US Dollar and the Fed Rate Decision: Bought the Rumor, Now Sell the Fact?

US Dollar and the Fed Rate Decision: Bought the Rumor, Now Sell the Fact?

By:Ilya Spivak

The US Dollar sits at a make-or-break point in the price trend after three months of brutal losses as a pivotal FOMC rate decision looms ahead. Will it provide a lifeline to the battered currency?

- The US Dollar has suffered deep losses for three months amid settling Fed rate hike bets

- Chair Jerome Powell and the FOMC committee set to issue 0.25% hike as tightening slows

- Fading rates-path speculation may sour markets’ mood, boosting the Dollar’s haven draw

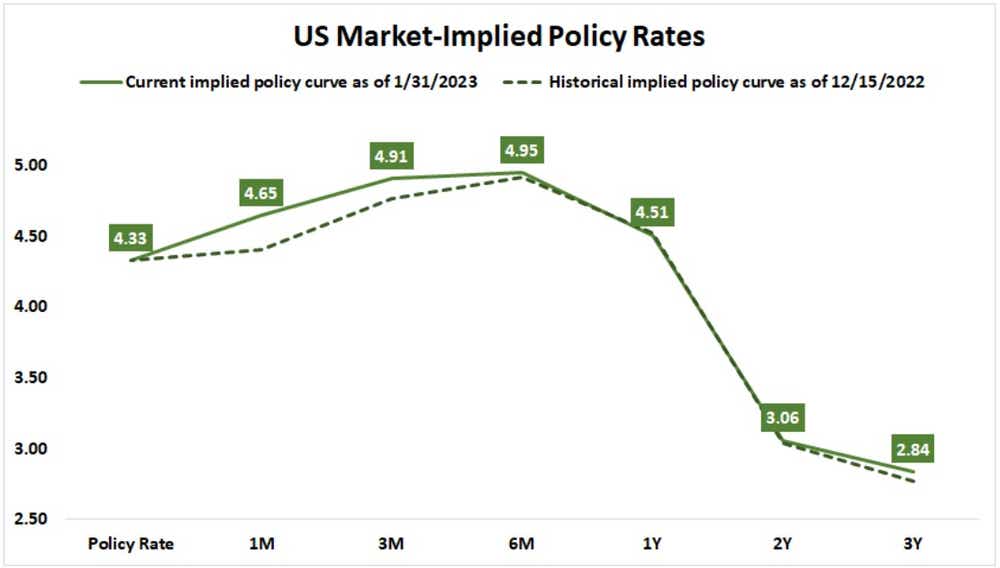

The US Dollar was battered bloody in past three months, reflecting the growing conviction that the Federal Reserve will pivot to cutting interest rates in the second half of 2023. Stocks, gold prices and most cyclical commodities (excluding energy, which marches to its own geopolitical drum recently) have duly rallied. Expectations priced into Fed Funds futures reveal that by the start of November, traders were convinced that the US central bank’s target interest rate will peak in the 4.75-5.00 percent target range by the middle of this year. That view has not budged since. Meanwhile, the projected path for the six months from there to the start of 2024 has turned increasingly dovish. At least one 0.25 percent rate cut is now expected in that period.

For their part, Fed Chair Jerome Powell and company have echoed the view that a downshift is on the menu. The latest guidance suggests that while inflation-fighting remains the focus, a fine-tuning period can now commence. This sounds like policymakers’ foot gradually coming off the gas pedal to allow for a kind of coast toward further tightening of financial conditions, powered by ongoing absorption of the blistering 425 basis points (bps) in hikes delivered in 2022 and the 50bps more expected for the first and (perhaps) second quarters. A given change in the benchmark lending rate is typically thought to take six to nine months to fully settle in the real economy. The markets seem to buy it: the priced-in rates path has hardly budged since the last gathering of the rate-setting FOMC committee in December.

FOMC Set to Deliver 0.25% Rate Hike, Maintain Familiar Policy Guidance

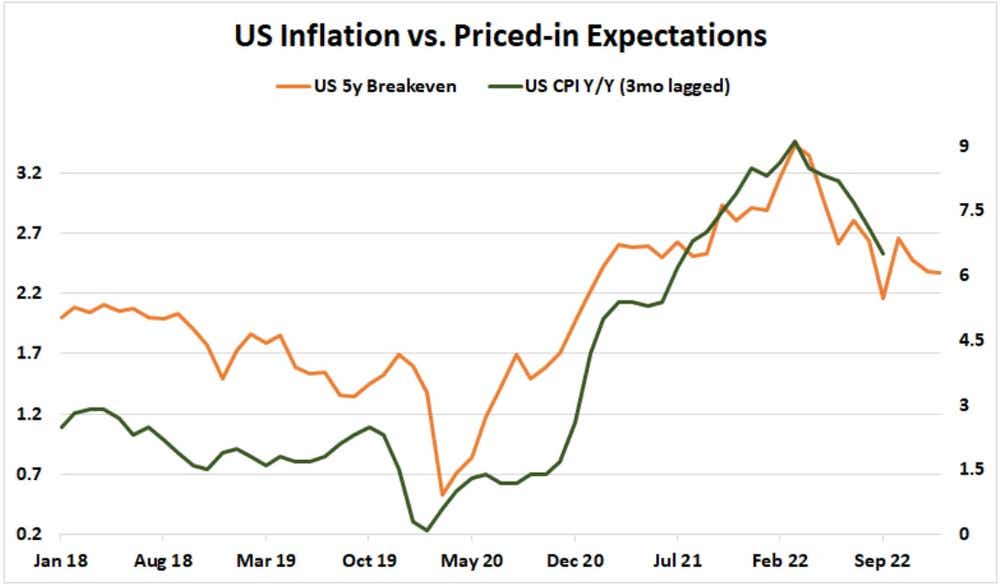

The steering group’s next conclave is now upon us. They are overwhelmingly expected to announce a 0.25 percent (25bps) rate rise on February 1 having issued either a 50 or 75bps increase at six consecutive meetings previously. The accompanying message seems unlikely to change considering their efforts have delivered as anticipated. By all accounts, inflation appears to have peaked, at least for now. The price growth outlook extrapolated from bond markets by taking the difference between nominal and inflation-adjusted yields of the same maturity – the so-called “breakeven” rate – has clearly changed direction. The realized consumer price index (CPI) measure of the trend in cost growth has done the same, with a modest three-month lag. Meanwhile, the labor market – the second target of the Fed’s dual policy mandate – is yet to take a worrying turn for the worst.

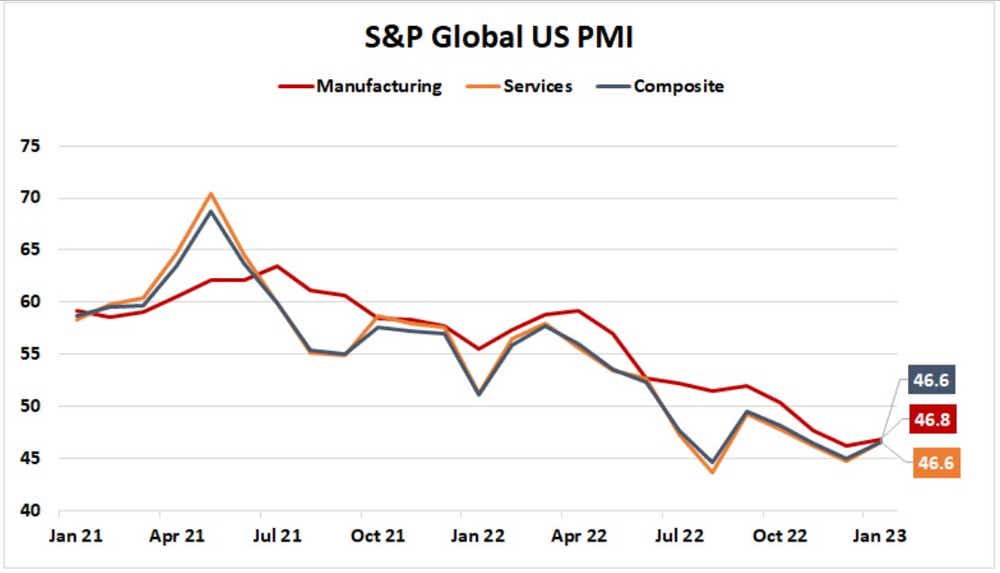

Still, a sharp deceleration in economic growth seems to have been the price of this preliminary victory. While fourth-quarter GDP data registered nominally better than economists expected, timelier measures of the business cycle are sobering. Surveys of corporate purchasing managers by S&P Global suggest both the US manufacturing and services sectors have faced deepening contraction in economic activity for months. In the logic of these “PMI” indicators, the 50 level is the neutral setting. Values above that mark expansion, while those below it speak of retrenchment. Distance above or below 50 represents velocity.

Bought the Rumor, Now Sell the Fact?

This might set up a curious dynamic for the markets’ reaction to the FOMC policy announcement. A broadly as-expected outing appears likely to cement what traders have busily priced in over the past three months: the rate hike cycle will pause by mid-year having seemingly delivered enough tightening to return inflation to Mr Powell’s happy place. That may have the effect of aging the narrow story about where rates go next out of speculative interest. With markets and Fed officials on the same page, there would be little more to drive price volatility. In turn, this might broaden the lens to focus on the consequences of the sluggish economic environment that rapid rate increases have produced.

The result may be evaporating risk appetite. If the past three months have been powered by the pricing in of the end of the tightening cycle – and if that narrative has now run its course – the next chapter may well be about how badly growth will deteriorate from here. Worries about some sort of dislocation in the credit markets before all is said and done could begin to proliferate as well. After all, this has been the fastest pace of rate rises in 40 years, after the longest period at ultra-low interest rates between easing and tightening cycles since the modern financial market order was birthed in the early 1970s. It is not far-fetched to think that more trouble lurks beneath the surface, beyond the turmoil already afoot in the cryptocurrency space and the broader tech sector.

The US Dollar would probably benefit from such a backdrop as the liquid cash-out venue of choice. It is uniquely liquid, and so tends to attract capital fleeting from riskier corners of the market, alongside Treasury bonds. Prices are positioned in a convenient place for such an outcome. A monthly chart of the Invesco DB USD ETF shows them having pulled back to retest long-term resistance-turned-support in the 26.50-27.19 area. This would be a natural place to find a floor, assuming it holds up. Rebounding from here may set the stage for another foray toward the 2022 swing high at 30.76. Alternatively, breaking through support may set the stage for a deeper pullback toward the 23.14-24.09 zone.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.