Stock Markets May Turn Lower as Global Recession Fears Return

Stock Markets May Turn Lower as Global Recession Fears Return

By:Ilya Spivak

Stock markets are cheering soft U.S. economic data. They may have second thoughts if global recession fears return.

Stock markets cheering as soft U.S. economic data boosts Fed rate cut odds

Global recession fears will return if U.S. economic resilience appears to falter

China’s trade and inflation data to highlight fragile global growth trajectory

Wall Street has been in a chipper mood since April’s weaker-than-expected U.S. labor market data breathed new life into Federal Reserve rate cut hopes.

The report showed the economy added just 175,000 jobs last month, lower than the rise of 243,000 projected by analysts. The unemployment rate unexpectedly rose to 3.9%. The markets are now pricing in 36 basis points (bps) in rate cuts this year, up from 23bps a week ago.

Should stocks be cheering as U.S. economic data weakens?

Published alongside the jobs report, a survey tracking conditions in the U.S. service sector from the Institute of Supply Management (ISM) revealed a shocking contraction of economic activity. The result marked the first failure to expand in the most impactful part of the world’s largest economy since December 2022.

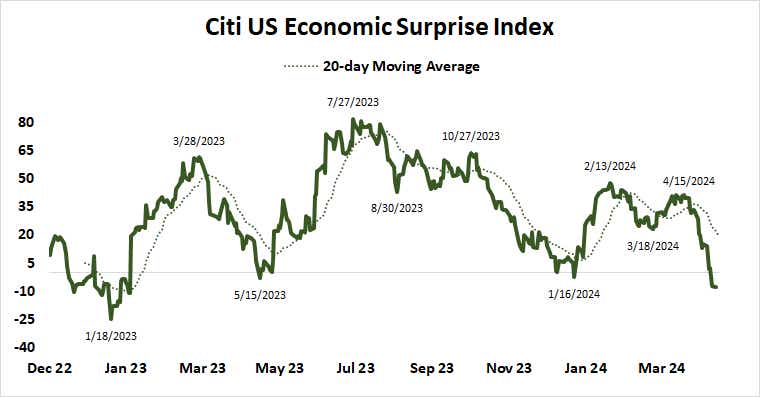

These sobering results extend a series of disappointments on U.S. economic data since mid-April. The downshift in the U.S. economy that such outcomes imply would be most unwelcome for overall global growth.

For the past 12 months, the North American giant has been an essential pillar of support amid weak conditions in other key economies.

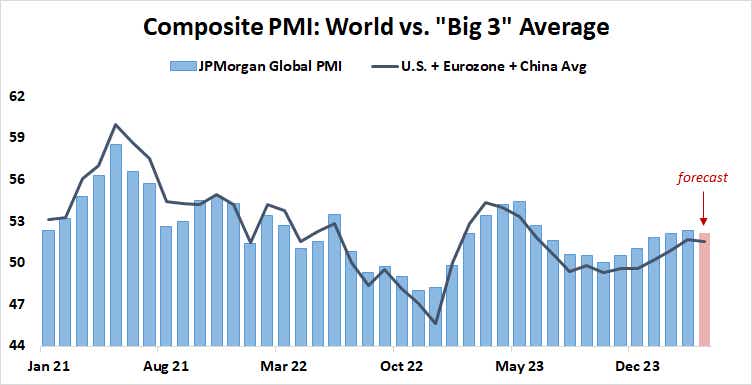

Purchasing manager index (PMI) data from S&P Global reveal that China is still struggling to reboot after a belated exit from COVID lockdowns.

Meanwhile, the Eurozone has only just returned to growth in March after nine months of contracting manufacturing- and service-sector activity.

Global recession risk: time to be worried?

Together with the U.S., these three economies account for about 50% of global gross domestic product (GDP). This understates their contribution to overall output since much of the rest of the world is made up of vendor economies that depend on demand from the “big three.”

This week, soggy trade and inflation data out of China may highlight that it is in no position to offset a U.S. downturn. The trend in Europe has been better so far this year, but growth levels are still sluggish. Taken together with the U.S. and China, they add up to April marking the first time that global growth has slowed since October.

This hardly sounds supportive for stock markets. A modest dovish shift in Fed policy expectations is a pyrrhic victory if it comes because the threat of global recession has reemerged in earnest. If incoming news-flow underscores as much, last week’s upswell of risk appetite may be quick to dissipate.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.