Micron Earnings: Will The Stock Finally Push to New Highs?

Micron Earnings: Will The Stock Finally Push to New Highs?

By:Mike Butler

Analysts project a 10% price move for one of the only tech stocks up in value for the year

- Micron Technology will report quarterly earnings after the market closes on Thursday, March 20.

- The company’s stock has traded within a $25 channel for almost a year, and analysts expect earnings per share of $1.43 on $7.9 billion in revenue.

- It is one of the only tech stocks up on the year in 2025.

- Micron has had stellar earnings history, beating EPS and revenue expectations the past four quarters in a row.

Micron Technology (MU) is on the verge of posting a fifth straight stock price rally today, and the American tech company is set to report quarterly earnings on Thursday after the market closes. Micron has had a great earnings history, exceeding earnings-per-share (EPS) and revenue estimates four quarters in a row. With that said, the stock price has traded within a $25 point channel at the lower end of the stock price range for almost a year. The tech company will look to bounce out of the slump on Thursday after the earnings announcement.

Micron Technology is expected to report an EPS of $1.43 on $7.9 billion in revenue.

During the recent stock market sell-off, we've seen a lot of capital flow out of the Magnificent Seven stocks, along with other household name tech stocks. That hasn't been the case for Micron. The company’s stock is almost back to its highs of the end of February, which is when the market began to sell off. This could be encouraging news for the earnings announcement, nn although there's still plenty of implied volatility baked into the announcement itself.

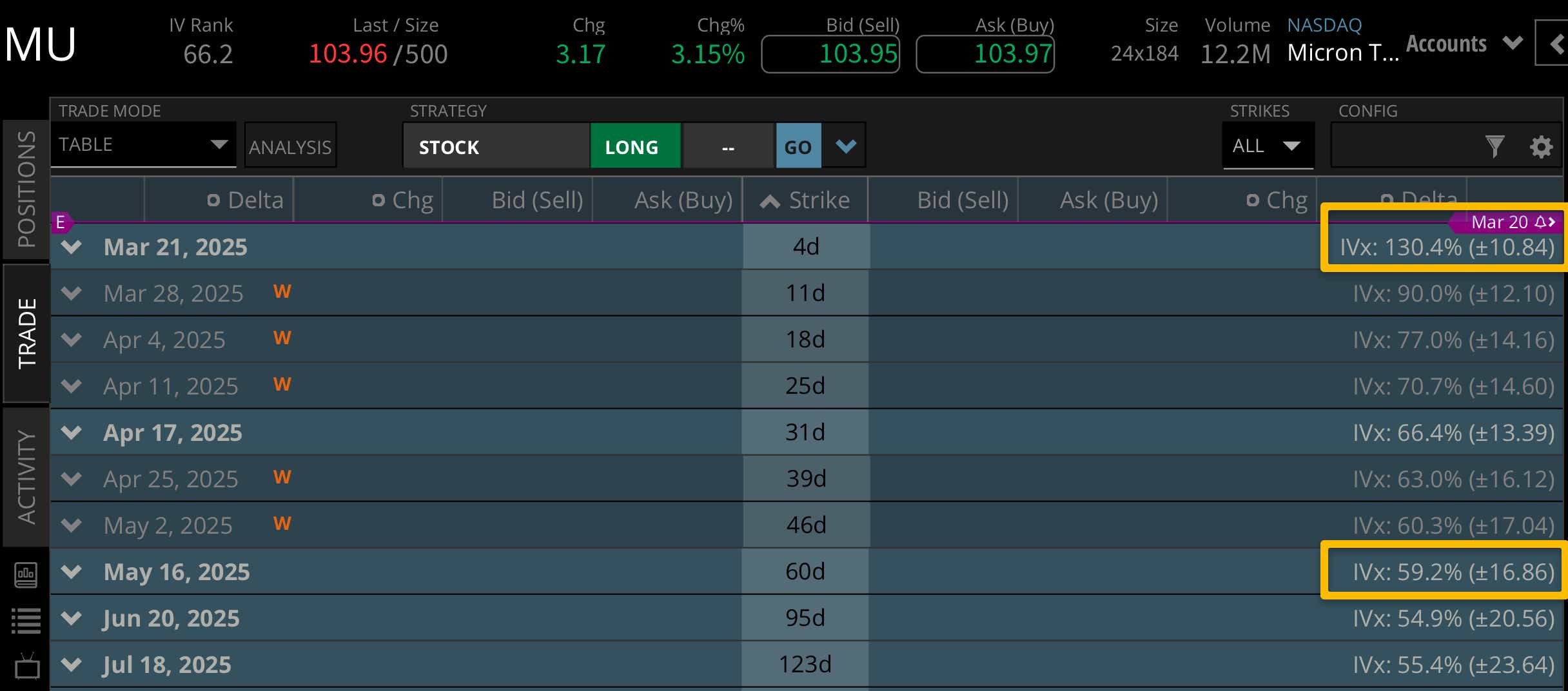

Based on current implied volatility, MU stock has a projected weekly range of +/- $10.84 against the current stock price of $104 per share. Most companies have an implied volatility range of 5%-10% of the notional value of the stock price, so Micron is on the high end of earnings implied volatility.

Looking to the May options cycle, we can see an implied move of +/- $16.86. With the weekly expected move making up well over 50% of the May cycle, we can expect some volatile moves after the announcement on Thursday.

Micron President and CEO, Sanjay Mehrotra, offered a positive outlook for 2025 in the last earnings call: “We had previously shared our expectation that customer inventory reductions in the consumer-oriented segments and seasonality would impact fiscal Q2 bit shipments. We are now seeing a more pronounced impact of customer inventory reductions.

As a result, our fiscal Q2 bit shipment outlook is weaker than we previously expected. We expect this adjustment period to be relatively brief and anticipate customer inventories reaching healthier levels by spring, enabling stronger bit shipments in the second half of fiscal and calendar 2025. We are on track to achieve our HBM targets and also deliver a substantial record in Micron revenue, significantly improved profitability and positive free cash flow in fiscal 2025."

Bullish on Micron Technology stock for earnings

If you're bullish on MU stock for earnings, you want to hear more about the positive sentiment for 2025, and you'll want to see another EPS and revenue beat as well. The stock hasn't moved out of the $25 point channel in quite some time, and it seems to need a spark to aid a breakout. A strong earnings report paired with upgrades to 2025 estimates could be just what bulls are looking for.

Bearish on Micron Technology stock for earnings

If you're bearish on MU stock for earnings, you may think the big-name tech stocks are just the first tech stocks to fall, and the market is waiting for MU earnings to pull out capital if the earnings report is weak. With such a strong earnings history, any sort of EPS or revenue miss could be trouble for MU stock this week.

Either way you see it, a 10% stock price move is nothing to brush off ahead of an earnings announcement. Tune in to Options Trading Concepts Live at 11 a.m. CDT on Thursday for an in-depth look at Micron Technology earnings strategies.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.