S&P 500 Losing Modest Gains after Trump Slams Fed Inaction

S&P 500 Losing Modest Gains after Trump Slams Fed Inaction

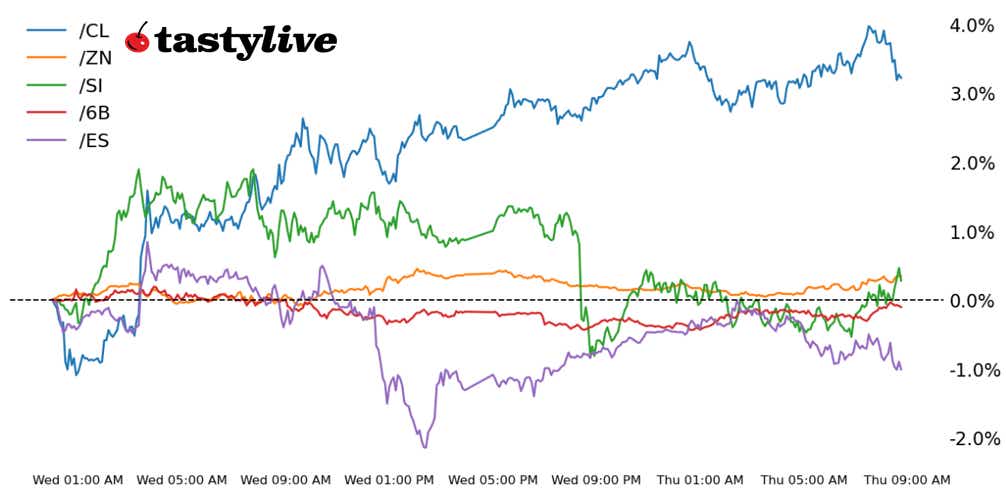

Also, 10-year T-note, silver, crude oil and British pound futures

- S&P 500 E-mini futures (/ES): +0.26%

- 10-year T-note futures (/ZN): -0.06%

- Silver futures (/GC): -1.43%

- Crude oil futures (/CL): +1.26%

- British pound futures (/6B): +0.2%

Traders woke up on today to a screed from U.S. President Donald Trump about Federal Reserve Chair Jerome Powell’s refusal to cut interest rates, saying that “Powell’s termination cannot come fast enough!” The silver lining is that Powell’s term is set to expire in May 2026, and until Humphrey’s Executor is overturned (currently in review at the Supreme Court), it would seem Powell’s job is safe. Otherwise, trade war is the topic du jour (again) as Trump has likewise publicized meetings with Japanese and Mexican officials over the past 24 hours.

Symbol: Equities | Daily Change |

/ESM5 | +0.26% |

/NQM5 | +0.49% |

/RTYM5 | +0.81% |

/YMM5 | -1.1% |

S&P 500 futures (/ESM5) rose about 0.5% in early trading after trimming some gains from the overnight session following a statement from Trump that called for the firing of Powell. Taiwan Semiconductor Manufacturing (TSM) lifted technology stocks after the company provided a rosy sales forecast. However, healthcare stocks fell after UnitedHealth (UNH) dropped 20% following weak earnings results and guidance. Despite today’s gains, the S&P 500 is on track to record a weekly loss of about 1% ahead of an extended holiday weekend.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4750 p Short 4800 p Short 5850 c Long 5900 c | 66% | +480 | -2020 |

Short Strangle | Short 4800 p Short 5850 c | 72% | +3525 | x |

Short Put Vertical | Long 4750 p Short 4800 p | 83% | +320 | -2180 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.03% |

/ZFM5 | +0.03% |

/ZNM5 | -0.06% |

/ZBM5 | -0.35% |

/UBM5 | -0.55% |

Bond prices rose to trim losses after U.S. labor market data disspelled some fears of an economic contraction. Yesterday, Powell pushed back on the notion that the Fed would step in to act quickly to calm markets. Bond investors remain focused on the trade war, which could benefit foreign bonds if the restrictions on trade don’t ease over the short term. Meanwhile, German bunds in Europe are performing well after the European Central Bank (ECB) removed the word “restrictive” in its policy statement.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 107.5 p Short 115 c Long 116.5 c | 69% | +281.25 | -1218.75 |

Short Strangle | Short 107.5 p Short 115 c | 73% | +578.13 | x |

Short Put Vertical | Long 106 p Short 107.5 p | 90% | +125 | -1375 |

Symbol: Metals | Daily Change |

/GCM5 | -0.51% |

/SIK5 | -1.43% |

/HGK5 | -1.06% |

Silver futures (/SIK5) dropped, outpacing gold futures to the downside, as growth fears in the global economy accelerated. Freight shipping companies are seeing a reduction in shipments, signaling the U.S.-imposed trade restrictions are now having a material impact on the global economy. The move lower comes after gold prices hit a record high today. A reprieve for the dollar is also putting some pressure on precious metals today.

Strategy (69DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.75 p Short 28.5 p Short 37 c Long 37.75 c | 64% | +950 | -2800 |

Short Strangle | Short 28.5 p Short 37 c | 71% | +4270 | x |

Short Put Vertical | Long 27.75 p Short 28.5 p | 82% | +395 | -3255 |

Symbol: Energy | Daily Change |

/CLK5 | +1.26% |

/HOK5 | +0.88% |

/NGK5 | +0.15% |

/RBK5 | +1.01% |

Crude oil prices (/CLM5) rose to a two-week high, with traders pushing prices about 1.5% higher this morning, as the U.S. ramps up pressure on Iran. The United States imposed fresh sanctions on Iran that aim to curb its oil exports. The U.S. is also increasing enforcement measures against those who accept Iranian crude, evidenced by a move to sanction a Chinese refinery. Meanwhile, OPEC+ said that Iraq and other countries would move to reduce production after running above output quotas.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 52 p Short 53.5 p Short 73.5 p Long 75 c | 67% | +320 | -1180 |

Short Strangle | Short 53.5 p Short 73.5 p | 73% | +1700 | x |

Short Put Vertical | Long 52 p Short 53.5 p | 81% | +220 | -1280 |

Symbol: FX | Daily Change |

/6AM5 | +0.3% |

/6BM5 | +0.2% |

/6CM5 | +0.13% |

/6EM5 | -0.21% |

/6JM5 | -0.11% |

British Pound futures (/6BM5) rose to six-month highs as the currency heads for an eigtht-day gain. Inflation data supported the Bank of England’s plan to continue cutting interest rates. Traders see the Pound as a preferred currency to avoid the impact of the U.S. trade war, along with the euro and the yen, all of which have outperformed against the dollar recently. Long positioning in the pound remains unremarkable when considering the recent gains, which could mean the pound can accept higher flows in the coming weeks.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.31 p Short 1.315 p Short 1.34 c Long 1.345 c | 27% | +212.50 | -100 |

Short Strangle | Short 1.315 p Short 1.34 c | 55% | +1437.50 | x |

Short Put Vertical | Long 1.31 p Short 1.315 p | 67% | +112.50 | -200 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.