful tool for investors and traders who are looking for income generation, limited risk, upside potential, flexibility, and/or diversification in their investments. However, it's important to understand the risks and limitations of the covered call strategy.

FAQ

What is a covered call and how does it work?

A covered call combines a long stock position with a short call position, and is a common strategy deployed by both investors and traders.

Investors and traders generally deploy covered calls when they are slightly bullish but expect the underlying stock to trade sideways for the foreseeable future. To capitalize on this outlook, the investor or trader sells call options against an existing long stock position to generate income from the option premium.

Can I make money with covered calls?

The maximum profit potential of a covered call is achieved if the stock price is at or above the strike price of the call at expiration.

The worst potential outcome for a covered call is if the underlying stock drops to zero, however, in that case the bulk of the losses come from the long stock position (which the investor theoretically would have been holding anyway).

The covered call strategy can be used in a variety of market conditions and for a range of investment objectives, including income generation, risk reduction and hedging. However, it's important to understand the risks and limitations of the covered call strategy before deploying it in the market.

Why would I buy a covered call?

An investor or trader might decide to deploy a covered call if he/she holds an existing long stock position and thinks the underlying stock will trade sideways for the foreseeable future.

The covered call strategy can be used in a variety of market conditions and for a range of investment objectives, including income generation, risk reduction and hedging.

What are the downsides of covered calls?

One of the biggest potential drawbacks of the covered call strategy is that it theoretically limits the upside potential of a long stock position. If the price of the underlying stock rises above the strike price of the call option, the investor or trader is obligated to sell the stock at the strike price, potentially missing out on additional gains.

The covered call strategy may also be too complex for some investors and traders. When deploying covered calls, market participants need to evaluate the potential strike price and expiration date of the call option, as well as the potential income and overall risk profile of the strategy.

What to do if a covered call goes against you?

The worst potential outcome for a covered call is if the underlying stock drops to zero, however, in that case the bulk of the losses come from the long stock position (which the investor theoretically would have been holding anyway).

This loss occurs because the investor/trader still owns the underlying asset, which has decreased in value. But he/she also received a fixed amount from selling the call option. The short call actually helps to reduce one’s total losses in the maximum loss scenario.

What happens when a covered call expires in the money?

If a covered call expires in the money, it means that the price of the underlying stock has risen above the strike price of the call option. In this case, the option buyer has the right to buy the underlying stock at the strike price, and the investor/trader that sold the call option is obligated to sell the underlying stock to the buyer.