S&P 500 Loitering Below All-Time Highs as Yield Drop Sparks Silver

S&P 500 Loitering Below All-Time Highs as Yield Drop Sparks Silver

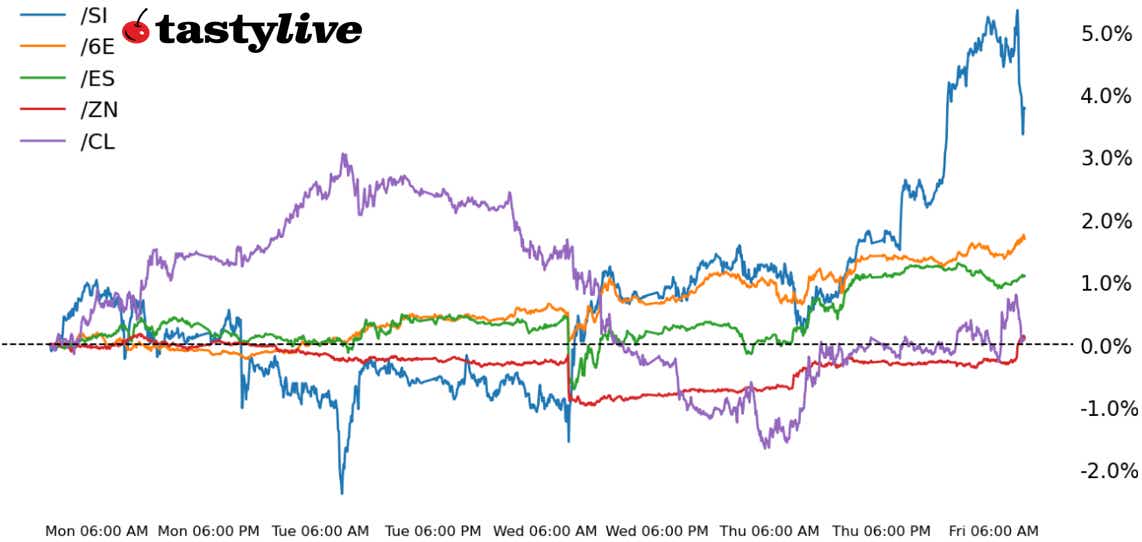

Also, 10-year T-note, silver, crude oil and euro futures

- S&P 500 E-mini futures (/ES): +0.07%

- 10-year T-note futures (/ZN): +0.36%

- Silver futures (/SI): +3.68%

- Crude oil futures (/CL): +0.49%

- Euro futures (/6E): +0.6%

A delayed start to tariffs has helped equity traders push prices higher through the week, with S&P 500 futures (/ESH5) closing near record highs on Thursday. Now, traders are speculating that still-elevated inflation could further blunt the Trump administration's appetite for trade tariffs. The U.S. administration will have to be restrained in the way they implement trade and immigration policies or risk igniting more inflation, which could impede economic growth—something Trump would likely want to avoid in his first year back in office. Chinese and European markets closed mostly higher overnight.

Symbol: Equities | Daily Change |

/ESH5 | +0.07% |

/NQH5 | -0.01% |

/RTYH5 | +0.41% |

/YMH5 | -0.06% |

S&P 500 futures (/ESH5) were slightly higher in early trading today, with prices up about 0.07% just after the New York trading session started. Apple (AAPL) increased its weekly gains in early trading, adding about 0.9% to its weekly rally today. The stock was on track to record its best weekly gain since July, following a series of announcements from the iPhone maker. Moderna (MRNA) managed to claw back losses from pre-trading hours after the company posted a bigger-than-expected loss on earnings per share (EPS). GameStop (GME) rallied over 6% after reports crossed the wires that said the company is considering investing in bitcoin (/BTC).

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5750 p Short 5825 p Short 6475 c Long 6550 c | 67% | +537.50 | -3212.50 |

Short Strangle | Short 5825 p Short 6475 c | 71% | +1775 | x |

Short Put Vertical | Long 5750 p Short 5825 p | 89% | +187.50 | -2312.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.1% |

/ZFH5 | +0.26% |

/ZNH5 | +0.36% |

/ZBH5 | +0.54% |

/UBH5 | +0.62% |

Bonds moved higher today to bring prices positive across much of the curve. Earlier in the week, bonds sold off after investors digested news that the Trump administration could investigate Treasury debt payments. However, prices rose on Thursday and continued to build on those gains Friday morning after traders saw a softer approach on trade policies, which could ease the path for inflation going forward. The 10-year T-note futures (/ZNH5) rose about 0.36% in early trading.

Strategy (70DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 106.5 p Short 112 c Long 113.5 c | 63% | +265.63 | -1234.38 |

Short Strangle | Short 106.5 p Short 112 c | 66% | +484.38 | x |

Short Put Vertical | Long 105 p Short 106.5 p | 89% | +125 | -1375 |

Symbol: Metals | Daily Change |

/GCJ5 | +0.04% |

/SIH5 | +3.68% |

/HGH5 | -1.54% |

Silver prices (/SIH5) jumped today to build on gains from earlier in the week. The metal is on track to record a fourth weekly gain, and traders now have the highs from October within sight. A pullback in the dollar helped to clear a path higher for silver this week as sentiment around U.S. trade policies helped to diminish the U.S. currency. The move helped silver catch up to gold’s recent gains, although the gold/silver ratio remains rather elevated, especially compared to levels traded through the fourth quarter of 2024. That could mean silver has more fuel in the tank to climb compared to gold if investors continue to seek out a safe haven in metals.

Strategy (69DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 29.25 p Short 30 p Short 38.25 c Long 39 c | 66% | +1120 | -2635 |

Short Strangle | Short 30 p Short 38.25 c | 74% | +5060 | x |

Short Put Vertical | Long 29.25 p Short 30 p | 84% | +560 | -3190 |

Symbol: Energy | Daily Change |

/CLH5 | +0.49% |

/HOH5 | +0.85% |

/NGH5 | +2.51% |

/RBH5 | +0.37% |

Crude oil prices were slightly higher going into the weekend, up about 0.40%, as the commodity tracks toward a small weekly gain. It has sold off in recent weeks on fears that a trade war between the U.S. and its trading partners could dampen economic growth and energy demand. A potential deal between Russia and Ukraine is also dampening sentiment for oil, with a deal potentially allowing Russian oil to return freely to the global market. A build in U.S. inventories this week also weighed on prices, but frigid temperatures across Europe is helping to fuel some demand in the continent.

Strategy (61DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 62.5 p Short 64 p Short 80 c Long 81.5 c | 66% | +330 | -1170 |

Short Strangle | Short 64 p Short 80 c | 72% | +1420 | x |

Short Put Vertical | Long 62.5 p Short 64 p | 82% | +200 | -1300 |

Symbol: FX | Daily Change |

/6AH5 | +0.93% |

/6BH5 | +0.63% |

/6CH5 | +0.5% |

/6EH5 | +0.6% |

/6JH5 | +0.52% |

Despite worries over lagging growth in Europe, traders pushed the currency higher this week and those gains were extended in Friday trading, with prices up about 0.6% in the morning. The Trump administration’s restraint on implementing broad tariff measures helped the European currency climb through the week despite lingering political concern in France and Germany. The currency could remain at risk, especially if the U.S. increases its rhetoric on tariffs in the coming weeks.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.015 p Short 1.03 p Short 1.08 c Long 1.095 c | 63% | +487.50 | -1387.50 |

Short Strangle | Short 1.03 p Short 1.08 c | 68% | +825 | x |

Short Put Vertical | Long 1.015 p Short 1.03 p | 88% | +212.50 | -1662.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.