United Airlines Earnings Preview—Rebound Ahead?

United Airlines Earnings Preview—Rebound Ahead?

By:Mike Butler

United (UAL) Earnings: Can the Stock Beat Lowered Expectations?

- United Airlines will report quarterly earnings on after the market closes tomorrow.

- UAL stock has a 9% implied range for this week's announcement.

- The company has exceeded earnings-per-share and revenue estimates four quarters in a row.

- Earnings estimates are significantly lower this quarter. It is expected to announce a earnings per share of $0.78 on $13.18 billion in revenue.

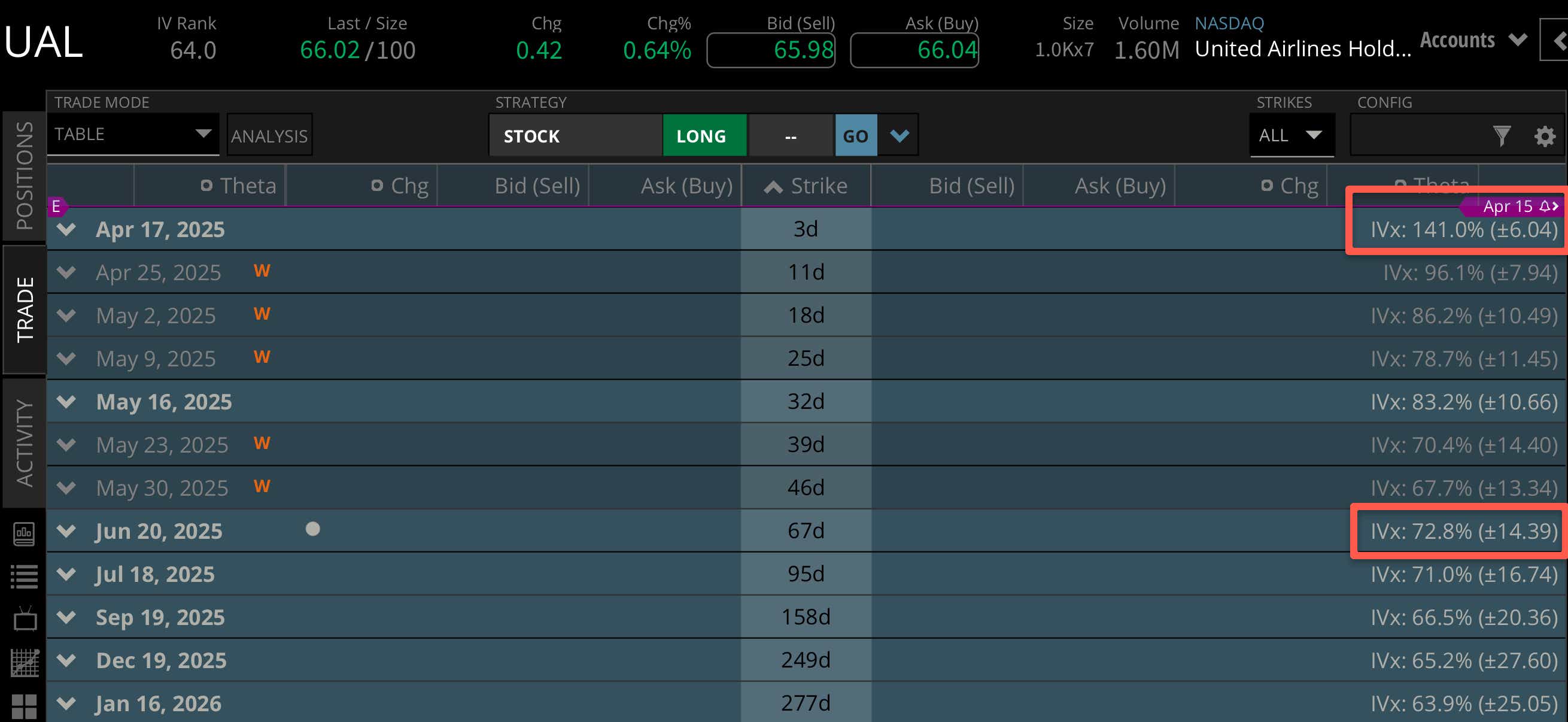

Earnings season is back, and we may be in for a bumpy ride over the next few weeks with tariff implications affecting major companies. Implied stock price moves appear to be higher than usual, with United Airlines (UAL) clocking in at a 9% expected stock price move for this week based on current implied volatility. This time last year, the expected move was only 7% of the stock price.

Stock in United, one of the top domestic airlines, has been beaten up so far in 2025. After opening the year at $97.29, it has tumbled to a recent low of $52 per share, falling sharply with the broader market after tariff news was released. The stock has since rallied to around $66 per share.

The company is expected to announce earnings per share (EPS) of $0.78 on $13.18 billion in revenue.

While United has exceeded EPS and revenue forecasts four quarters in a row, this quarter's estimates are significantly lower than last quarter's results—an EPS of $3.26 on $14.70 billion in revenue.

In the last earnings call, United released some great data points for the company:

- It set the company record for most customers carried in a year at nearly 174 million system-wide and an average of 4,340 daily flights, operating 145 more mainline flights per day compared to 2023.

- United announced the largest international expansion in its history, bringing service to nine new destinations abroad for Summer 2025, eight of which are not served by any other U.S. carrier: Ulaanbaatar, Mongolia; Nuuk, Greenland; Kaohsiung, Taiwan; Palermo, Italy; Bilbao, Spain; Faro, Portugal; Madeira Island, Portugal; Puerto Escondido, Mexico; and Dakar, Senegal.

- The airline began using generative AI on united.com to expedite customer search and in its industry-leading flight status notification system, enabling real-time flight status updates.

- It operated a record number of 100% completion days for United Express in a year, achieving 88 total days with no cancellations in 2024—13 days more than in 2023.

United Airlines CEO Scott Kirby offered strong words of encouragement for the future as well: “2024 was a strong year across the board for United as we've become the leading global airline, and we enter 2025 with demand trends continuing to accelerate, which puts us on the path to double-digit pre-tax margins."

The banks kicked off earnings season last week, and CEO commentary centered on the implications of tariff s and how we could be in for turbulent times this quarter. We will see the full impact and projection from UAL in a few days, which could hint at the other airlines' success or failure.

When we look at implied volatility in the near-term cycle for earnings, we're looking to see how much of an expected move is projected relative to the notional value of the stock price. The higher the expected move, the more uncertainty there is baked into the earnings call and vice versa.

This week, we're seeing a 9% stock price expected move for United earnings with a +/- $6.04 implied stock price range. This puts the announcement on the higher end of the range for most companies, as we typically see a 5%-10% stock price range for earnings.

Looking farther out in time, however, we see a +/- $14.39 implied stock price range in the June options cycle 67 days away. Normally, we see a much lower expected move relative to earnings week when we see a high IV earnings projection, but I think this speaks to the heightened overall implied volatility in the market and how this earnings call is just the beginning of volatile markets we should expect to see over the next few months. Realized volatility in the market has confirmed that over the past few weeks.

Bullish on UAL stock for earnings

If you're bullish on UAL stock for earnings, you want to see the airline exceed EPS and revenue estimates. Executives consistently hint at double digit pre-tax margins, and bullish UAL traders will want to see a roadmap for achieving that goal. Reduced estimates could make it easier for United to perform well this earnings season, but they still need to post some good numbers.

Bearish on UAL stock for earnings

If you're bearish on UAL stock for earnings, you're likely worried about the reduced EPS and revenue estimates. If the company fails to reach the mark for reduced estimates, we could see the stock tumble back to lows. Any sort of weakness in the estimates for the rest of the year could spell trouble.

Tune in to Options Trading Concepts Live at 11 a.m. CDT on tastylive for an in-depth look at options strategies for United Airlines ahead of the earnings announcement after the close.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.