Nasdaq 100 Jumps to Start Week as Trump Walks Back April 2 Tariffs

Nasdaq 100 Jumps to Start Week as Trump Walks Back April 2 Tariffs

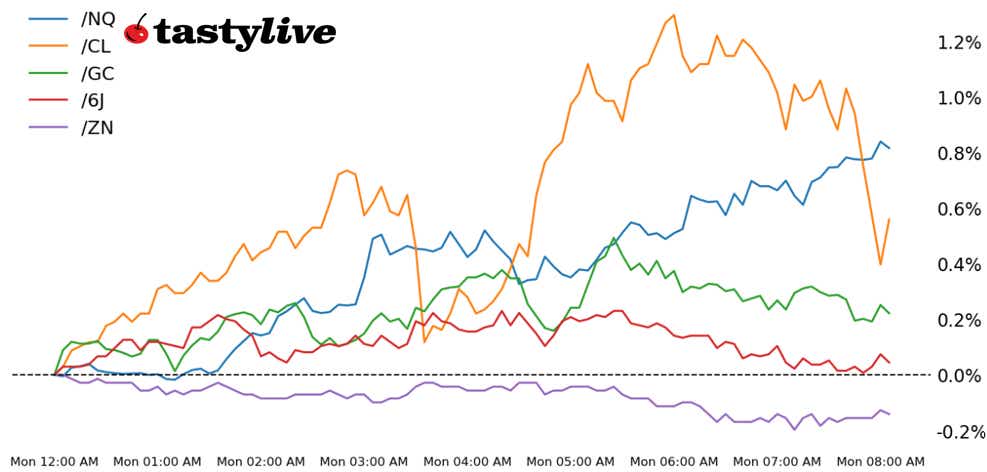

Also, 10-year T-note, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): +1.56%

- 10-year T-note futures (/ZN): -0.25%

- Gold futures (/GC): +0.31%

- Crude oil futures (/CL): +0.34%

- Japanese yen futures (/6J): -0.38%

Risk appetite is improving in global markets at the start of the week after reports emerged over the weekend that the Trump administration would be narrowing the scope of tariffs set to go into effect on April 2. U.S. equity markets are higher across the board, and with autos and semiconductors reportedly exempt, the Nasdaq 100 and Russell 2000 are competing for the top spot. Reduced tariff rates means less of a drag on growth, which may be helping lift yields at the long-end of the Treasury curve today. Commodities are well-supported in part thanks to a weaker U.S. dollar; similarly, the Japanese yen and Swiss franc are down on the day.

Symbol: Equities | Daily Change |

/ESM5 | +1.19% |

/NQM5 | +1.56% |

/RTYM5 | +1.59% |

/YMM5 | +0.96% |

Stocks are stronger out of the gate thanks to news that reciprocal tariffs will be implemented in a more targeted fashion on April 2. Concern about growth is likewise ebbing in the wake of the March U.S. S&P Global purchasing managers’ index (PMI) reports, which showed an accelerating economy led by the services sector—the opposite spin in data from a month ago that kicked off the sharp downturn in equities. Oklo (OKLO) and KB Home (KBH) report earnings after-hours today.

Strategy: (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18250 p Short 18750 p Short 21500 c Long 22000 c | 60% | +2930 | -7070 |

Short Strangle | Short 18750 p Short 21500 c | 66% | +7180 | x |

Short Put Vertical | Long 18250 p Short 18750 p | 82% | +1315 | -8675 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.08% |

/ZFM5 | -0.19% |

/ZNM5 | -0.25% |

/ZBM5 | -0.48% |

/UBM5 | -0.51% |

Bond prices fell along the curve, with the 10-year T-note contract (/ZNM5) falling 0.44% this morning. The risk-on tone across markets pushed traders out of bonds and into equities, as President Trump indicated tariffs could be more targeted going forward. Bond traders have several potentially high-impact auctions on the schedule this week, with two-year floating rate notes (FRNs) expected to auction later this week, as well as five-year and seven-year notes.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 108 p Short 113 c Long 114 c | 64% | +256.63 | -734.38 |

Short Strangle | Short 108 p Short 113 c | 69% | +609.38 | x |

Short Put Vertical | Long 107 p Short 108 p | 91% | +109.38 | -890.63 |

Symbol: Metals | Daily Change |

/GCM5 | +0.31% |

/SIK5 | +0.56% |

/HGK5 | +0.79% |

Metals are lightly bid to start the week although traders’ attention is certainly elsewhere given the tariff news. While gold (/GCM5) and silver (/SIK5) have been viable safe havens in 2025 as equity markets have tumbled, the reversal higher in stocks may prove to be an albatross for the metals in the short-term. Volatility continues to contract, with IVRs for /GCM5 and /SIK5 below 30 and 15, respectively.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2850 p Short 2875 p Short 3250 c Long 3275 c | 65% | +700 | -1800 |

Short Strangle | Short 2875 p Short 3250 c | 72% | +3750 | x |

Short Put Vertical | Long 2850 p Short 2875 p | 83% | +370 | -2130 |

Symbol: Energy | Daily Change |

/CLK5 | +0.34% |

/HOJ5 | +0.09% |

/NGJ5 | -0.1% |

/RBJ5 | -0.22% |

Crude oil futures (/CLK5) gained nearly 1% to start the week as traders weighed how new sanctions on Iranian oil exports would affect the market. Oil is coming off a second weekly gain, but prices remain below 70 amid ongoing negotiations between Ukraine and Russia that could potentially end the war and see sanctions on Russia removed. Meanwhile, OPEC+ is expected to start pushing more oil into the market starting in April despite the threat of an economic slowdown that could make it harder for the market to absorb those barrels.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 60.5 p Short 62 p Short 76 c Long 77.5 c | 65% | +360 | -1140 |

Short Strangle | Short 62 p Short 76 c | 71% | +1400 | x |

Short Put Vertical | Long 60.5 p Short 62 p | 81% | +220 | -1280 |

Symbol: FX | Daily Change |

/6AM5 | +0.2% |

/6BM5 | +0.06% |

/6CM5 | +0.04% |

/6EM5 | 0% |

/6JM5 | -0.38% |

Japanese yen futures (/6JM5) fell 0.7% this morning, breaking through an area of resistance and the 21-day exponential moving average (EMA). Improving U.S. economic indicators allowed rate traders to keep at least two Federal Reserve interest rate cuts on the board, underpinning the narrative that the Fed can hold onto its soft landing narrative. The gains in U.S. yields are also working against the yen. Traders will digest the Bank of Japan’s summary of opinions later this week.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00635 p Short 0.0065 p Short 0.0069 c Long 0.00705 c | 64% | +425 | -1450 |

Short Strangle | Short 0.0065 p Short 0.0069 c | 68% | +712.50 | x |

Short Put Vertical | Long 0.00635 p Short 0.0065 p | 87% | +150 | -1725 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.