U.S. inflation and retail sales, Japan G.D.P: Macro Week Ahead

U.S. inflation and retail sales, Japan G.D.P: Macro Week Ahead

By:Ilya Spivak

All eyes are on U.S. inflation data as traders wonder how many interest rate cuts would be enough to comfort the markets.

- U.S. inflation data in focus as stocks soar despite cooling Fed rate cut bets.

- Japan’s economy may return to growth, but a hawkish BOJ remains unlikely.

- Retail sales, consumer confidence data round out U.S. economic calendar.

The bulls continued to charge last week on Wall Street. The bellwether S&P 500 index rose 1.28%, posting the fifth consecutive weekly rise.

This is despite the markets having pulled back Federal Reserve rate cut expectations to 100 basis points (bps) for 2024. That's down from the 150 bps in reductions traders expected in mid-January.

The U.S. dollar idled against its major counterparts. Gold prices edged cautiously lower but stayed well within the narrow range containing them for over two months. Treasury yields moved higher as bonds pulled back across maturities. Crude oil prices retraced most of last week’s outsized losses, leaving it little-changed on the month.

Here are the macro waypoints that are likely to shape price action in the week ahead.

U.S. consumer price index (CPI) data

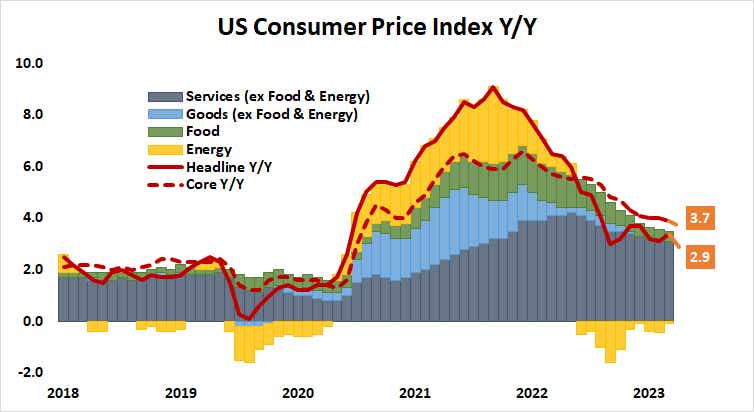

The markets expect to find that headline U.S. inflation fell back below the 3% threshold in January. The headline consumer price index (CPI) is seen rising 2.9% year-on-year. The core measure excluding volatile food and energy prices is penciled in at 3.7%. Those would mark the slowest readings since March and April 2021, respectively.

The recent run of better-than-expected U.S. economic data speaks to upside surprise risk. If the business cycle is in a higher gear than analysts’ models are anticipating, upward pressure on prices may be stronger too. This raises a key question: can stocks power higher if rate cut bets are diluted further? The answer may prove to be trend-defining.

Japan gross domestic product (GDP) data

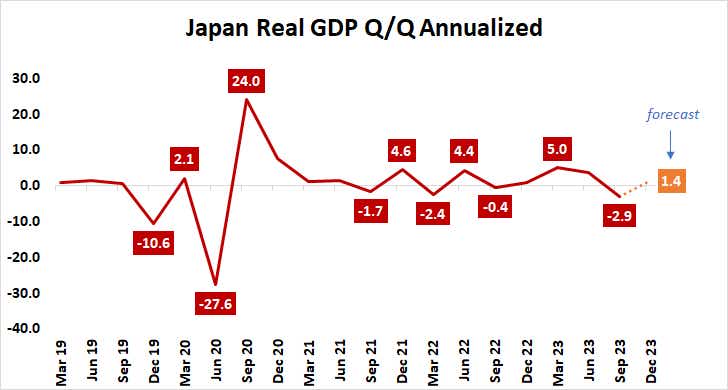

Analysts expect data to show Japan’s economy grew at an annualized rate of 1.4% in the fourth quarter, returning to expansion mode after shrinking at a blistering pace of 2.9% in the three months to September 2023. Absent an improbably dramatic upside surprise, the release is unlikely to encourage hawkish Bank of Japan (BOJ) policy bets.

The Japanese yen surged in the fourth quarter, which might have spurred consumption and encouraged prices higher. However, CPI data covering the period has already shown slow but steady disinflation continued as pressure from food costs eased further. If the currency holds up despite middling results, that might bookend the latest round of selling.

U.S. retail sales and consumer confidence data

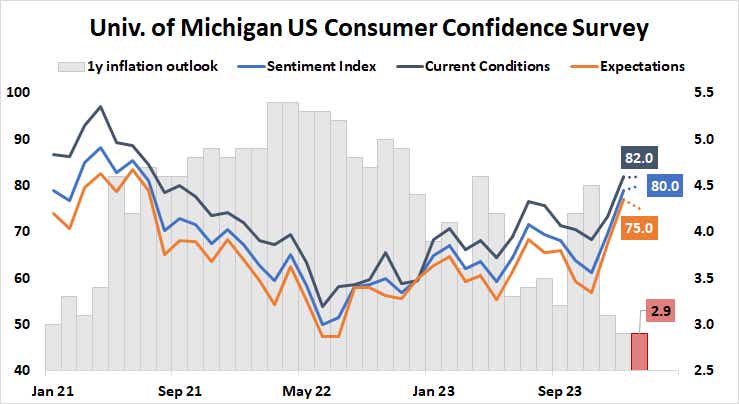

Economists expect U.S. retail sales to tick lower in January, sliding 0.1%. That follows a chipper 0.6% rise in December, which marked the biggest increase in three months. Nevertheless, the University of Michigan consumer sentiment survey is projected to show confidence surged to start to 2024.

Upside surprises here echoing the strength on display in U.S. data outcomes over recent weeks may continue to eat into Fed rate cut expectations. That seems likely to bode well for the U.S. dollar against its major counterparts. The stocks, the question remains the same: what is minimum number of rate cuts acceptable to sustain risk appetite?

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.