Shell Stock Price and IV Falls After Record Earnings Numbers

Shell Stock Price and IV Falls After Record Earnings Numbers

Shell Stock Posts Record Earnings Numbers

Shell, the British oil and gas giant, reported record figures on Thursday for its fiscal fourth quarter, posting just short of $10 billion in profits. That brought its 2022 profit to about $40 billion, more than double from the year prior.

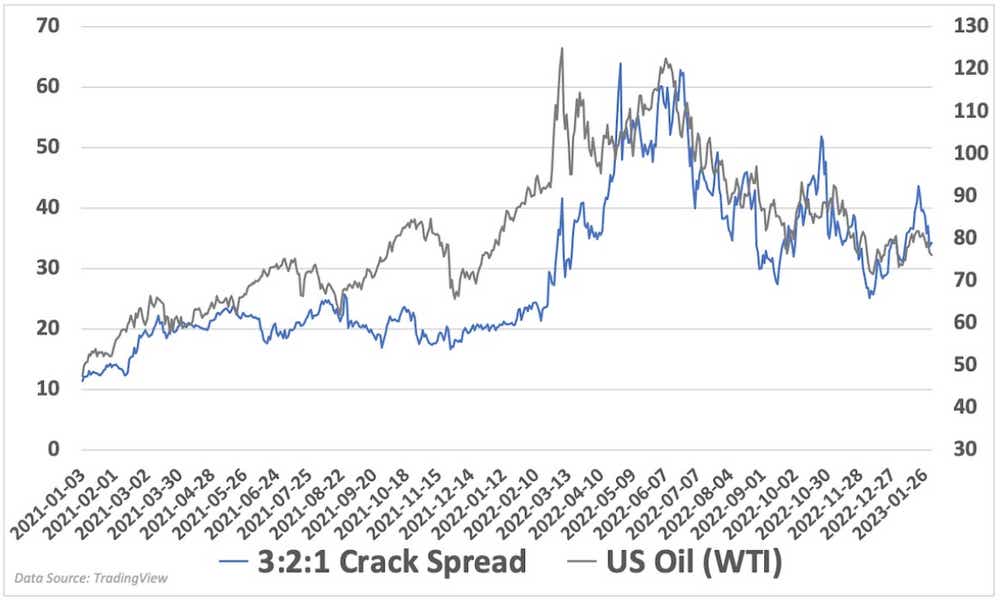

A surge in crude oil prices is the primary driver of the blockbuster numbers, with the war in Ukraine and western sanctions on Russia facilitating those higher prices. The post-pandemic economy helped drive refining margins higher as fuel demand surged, with the travel economy rebounding. Those refining margins remain elevated relative to historical norms. The 3-2-1 crack spread displayed in the chart below represents this illustration.

While the numbers are encouraging and reflect a broader industry trend, it will likely underpin already growing sentiment to increase taxes on oil companies at a time when inflation, which can be partially attributed to oil and fuel prices, is already pinching consumers’ pocketbooks. That may pose a long-term headwind to further profit growth and discourage investment.

The company also made big profits from its natural gas trading segment, adding about over half of its revenue for the quarter. Earlier last year, that trading unit got caught on the wrong side of a natural gas rally, so investors can’t bank on those types of trading returns to continue.

Price Action Disappoints as Crude Oil Prices Slip

Those refining margins remain elevated relative to historical norms. The 3-2-1 crack spread displayed in the chart below represents this illustration. Shell traded higher in London but trimmed gains into the close finishing just 0.08% higher on the day.

Prices fared worse in New York trading, with the stock price shedding over 0.5% in early trading—likely due to falling crude oil prices. The U.S. Energy Information Administration (EIA), on Wednesday, reported a surprise 4.1 million barrel stockpile build for the week ending January 27. Analyst predicted a build of around 400k barrels.

The increasing inventory levels suggest that the post-pandemic rebound in oil demand may be leveling off. However, bullish factors for the commodity remain in place, but the fundamental backdrop has deteriorated in recent months as economic indicators show the economy slowing as the impact of rate hikes trickles down into the economy.

IV Contraction Puts Long Strategies in Focus for Shell

After reporting earnings, Shell stock’s Implied Volatility Rank (IVR) fell into negative space, meaning Implied Volatility (IV) pierced below its previous low. The IV contraction makes sense after earnings, but the strong contraction makes long option strategies attractive for those trying to take advantage of the mean-reverting nature of IV.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.