ECB Preview: Has the Euro Finally Gone Too Far Against the U.S. Dollar?

ECB Preview: Has the Euro Finally Gone Too Far Against the U.S. Dollar?

By:Ilya Spivak

An epic euro rally may run out of steam as the ECB dials up dovish signaling

- The euro has soared against the U.S. dollar as trade war worries roil the markets.

- Price action has tellingly decoupled from near-term central bank policy speculation.

- A dovish tone from the ECB may put the brakes on the euro rally, at least for now.

The euro has pushed relentlessly higher against the U.S. dollar, surging to the highest levels in over three years. However, the exchange rate has notably decoupled from its usual trade dynamics as worries about a gathering trade war and its implications for the global economy play out across the markets.

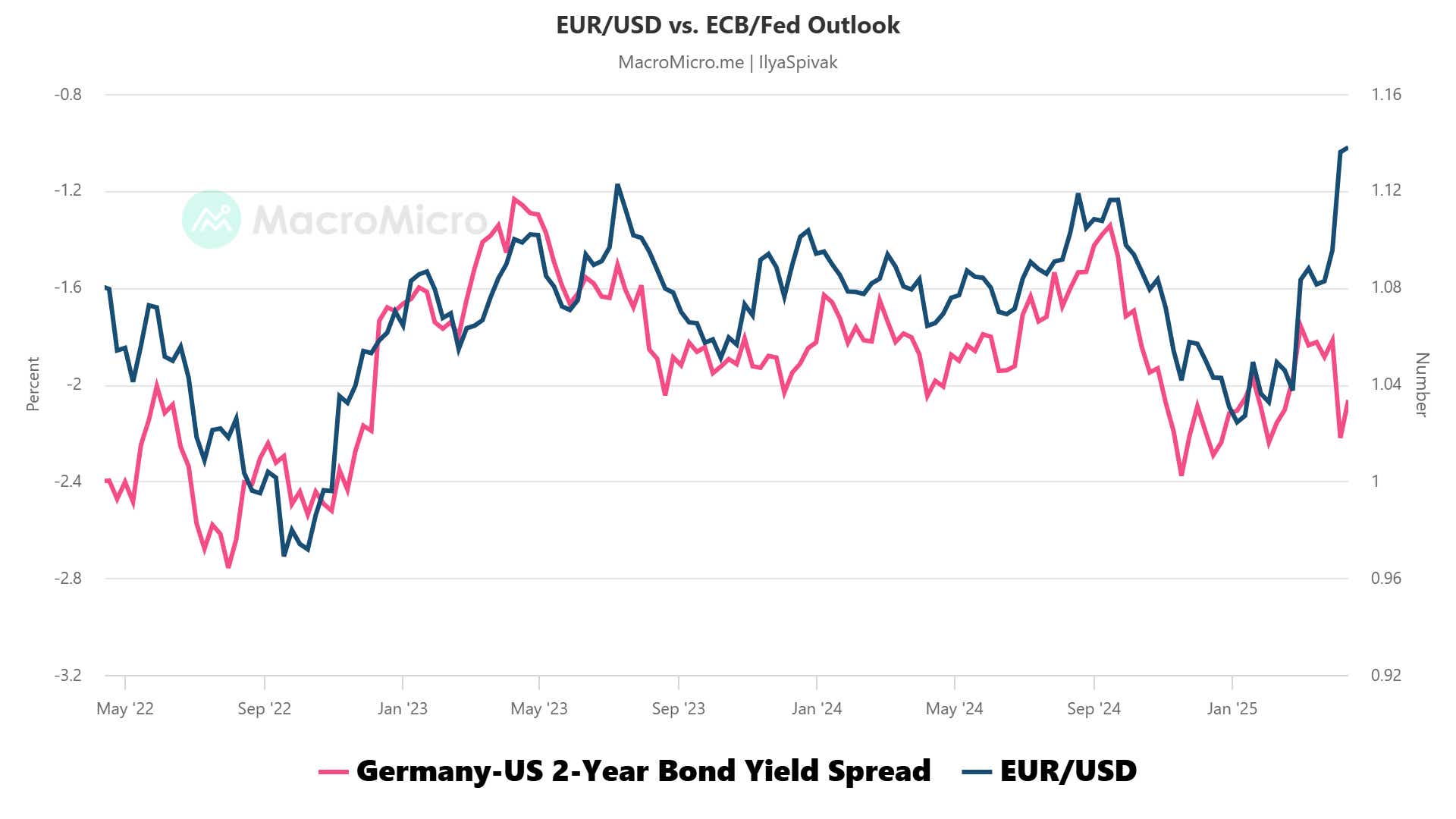

The euro traded in lockstep with the spread between German and U.S. two-year bond yields for close to four years, a reflection of the trend in relative monetary policy expectations, until the link broke down at the start of April. So far this month, the single currency has surged even as its yield advantage has narrowed.

Bond yields lost sway over the euro vs. U.S. dollar exchange rate

This seems to reflect increasing uncertainty about the path ahead for U.S. fiscal policy alongside expectations that trade frictions will bring on a slump in economic growth, and perhaps full-on recession. Treasury yields have surged in the past two weeks even as rapidly rising term premium points to demand for higher compensation of duration risk.

Meanwhile, inflation expectations priced into German bond markets – so-called “breakeven rates” – have moved rapidly lower. That seems to suggest that the markets envision a steep slump in economic performance downwind that weakens price pressure. That has weighed on Eurozone yields.

Against this backdrop, the European Central Bank (ECB) is preparing to deliver a monetary policy announcement. A 25-basis-point (bps) interest rate cut is expected. Benchmark ESTR interest rate futures price in 72bps in cuts this year, amounting to three standard-sized rate reductions.

A loudly dovish ECB may sting the euro as 2026 rate hike bets unravel

However, the markets still seem to be holding on to the idea that a big-splash defense spending spree will boost growth and inflation in 2026, so much so that a rate hike may be needed. The probability of such a move is now priced at a considerable 44%.

.png?format=pjpg&auto=webp&quality=50&width=743&disable=upscale)

Eurozone inflation has cooled, hitting a four-month low of 2.2% year-on-year in March. Purchasing managers index (PMI) data suggests that economic activity growth has returned to positive territory so far in 2025, but the pace of expansion is disappointingly slow.

If this translates into a dovish tone from ECB President Christine Lagarde and the central bank’s Governing Council, that would not mark much of a change for this year’s expected policy path. However, it may also dilute next year’s rate hike possibilities. That might take some of the steam out of the euro rally, if only temporarily.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.