Nike Earnings Preview: What to Expect from CEO Hill's Second Report

Nike Earnings Preview: What to Expect from CEO Hill's Second Report

By:Mike Butler

The company’s stock is trading near five-year lows, and analysts project an 8% price range

- Nike will report quarterly earnings after the market closes on Thursday.

- The company is expected to report earnings-per-share of $0.28 on $11.02 billion in revenue.

- Both figures are lower than last quarter even though Nike exceeded both estimates

- This will be the second earnings report under new CEO Elliott Hill.

This earnings season is coming to a close, and Nike (NKE) is one of the final household brand names that has yet to report. On Thursday, it will report quarterly earnings after the market closes. This will be the second earnings report under new CEO, Elliott Hill. Although Nike exceeded earnings-per-share (EPS) and revenue estimates last quarter, the expectation bar is lower this time.

Nike is expected to report an EPS of $0.28 on $11.02 billion in revenue, and both figures are lower than last quarter's estimates.

NKE stock is trading near five-year lows, hovering around $72 per share. This is slightly lower than the stock opened in 2025 at $76.25 per share. The stock has bounced to the upside around $70, so hopefully the world's largest athletic shoe and apparel company can find a way back to a better stock price. With that said, NKE stock realized a massive sell-off after the earnings report in June 2024, falling over 20% the next day. The realized volatility is real here, and traders are looking for some positive sentiment this week.

During the last earnings call, Nike executives offered words of encouragement for the future of the brand. CEO Elliot Hill had this to say: “After an energizing 60 days of being back with my Nike teammates, our clear priority is to return sport to the center of everything we do. ... We're taking immediate action to reposition our business, so we can get back to driving long-term shareholder value. Our team is ready to go, and I'm confident you will see more moments of Nike being Nike again."

Matthew Friend, chief financial officer, said, "Nike’s second-quarter financial performance largely met our expectations, as we continue to make progress in shifting our portfolio. ... Under Elliott's leadership, we are accelerating our pace and reigniting brand momentum through sport."

When a new CEO takes over, even if it was someone who worked at Nike previously, there's going to be some turbulence along the way. We're seeing that now, and the market is pricing in a relatively large stock price range for earnings this week.

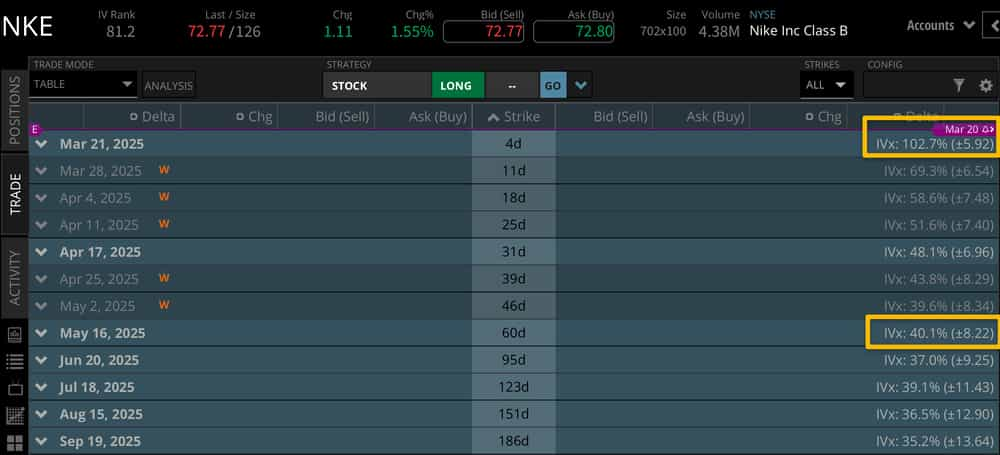

Based on current implied volatility, we're looking at a +/- $5.92 stock price range against a $72 stock price. This is about 8% of the notional value of the stock price, which is on the higher end of the typical 5%-10% range we see for earnings.

Looking to the May 2025 options cycle, we can see the market is only pricing in a range of +/- $8.22. That means the earnings announcement this week makes up for over 75% of the expected stock price range for the next 60 days.

Bullish on Nike stock for earnings

If you're bullish on NKE stock for earnings, you're looking for another strong report against lower estimates. If Nike can post two earnings beats in a row, we could see the stock price rally from lows. It could help that the general market volatility has come down a bit, which could entice investors to engage in products trading near multi-year lows, and Nike is certainly one of them.

Bearish on Nike stock for earnings

If you're bearish on NKE stock for earnings, you're looking for an earnings miss against lower estimates. If the company can't beat estimates, the stock retreat to levels we haven't seen in many years. High implied volatility going into an earnings announcement means there's plenty of uncertainty, and the market is waiting to see what is said on Thursday.

Tune in to Options Trading Concepts Live on Thursday at 11 a.m. CDT for an in-depth look at options strategies ahead of the earnings announcement after the close.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.