Filter

Contents

Broken Wing Butterfly: Short & Long Options

By: Sage Anderson. Reviewed By: JJ Kinahan.

Updated Nov 19, 2022

Contents

What’s a Broken Wing Butterfly?

A broken wing butterfly is a long butterfly spread with long strikes that aren’t equidistant from the short strike. This leads to having greater risk than the other, which makes the trade slightly more directional than a standard long butterfly spread.

Another way to think about this strategy is as a ratio spread with defined risk. Due to its widest out-of-the-money (OTM) wing, known as the broken wing, risk is eliminated on the OTM side when the trade is done for a net credit. This strategy is nothing more than a debit spread + a credit spread with short options on the same strike, where the credit spread is wider and completely finances the cost of the debit spread portion of the trade.

This net credit strategy is ordinarily used to increase the probability of profit ta(POP) by routing the trade for a credit. The main objective is not to incur any cost upfront. So, by taking a credit on entry instead of a debit; the risk of losing money is eliminated if the entire spread expires OTM.

Broken Wing Butterfly vs Regular Butterfly

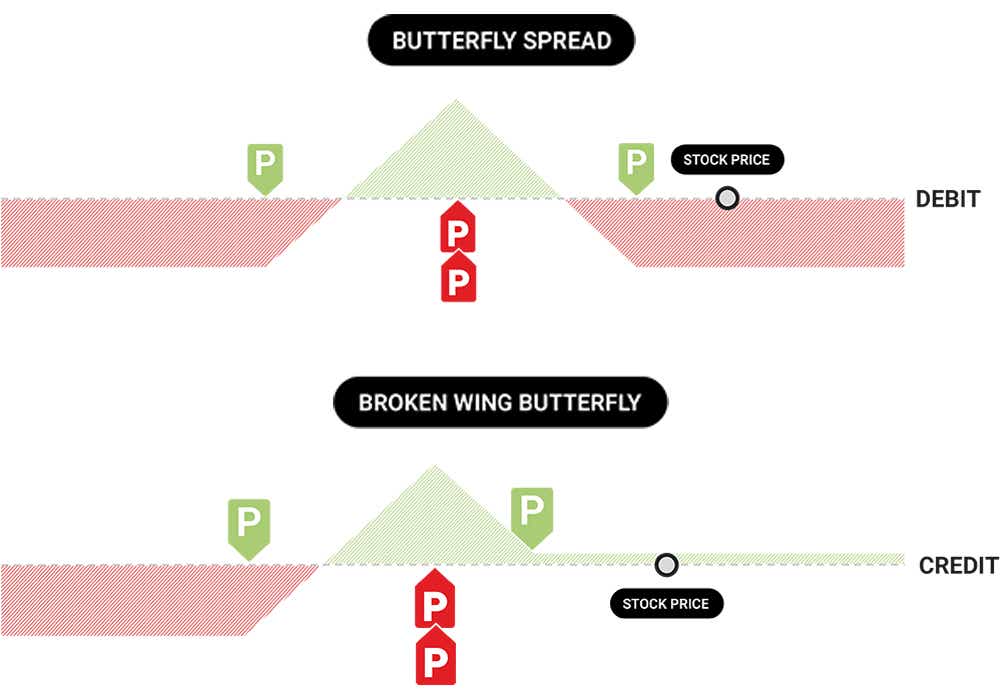

Let’s compare a regular butterfly with a broken wing butterfly using put options.

With a regular butterfly, a debit scenario is created when you sell two options and buy two options on either side that are equal in distance as seen in the image below.

Whereas with a broken wing butterfly, we’re ensuring that the debit spread portion of the trade is more narrow than the credit spread portion of the trade, so that we collect a credit up front and have no risk to the OTM side.

Overview

DEFINITION

A broken wing butterfly – or a skip strike butterfly, is a net credit, high probability trade that can make money even if your speculation is directionally wrong.

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

PROFIT / LOSS CHART

How to set up a Broken Wing Butterfly

It’s preferable to set up broken wing butterflies in high implied volatility (IV) environments. When initiating a trade, you’ll typically look for underlyings with high IV rank and a high IV% and enter for a credit. The POP will improve when the trade is initiated for a credit, because we remove risk from the OTM side of the trade. Broken wing butterfly spreads benefit from a decrease in volatility.

Broken wing butterfly spreads can be constructed with either all calls or all puts. The trade is comprised of two short options and a long option above and below the short strike.

So, this is the typical setup of a broken wing butterfly:

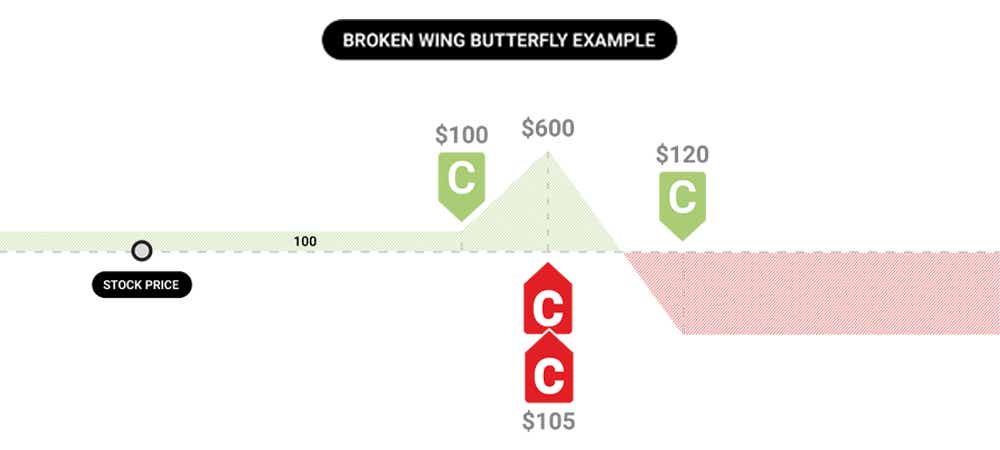

Broken Wing Butterfly Example

Suppose you’re slightly bullish on the stock of company XYZ and you think it will rise to $105 by the expiration of your trade. You enter a broken wing butterfly spread with a long call at $120 (15 points above the short strike) and another long call at $100 (5 points below the short strike), while selling two $105 calls, which leaves you with a net credit of $1.00

- Buy one $120 call in XYZ

- Sell two $105 calls in XYZ

- Buy one $100 call in XYZ

- Net credit = $1.00

The credit spread side with the option that’s further away from the short strike is called the “broken” side, and this is what gives the strategy its name. This is the 105/120 credit spread in this example. This wider credit spread of $15 points completely finances the cost of the 100/105 debit spread.

Widening out the long strike on the upside leads to the trade being placed for a credit, which means there’s no risk to the downside in this scenario, since you’re collecting premium up front and will profit by that premium amount if the spread expires OTM.

tastylive Approach

Our approach to broken wing butterfly spreads is simple – we always route this for a credit. By doing this, we eliminate the risk of losing money if the entire spread expires OTM. For this very reason, routing this trade for a credit also drastically improves our probability of profit.

CLOSE / MANAGE

WHEN TO CLOSE

When routing this strategy, it is usually for a very small credit. Therefore, we won’t look to close the trade if we see a small profit from that. We usually aim for 50% of our max profit on the trade. That would be when our closest long option to the stock price goes ITM near expiration. To get a rough calculation of this, just take the distance between the closest long option and the short options and divide by two.

WHEN TO MANAGE

If our spread goes against us, we will look to close our long spread aspect of the trade for max profit, and potentially roll the remaining short spread out in time if we can do so for a credit.

Broken Wing Butterfly Profit & Loss

Broken wing butterfly profit and loss are influenced by time and volatility. You can make money with this strategy if done for a credit and the underlying moves against you OTM. By using calls, you’ll make profit towards the downside equivalent to the credit received upfront, while puts will give you profit towards the upside. So, you’re financing your long put spread with a much wider short put spread, and the same is true with the call broken wing butterfly, just with call spreads.

Broken Wing Butterfly Max Profit

The typical broken wing butterfly spread profits when:

- Stock price stays the same, IV decreases

- Stock price goes up or down, but not past the credit spread strikes

- Time passes and IV decreases

- Stock price moves toward the short strikes

In other words, broken wing butterflies require time and volatility contraction to make money. You’ll need to keep this in mind to achieve the maximum profit.

How is max profit calculated?

Width of narrower debit spread + credit received

OR

Width of narrower debit spread - debit paid

Broken Wing Butterfly Max Loss

A broken wing butterfly will show losses at expiration when:

- Stock is below the short puts by more than credit received plus the width of the put spread

- Stock is above short calls by more than credit received plus width of call spread

- Loss is capped at the furthest OTM long option

How max loss is calculated in a long symmetrical butterfly spread:

Debit paid + commissions (if the spread is completely ITM or OTM)

Max loss calculation for broken wing butterfly spreads is one of either:

Width of credit spread - width of narrow debit spread - credit received

OR

Width of credit spread - width of narrow debit spread + debit paid

How to Calculate Breakevens

The breakeven on a broken wing butterfly is slightly wider than a regular butterfly strategy, because we’re collecting a credit instead of paying a debit, and that credit collection helps us offset our breakeven price past our short strike.

Breakevens – Call Broken Wing Butterfly

Net credit

(Short strike + width of narrower debit spread) + credit received

Net debit

Upside: (short strike + width of narrower debit spread) - debit paid

Downside: lower long call strike + debit paid

Breakevens – Put Broken Wing Butterfly

Net credit

(Short strike - width of narrower debit spread) - credit received

Net debit

Upside: higher long put strike - debit paid

Downside: (short strike - width of narrower debit spread) + debit paid

Broken Wing Butterfly vs Credit Spread

Let’s take a look at how a broken wing butterfly compares to a credit spread:

Broken Wing Butterfly

- Setup: calls if you want your max profit and risk to be to the upside, or puts if you want your max profit and risk to be to the downside

- Trade is comprised of two short options and two long options (one above and one below the short strike)

- Risk is defined

- Max profit is the width of the debit spread portion of the trade, less the debit paid, or plus the credit received on trade entry. To reach max profit the stock must pin your short strike at expiration.

- Max loss is the width of the credit spread, minus the width of the debit spread, minus the credit received upfront (or plus the debit paid upfront)

- Ideal environment for this strategy: high IV

Credit Spread

- Setup: either calls when market assumption is bearish or puts when market assumption is bullish

- Trade is set up with a long and a short option contract at different strikes, with the short option trading at a higher premium than the long option

- Risk is defined

- Max profit is the credit you receive for selling the spread up front– you can't make any more money than the initial credit received. To reach max profit the spread just needs to expire OTM.

- Max loss is the width of credit the spread minus the credit received upfront

- Ideal environment for this strategy: high IV

Broken Wing Butterfly Summed Up

- A broken wing butterfly is created for a credit instead of a debit

- It’s a popular options strategy as the risk is low relative to possible reward and requires a low buying power reduction in comparison to many other strategies

- Compared to a regular butterfly, the broken wing has a higher POP because we collect a credit up front instead of paying a debit

- The butterfly spread is constructed with either all calls or all puts- the broken wing butterfly works the same way, and is typically placed ATM/OTM

- The trade is set up by buying a debit spread and selling a wider credit spread against it, using the same short strike. This can create a net credit up front, regardless of whether you’re using calls or puts

- What makes it unique is that it has been widened on the credit spread side to eliminate risk if the spread expires OTM, when routed for a credit up front

- Max possible profit is higher with a broken wing butterfly than a regular butterfly, simply because we’re collecting a credit up front instead of paying a debit. Max profit is realized if the stock price is right on the short strike at expiration

FAQs

How do you manage a broken wing butterfly?

To manage or defend a broken wing butterfly, we typically separate the long and short spreads. If the trade goes against you, there are a few defensive tactics you can try out:

- Secure the long spread value, which is then used as a cost-basis reduction against your short spread that’s tested

- Roll the short spread for a credit to add time to the trade

- Collecting a credit when rolling the short credit spread results in a lower max loss, a higher max profit, and more time for the trade to work out at no additional added risk

Should I let butterfly spread expire?

Yes, you can let the butterfly spread expire, especially if the spread is far OTM at expiration. If your butterfly wing spread goes against you, then you have the option of closing the long spread aspect of the trade for max value, and potentially roll the remaining short spread out in time if you can do so for a credit. If your butterfly spread is partially ITM, we look to close the position instead of holding it through expiration so that we don’t end up with unwanted shares in the next trading session.

What’s a broken wing butterfly options strategy?

A broken wing butterfly options strategy is slightly more directional than a standard long butterfly spread. They carry defined risk on one side of the market when routed for a credit, and rely on volatility contraction, the passage of time, and/or a movement towards the short strike at expiration for profitable management.

Typical setup of a broken wing butterfly:

- Buy debit spread ATM/OTM

- Sell wider credit spread further OTM for more than the cost of the debit spread

- Short strikes are shared between the spreads

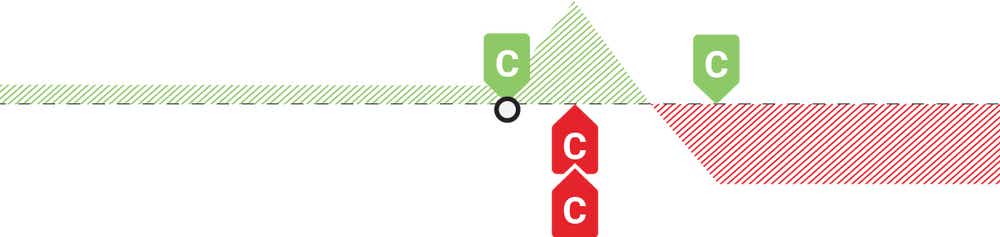

What’s a broken wing butterfly call spread?

A broken wing butterfly call spread is an omnidirectional options trading strategy where you buy an OTM call debit spread and finance it with a wider, further OTM call credit spread sharing the same short strike as the debit spread. If the trade is routed for a credit upfront, no downside risk exists.

To set up a call broken wing butterfly:

- Buy one OTM long call

- Sell two further OTM short calls

- Buy one OTM long call above the short calls

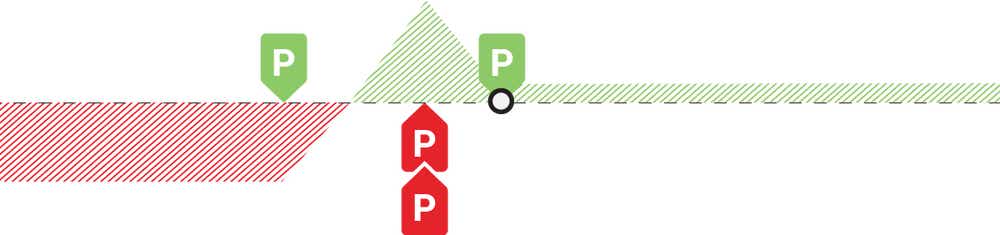

What’s a broken wing butterfly put spread?

A broken wing butterfly put spread is an omnidirectional options trading strategy where you buy an OTM put debit spread and finance it with a wider, further OTM put credit spread sharing the same short strike as the debit spread.

If the trade is routed for a credit, no upside risk exists.

To set up a put broken wing butterfly:

- Buy one OTM long put

- Sell two further OTM short puts

- Buy one OTM long put below the short puts

In order to create a credit on trade entry, you’ll move the OTM put option even further away from the short strike price of the trade. The put credit spread now finances the cost of the put debit spread, and a credit can be received on trade entry.

When can I exit a butterfly trade?

The best time to exit a butterfly trade is when you see a small profit. We like to aim for 25% of the max profit on the trade. That would typically be realized when your closest long option to the stock price goes ITM near expiration. To get a rough calculation of our profit target, take the distance between the closest long option and the short options and divide it by four.