Macro Week Ahead: Will the Fed Save Stock Markets from Recession Fears?

Macro Week Ahead: Will the Fed Save Stock Markets from Recession Fears?

By:Ilya Spivak

The markets are begging to be rescued by the Federal Reserve. Will the U.S. central bank comply?

- Recession-minded markets hope for a dovish policy shift from the Federal Reserve.

- The Bank of Japan may send the yen higher if it signals more rate hikes this year.

- The British pound may rise as the Bank of England weighs defense spending plans.

Stock markets continued to suffer last week as economic growth concerns kept traders in a defensive mood. Treasury yields managed a slight uptick but the broader downtrend in place from the beginning of the year held firmly intact. Gold prices jumped to a record high and the U.S. dollar continued to weaken against its major currency peers.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

Federal Open Market Committee (FOMC) meeting

All eyes are on the Federal Reserve to see if officials are prepared to ride to the markets’ rescue amid growing recession fears since late February.

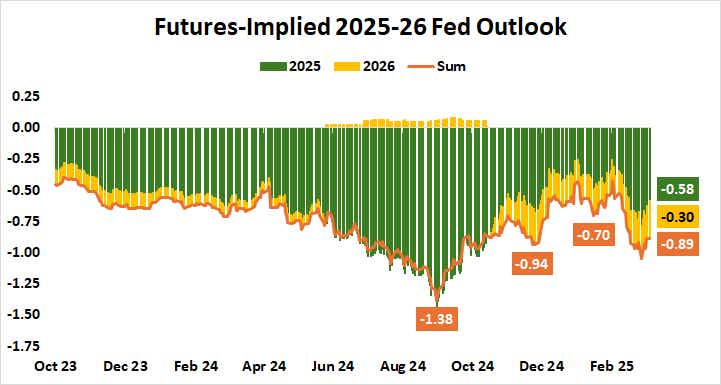

Benchmark Fed Funds interest rate futures have moved from pricing in about 50 basis points (bps) in rate cuts through the end of 2026 a month ago, to nearly double that at 89bps now.

No changes to the target rate range are expected at this meeting, but the quarterly update of the FOMC’s Summary of Economic Projections (SEP) will be closely scrutinized in hopes of a dovish signal. Traders are likely to be disappointed if officials opt for a “wait-and-see” approach instead, as Fed Chair Jerome Powell signaled in a recent speech.

Bonds may continue to march higher as Treasury yields and the U.S. dollar fall if recession fears build against this backdrop. That would reflect traders expecting that a delay now will amount to faster and sharper rate cuts downwind as the Fed catches up to incoming economic weakness. If such hope for cheaper money lifts stocks remains to be seen.

Bank of Japan (BOJ) monetary policy meeting

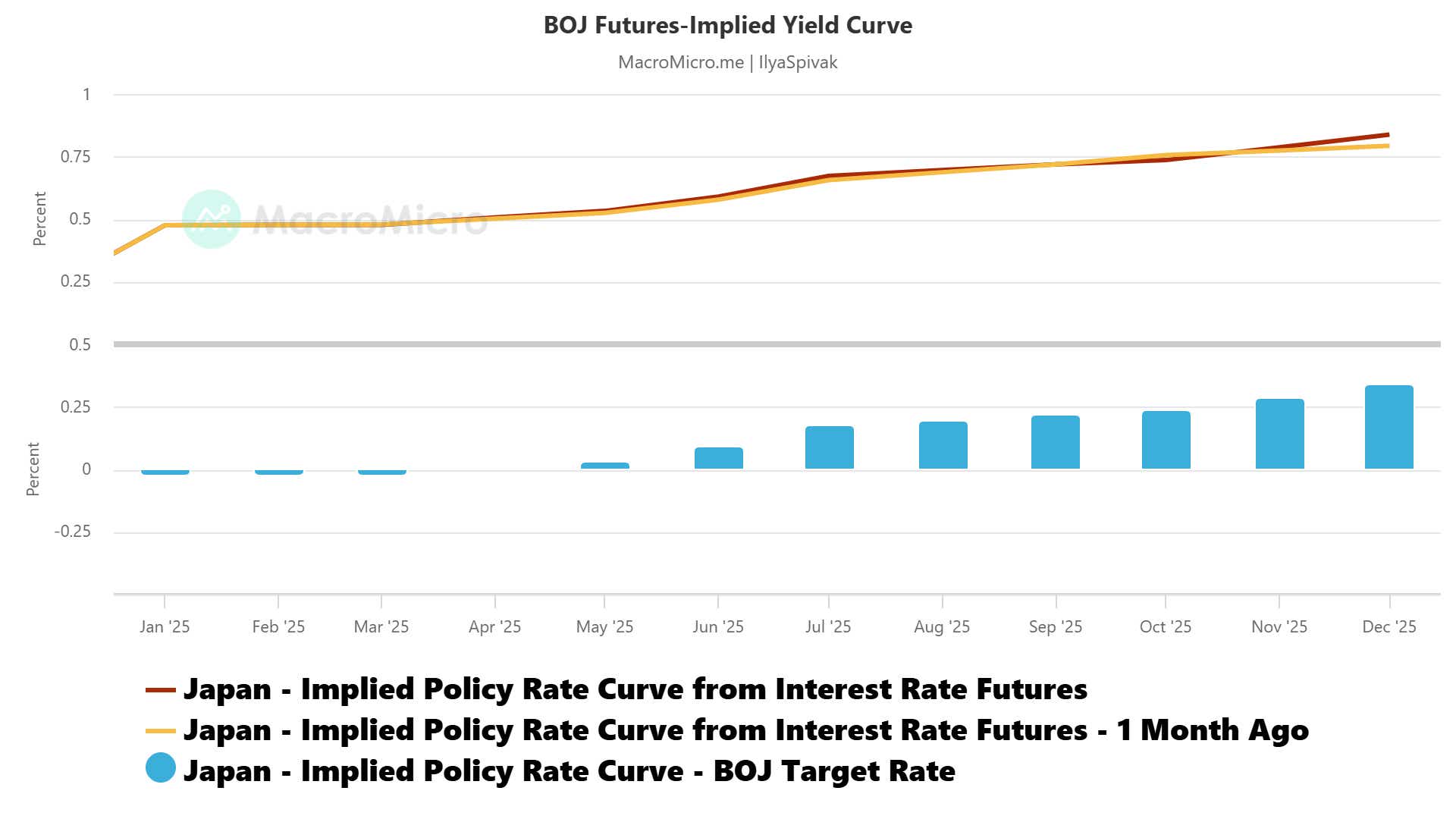

The Bank of Japan is expected to keep its target rate unchanged at 0.50% this week. The markets are pricing in one more 25-basis-point (bps) hike this year, due to arrive by November. Meanwhile, leading purchasing managers index (PMI) data from S&P Global speaks to accelerating growth and official inflation readings have surged.

Against this backdrop, traders will be curious to hear if BOJ Governor Kazuo Ueda and company are entertaining a hawkish rethink. Officials typically like to wait for annual wage negotiations that take place at Japan’s fiscal year end this month to make such a call. If they hint that faster tightening might follow thereafter, the Japanese yen may extend higher.

Bank of England (BOE) monetary policy meeting

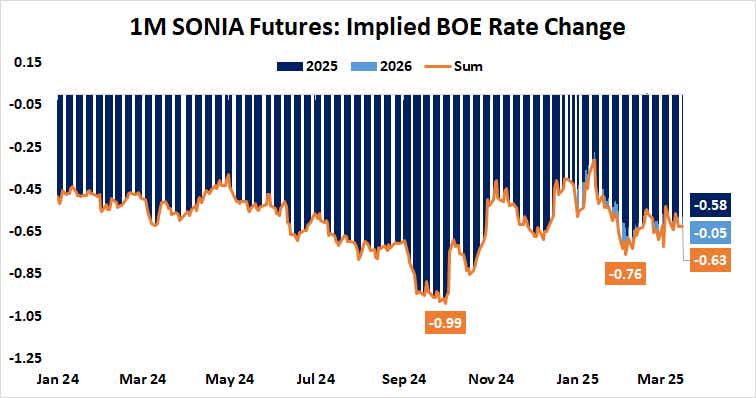

The U.K. central bank is widely expected to keep its target interest rate unchanged at 4.5% when policymakers meet this week. The markets price in 58bps in cuts this year, implying that two standard-sized 25bps reductions are fully discounted, along with a 32% probability of a third one.

Traders will be keen to hear what policymakers see from here as Europe gets set to ramp up defense spending. London, Paris and Berlin have signaled that the continent will re-arm in a hurry as worries emerge about the reliability of the U.S. security blanket. If the BOE tilts hawkish as it weighs what this means for inflation, the British pound may rise.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.