S&P 500 Attempts Tepid Rebound at Start of FOMC, Opex Week

S&P 500 Attempts Tepid Rebound at Start of FOMC, Opex Week

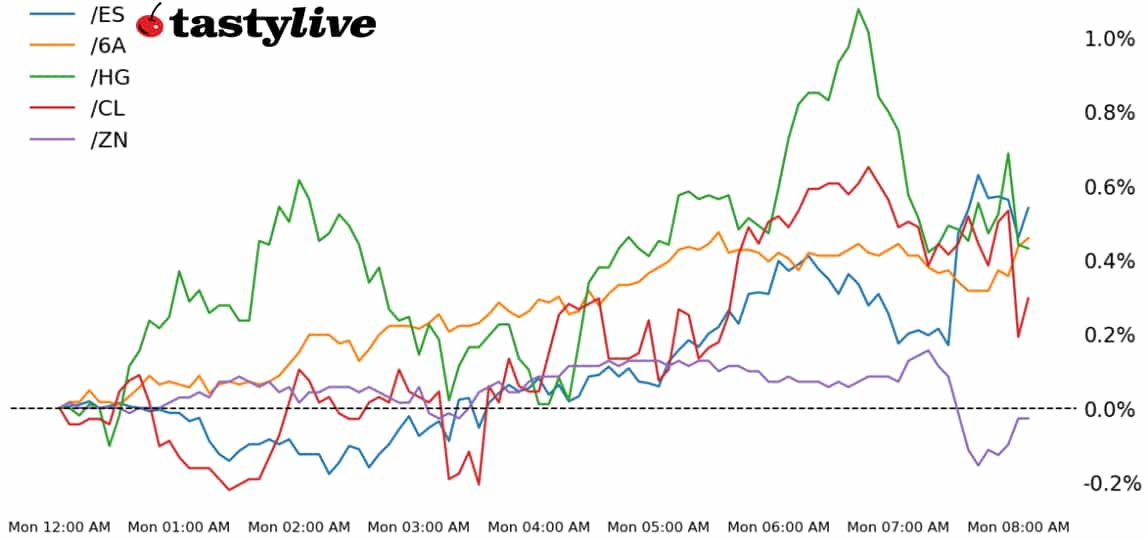

Also, 10-year T-note, copper, crude oil and Australian dollar futures

- S&P 500 E-mini futures (/ES): 0%

- 10-year T-note futures (/ZN): -0.03%

- Copper futures (/HG): +0.26%

- Crude oil futures (/CL): +1.09%

- Australian dollar futures (/6A): +0.47%

A turn higher at the end of the week and resiliency in the face of more discouraging commentary from the Trump administration has U.S. equity markets pointedly modestly higher on today. A big week lies ahead, with the March Federal Reserve meeting, Vixpiration and quadruple witching all arriving over the next few days. Long-end Treasury auctions barbell the Federal Open Market Committee (FOMC) meeting on Wednesday. It’s not just the Fed this week, however: the Bank of Japan and Bank of England will likewise hold their monthly meetings. Global macro is decidedly in the spotlight after the Ides of March.

Symbol: Equities | Daily Change |

/ESM5 | 0% |

/NQM5 | +0.12% |

/RTYM5 | -0.07% |

/YMM5 | -0.16% |

S&P 500 futures (/ESM5) were trading flat this morning before the opening bell. Traders are looking to extend gains from Friday after U.S. equity markets traded into correction territory last week. This morning’s retail sales report helped to revive some sentiment in the economy, but it isn’t translating to the market yet. Affirm Holdings (AFRM) fell over 12% after Klarna—a rival firm that is expected to list on U.S. markets later this year—snatched a deal from Walmart (WMT) to provide buy-now-pay-later services.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5250 p Short 5350 p Short 6050 c Long 6150 c | 63% | +1087.50 | -3937.50 |

Short Strangle | Short 5350 p Short 6050 c | 68% | +2900 | x |

Short Put Vertical | Long 5250 p Short 5350 p | 84% | +550 | -4450 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.06% |

/ZFM5 | -0.07% |

/ZNM5 | -0.03% |

/ZBM5 | +0.21% |

/UBM5 | +0.31% |

Bond markets are fairly steady to start the week. 10-year T-note futures (/ZNM5) rose 0.08% and yields were falling more on the long-end of the curve. The Federal Reserve will have to assure markets this week that they are ready to support the economy amid the recent market decline. The Bank of England and the Bank of Japan are also set to deliver rate decisions this week. The Treasury will auction off 20-year bonds tomorrow and 10-year Treasury Inflation-Protected Securities (TIPS) later this week.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 108.5 p Short 112.5 c Long 114 c | 69% | +328.13 | -1171.88 |

Short Strangle | Short 108.5 p Short 112.5 c | 72% | +500 | X |

Short Put Vertical | Long 107 p Short 108.5 p | 89% | +140.63 | -1359.38 |

Symbol: Metals | Daily Change |

/GCJ5 | -0.14% |

/SIK5 | -0.89% |

/HGK5 | +0.26% |

Copper prices (/HGK5) started the week with a bid after China reported better-than-expected retail sales for the January-February period. Industrial output in the country also rose more than expected. The upbeat economic data is encouraging amid the opening of the trade war with the U.S., and it likely provides policymakers with some additional support for stimulus measures later this year. Copper will have to clear last week’s high of 4.9575 before setting sights on the swing high from last May.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.55 p Short 4.6 p Short 5.25 c Long 5.3 c | 66% | +437.50 | -812.50 |

Short Strangle | Short 4.6 p Short 5.25 c | 75% | +2400 | x |

Short Put Vertical | Long 4.55 p Short 4.6 p | 83% | +237.50 | -1012.50 |

Symbol: Energy | Daily Change |

/CLK5 | +1.09% |

/HOJ5 | +1.18% |

/NGJ5 | -1.61% |

/RBJ5 | +1.34% |

Crude oil prices (/CLK5) rose over 1% to start the week after the U.S. said it would keep targeting Houthis in the Red Sea. The U.S. conducted military strikes against the group over the weekend. The upbeat Chinese economic data is also supporting the demand outlook for crude prices. Meanwhile, Iranian oil output is expected to slow in the coming months as the U.S. exerts more pressure on the regime.

Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 58.5 p Short 60 p Short 75.5 c Long 77 c | 65% | +350 | -1150 |

Short Strangle | Short 60 p Short 75.5 c | 71% | +1460 | x |

Short Put Vertical | Long 58.5 p Short 60 p | 83% | +200 | -1300 |

Symbol: FX | Daily Change |

/6AM5 | +0.47% |

/6BM5 | +0.34% |

/6CM5 | +0.32% |

/6EM5 | +0.2% |

/6JM5 | -0.21% |

An initial frame for a stimulus plan in China and improved economic data gave the Australian dollar (/6AM5) a boost to start the week, rising about 0.5% this morning. Traders are watching out for labor market data from Australia due on Thursday. Meanwhile, slowing growth in the United States might help to provide some support to the Australian dollar moving forward. Bulls will look to attack the February swing high at 0.64140, which could open some additional upside if breached.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.6 p Short 0.615 p Short 0.655 c Long 0.67 c | 63% | +340 | -1160 |

Short Strangle | Short 0.615 p Short 0.655 c | 67% | +520 | x |

Short Put Vertical | Long 0.6 p Short 0.615 p | 85% | +160 | -1340 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.