Nasdaq 100 Struggles to Find Footing as Bond Yields’ Surge Continues

Nasdaq 100 Struggles to Find Footing as Bond Yields’ Surge Continues

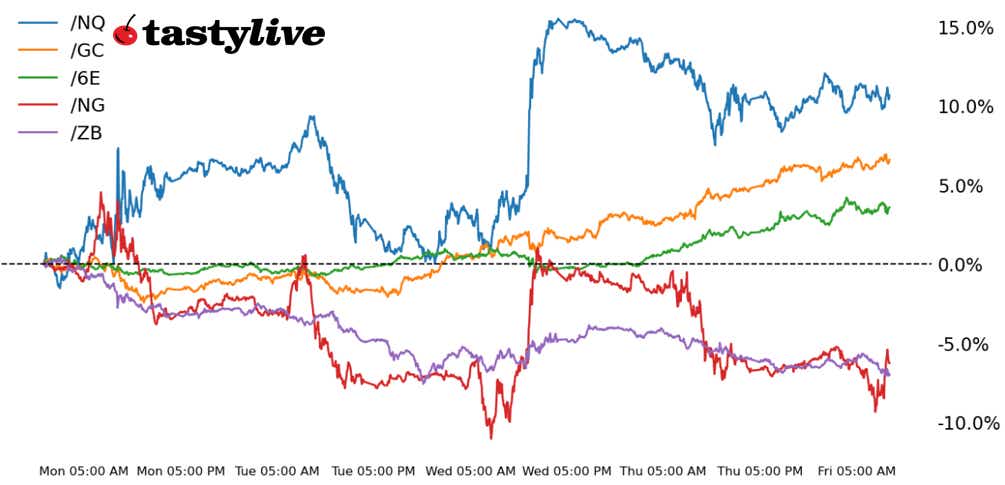

Also, 30-year T-bond, gold, natural gas and euro futures

- Nasdaq 100 E-mini futures (/NQ): -0.82%

- 30-year T-bond futures (/ZB): -1.43%

- Gold futures (/GC): +2.13%

- Natural gas futures (/NG): -1.66%

- Euro futures (/6E): +1.4%

“Sell America” has been the theme of the week, with stocks, bonds and the U.S. dollar bleeding out to their worst levels in weeks, months—or in some cases, years. In fact, bonds are doing something nothing short of historic: Depending upon where you look along the curve, it’s the worst week for Treasuries in over 40 years. The global growth scare seems to be taking a breather, as the dramatic weakness seen in commodities earlier this week has dissipated.

Symbol: Equities | Daily Change |

/ESM5 | -0.69% |

/NQM5 | -0.82% |

/RTYM5 | -0.66% |

/YMM5 | -1.59% |

U.S. equities continue to oscillate violently between gains and losses, which is no surprise given how we started the day: At the end of yesterday’s session, the 1DTE straddle was pricing in +/- 158 points in SPX. Out of the gate, the Nasdaq 100 (/NQM5) is marginally weaker, closely following the cadence of the bond market—as yields rise, stocks are coming under greater pressure. It’s all one trade at the moment.

Strategy: (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 15500 p Short 15750 p Short 21250 c Long 21500 c | 66% | +995 | -4005 |

Short Strangle | Short 15750 p Short 21250 c | 72% | +7985 | x |

Short Put Vertical | Long 15500 p Short 15750 p | 83% | +675 | -4325 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.19% |

/ZFM5 | -0.67% |

/ZNM5 | -1.06% |

/ZBM5 | -1.43% |

/UBM5 | -1.38% |

The bond beatdown is the most concerning aspect of price action over the course of the week. It’s the worst week for the long-end of the curve since 1982, a clear sign traders around the world are revolting against the Trump administration’s approach to tariffs. 30-year bonds (/ZBM5) are quickly approaching the “Trump put” line in the sand that apparently caused the president to implement his 90-day pause. The Trump put theory is going to be put to the test in real-time, it would seem.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 102 p Short 105 p Short 119 c Long 122 c | 65% | +734.38 | -2265.63 |

Short Strangle | Short 105 p Short 119 c | 73% | +2125 | x |

Short Put Vertical | Long 102 p Short 105 p | 83% | +390.63 | -2609.38 |

Symbol: Metals | Daily Change |

/GCQ5 | +2.13% |

/SIK5 | +3.03% |

/HGK5 | +2.56% |

The unwinding of American exceptionalism in financial markets has been a boon for metals. Gold prices (/GCQ5) have surged to fresh record highs this week, proving to be an alternative safe haven during a time of distress for the world’s reserve currency. Volatility has likewise expanded during the rally, a hallmark of strength in bull moves in recent months.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2975 p Short 3000 p Short 3525 c Long 3550 c | 65% | +700 | -1800 |

Short Strangle | Short 3000 p Short 3525 c | 73% | +5620 | x |

Short Put Vertical | Long 2975 p Short 3000 p | 83% | +350 | -2150 |

Symbol: Energy | Daily Change |

/CLK5 | -0.28% |

/HOK5 | -0.38% |

/NGK5 | -1.66% |

/RBK5 | +0.01% |

The tariffs are taking hold and weighing on energy markets, particularly natural gas (/NGK5). America produces substantially more LNG than it consumes, so the rise of trade barriers leaves a domestic market that is oversupplied in the short-term. A technical head and shoulders pattern may be in place: the measured move suggests /NGK5 could drop below 3 in the coming weeks.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.7 p Short 2.85 p Short 4.25 c Long 4.4 c | 62% | +510 | -990 |

Short Strangle | Short 2.85 p Short 4.25 c | 71% | +1940 | x |

Short Put Vertical | Long 2.7 p Short 2.85 p | 81% | +250 | -1250 |

Symbol: FX | Daily Change |

/6AM5 | -0.06% |

/6BM5 | +0.79% |

/6CM5 | +0.58% |

/6EM5 | +1.4% |

/6JM5 | +1.06% |

Dedollarization is picking up steam as every major currency continues to rally vs. the U.S. dollar. The greenback’s weakness in the face of rising U.S. Treasury yields is quite concerning, and alongside the drop in U.S. equities, suggests the world is selling America. The euro (/6EM5) has been the primary beneficiary of capital flows, with money flooding into European bonds and equities (particularly those that are domestic-focused on the Eurozone).

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.08 p Short 1.095 p Short 1.185 c Long 1.2 c | 63% | +550 | +1325 |

Short Strangle | Short 1.095 p Short 1.185 c | 70% | +1575 | x |

Short Put Vertical | Long 1.08 p Short 1.095 p | 83% | +287.50 | -1587.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.