U.S. CPI Preview: Markets May Hit a Sour Patch on Soft Data

U.S. CPI Preview: Markets May Hit a Sour Patch on Soft Data

By:Ilya Spivak

Pending U.S. CPI data may now spook the markets amid renewed recession worries

- Concerns about recession increase as central banks ratchet up the inflation fight.

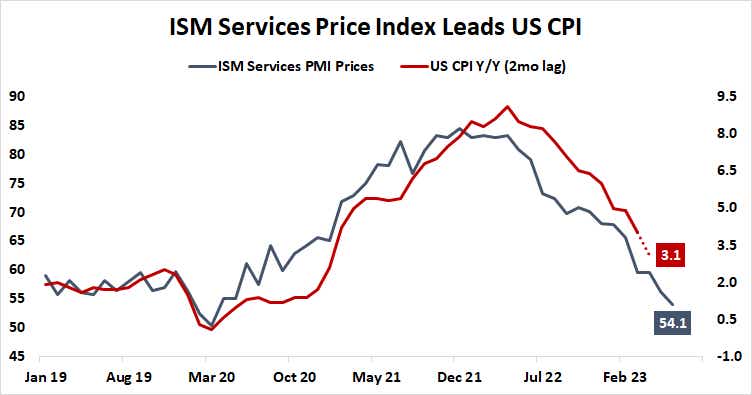

- With the U.S. CPI in focus, leading ISM data suggests disinflation is progressing.

- Soft inflation data may hurt stocks and risk appetite on growth fears.

Financial markets are seemingly undergoing thematic evolution from the first half of the year into the second.

The first six months of the year were punctuated by the banking crisis caused by the Silicon Valley Bank and the U.S. debt ceiling debacle. Each episode took its turn on the front burner for a relatively short while, then slowly retreated into the background as markets digested and moved on.

The second half of the year began with the curious combination of a rate hike pause at the June Federal Open Market Committee (FOMC) meeting and a sharpening of Fed officials’ hawkish rhetoric. Fed Chair Jerome Powell spent nearly a month brandishing the central bank’s appetite for renewed rate hikes at back-to-back speaking engagements.

Policymakers seem concerned that priced-in inflation expectations have stopped falling even after the disappearance of heady rate cut bets penciled in by panicked traders amid the first half’s two crises. They are now expected to deliver one more 25 basis point hike at this month’s FOMC conclave, followed by standstill until easing starts in March or May of next year.

Recession fears build as central banks ratchet up inflation fight

That marks a potent hawkish shift in market pricing. As recently as the start of June, the first interest rate cut was already priced in by January 2024. This readjustment seems to be feeding fears about a more severe slowdown in economic growth on the horizon.

As much seemed to emerge in the price action after June’s pivotal U.S. nonfarm payrolls (NFP) data crossed the wires last week. The spotlight now turns to the U.S. consumer price index (CPI) measure of inflation to see if the new regime survives.

Stocks may shudder if soft CPI data stokes growth concerns

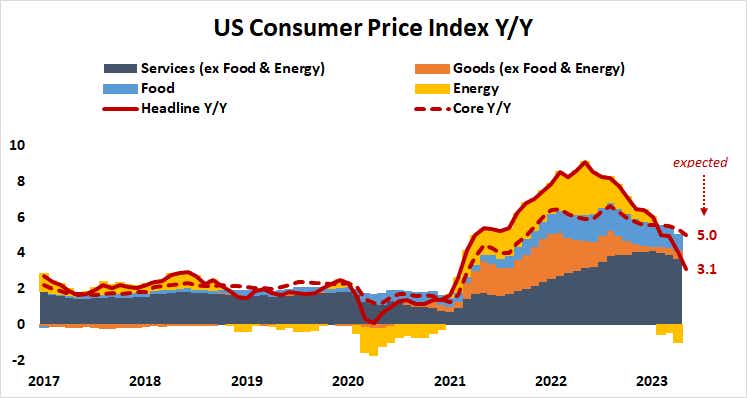

The headline number is expected to fall to 3.1% year-on-year in June. The core reading excluding food and energy—a focal point for the Fed considering policymakers’ acute focus on the service sector—is projected to be lowest since November 2021 at 5%.

While U.S. economic news-flow has generally improved relative to baseline forecasts recently, last week’s leading Institute of Supply Management (ISM) survey data suggested disinflation continues to progress. If this sets the stage for a soft set of numbers and post-NFP (nonfarm payroll) dynamics carry through, cycle-sensitive assets including equities may be hurt as economic downturn worries grow.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.