China's Economy is Weaker Than Meets the Eye Amid U.S. Trade War

China's Economy is Weaker Than Meets the Eye Amid U.S. Trade War

By:Ilya Spivak

Signs of economic strength in China are misleading as trade war pressure mounts.

- China started 2025 with faster economic growth than analysts expected.

- Perky retail sales and industrial production data is less than meets the eye.

- Stock markets have little to like in China’s results as trade war escalates.

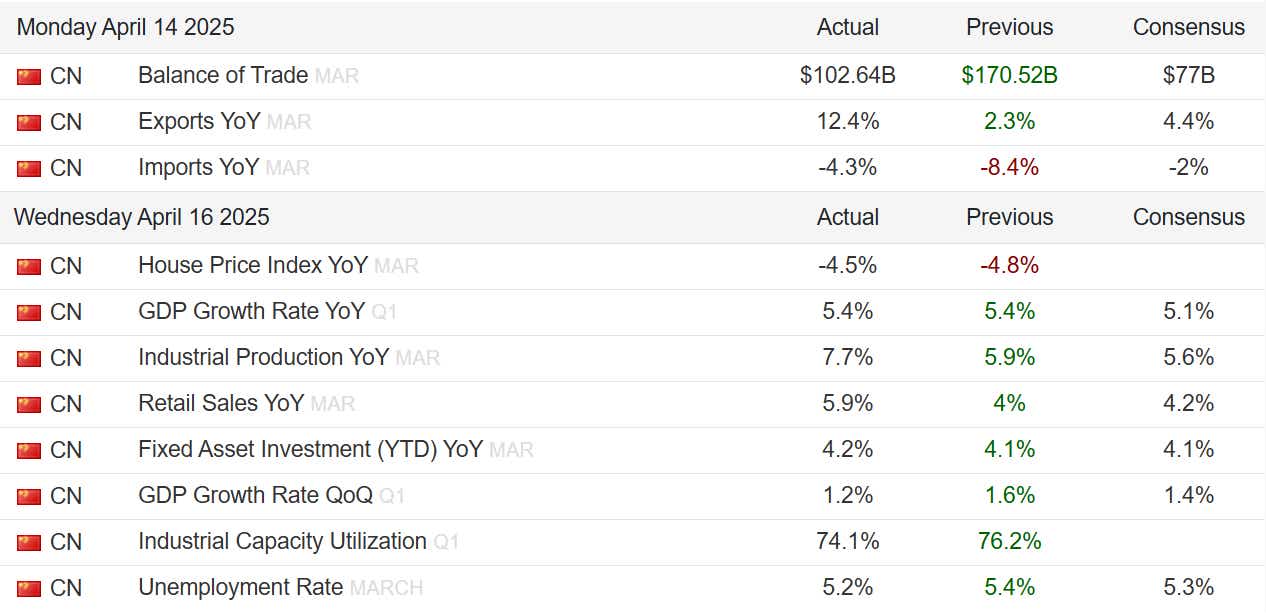

China’s economy performed better than expected in the first quarter of the year. Gross domestic product (GDP) grew 5.4% year-on-year, topping forecasts calling for a rise of 5.1% and matching the pace recorded in the three months to December 2024.

A slew of indicators released alongside the data also surprised on the upside. Retail sales grew 5.9% year-on-year, outpacing than the 4.2% penciled in by economists. Industrial production jumped 7.7% over the same period, marking a hearty beat of the 5.6% median projection and the biggest rise since June 2021.

Is China in a strong position as the spat with the U.S. heats up?

Such strong results might seem to suggest that China is well-positioned to weather the escalating trade war between it and the United States. U.S. President Donald Trump excluded the East Asian giant from a 90-day pause on reciprocal tariffs above 10% announced last week. The cumulative tariff on Chinese imports now stands at 145%.

In fact, the first quarter’s seemingly strong results probably say more about China’s precarious economic position than they do about resilience. Trade data published earlier in the week begins to tell the story. It showed that exports surged 12.4% year-on-year to clock the biggest rise since October. Imports fell for the second month, down 4.3%.

The contribution from global trade surged to an average of 2.26 percentage points (ppt) of overall GDP growth in the second half of 2024, the highest in three years. Meanwhile, the uplift from domestic consumption and investment cooled. This seemed to reflect an effort to build inventories to front-run rising costs from incoming tariffs.

Stock markets have little to cheer in Chinese economic data

The trade statistics point toward more of the same at the start of 2025. This probably helps explain surging industrial production, implying that it is inherently temporary and may have already run its course now that the new tariffs have landed.

.png?format=pjpg&auto=webp&quality=50&width=1920&disable=upscale)

The jump in retail sales seems likely to be short-lived as well. Subsidies to encourage consumers to replace ageing appliances and furniture have understandably boosted receipts, but this too is a temporary rise unless confidence rises in earnest. In fact, the trend seems to be pointing in the opposite direction.

The People’s Bank of China (PBOC), the country’s central bank, reports that households are funneling nearly three times as much cash into “time deposits” meant for savings as they are into “demand deposits” meant to be spent immediately. That’s the biggest disparity since at least 2008, and points to weak consumer intent.

This probably means that the deflationary slump that has bedeviled Beijing policymakers since early 2023 probably carried on for an eighth consecutive quarter in the first three months of 2025. A bitter trade war is likely to make things worse. Needless to say, that adds up to bad news for global growth, and by extension for the markets.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.