US Bond Prices May Swing on Federal Reserve Decision

US Bond Prices May Swing on Federal Reserve Decision

Fed’s February Interest Meeting in Focus

Treasury market volatility has cooled over the last several weeks, but the Federal Reserve’s interest rate decision may upend that trend later this week. On Monday, the policy-sensitive 2-year yield was trading around four basis points higher. The MOVE index, a measure of bond market volatility, traded at its lowest point since June 2022.

The subdued volatility won’t last forever. Last week, the United States posted a surprisingly strong gross domestic product (GDP) growth rate for the fourth quarter, while the Fed’s preferred inflation gauge, the personal consumption expenditures price index (PCE), showed a slowing rate of growth for prices. The firm economic growth amid slowing price growth is encouraging for the Fed but the market is having trouble digesting the information and how it will alter the Fed’s rate hikes.

Market-based bets remain firmly fixed on a 25-basis-point rate hike with a cut coming later this year, but traders will gauge Fed Chair Jerome Powell’s language for indications of future policy moves with a fresh eye. Because the US economy remains resilient in terms of GDP and unemployment, Mr. Powell may give a firm appearance and convey that rate increases will continue throughout the year.

While those increases may be delivered in 25-bps increments, they could still upset the bullish expectations priced into the stock and bond markets. Treasury yields are lower across the curve this year, with traders betting that the Fed will stop hiking rates this year. That said, if Mr. Powell’s speech on Wednesday spooks markets, we would likely see a selloff in bond markets, which would cause yields to rise and likely drag stock prices lower.

Fed and Market Views to Reconcile on FOMC?

However, the threat of a recession remains in the cards, and the Fed must carefully weigh that risk against a jubilant market. A dovish tone would result in a bond-buying spree in markets and likely result in a rapid loosening of financial conditions. On the other hand, too hawkish a tone and yields can spike, possibly triggering an otherwise avoidable recession.

Traders are betting that the heightened recession risk keeps the Fed from continuing to hike. An inverted 10-year/2-year yield spread, currently trading at about negative 71-bps, remains a warning sign to markets. Despite the upbeat GDP figure, higher-frequency data remains cautionary. S&P Global data showed another contraction in U.S. business activity during January, pointing to a fragile economic backdrop. Will the FOMC announcement force markets to reconcile their views with that of the Fed?

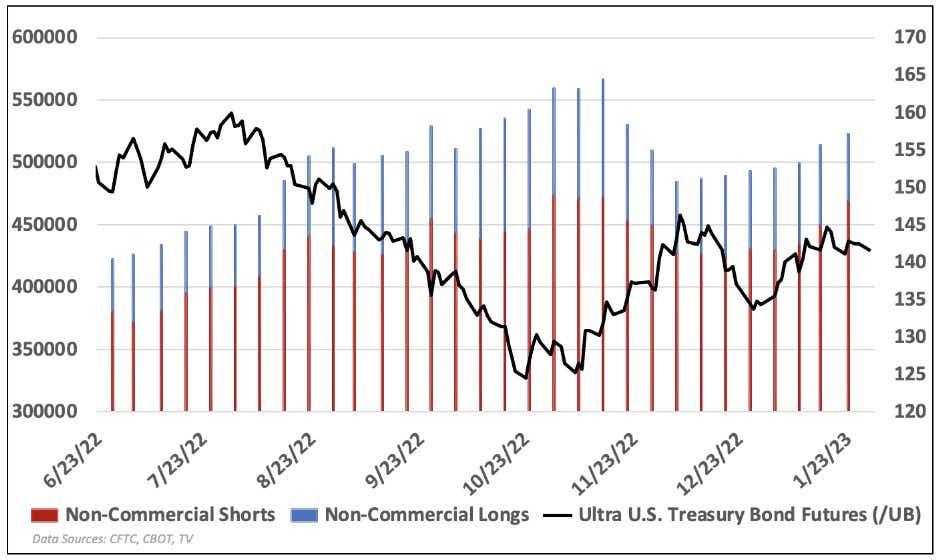

Bond Speculators Bet on Trend Reversal

Speculators in the bond market increased their short Treasury bets for a third week, according to data from the CFTC. The net-short position on ultra Treasury bond futures (/UB) for the week ending January 23 rose by 29,935 contracts, as longs closed and shorts added. This marked the largest net short position since February 2020 at 415k contacts.

The short trade is betting that the recent pullback in yields is overdone and that the Fed will disappoint market expectations. Alternatively, the elevated short positioning opens the trade up to a potential short squeeze should we get a dovish surprise.

FOMC Poses a Risk to the U.S. Corporate Debt Trade

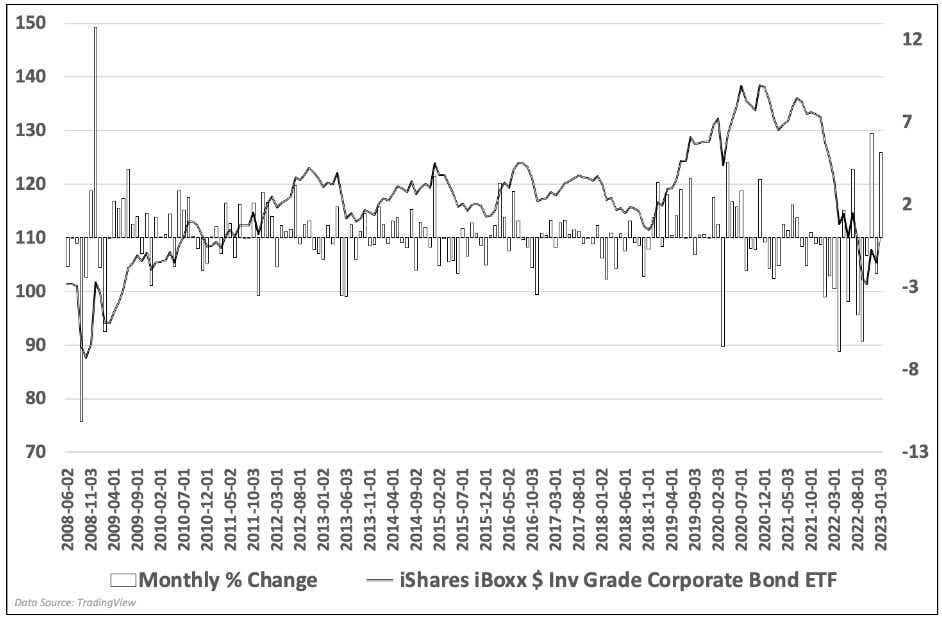

U.S. corporate debt is also being bought up, as the drop in Treasury yields make the higher-risk debt more attractive. Investors are accepting lower premiums even with a potential recession on the horizon. Traders see a modest recession risk being negligible to these positions and believe that most companies can weather the risk of default.

The iShares iBoxx Investment Grade Corporate Bond ETF (LQD) is trading near its highest point since August 2022, with a 4.5% gain throughout January. That is the largest January increase on record, and the second biggest since the 2008 financial crisis when the Fed dropped its benchmark rate by 100-bps to 0% - 0.25%. Given the sharp increase in the corporate bond space, it is susceptible to the same risk facing Treasuries. Wednesday’s FOMC will provide the next directional cue for bond markets.

Trading the Treasury Market as Fed and Market Views Diverge

The volatility contraction in the bond market ahead of the FOMC event suggests some indecision among traders. Taking a long volatility position to take advantage of any surprise reaction is one possible way to play the event. Employing a reverse iron condor trade would benefit from an increase in bond volatility while keeping a defined risk profile. The image below demonstrates the P/L dynamic of a hypothetical reverse iron condor on the 5-year T-Note (/ZF) futures.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.