Powell Testimony: Fed Chair in the Hot Seat as Inflation Risk Rebuilds

Powell Testimony: Fed Chair in the Hot Seat as Inflation Risk Rebuilds

By:Ilya Spivak

All eyes are on testimony from Fed Chair Jerome Powell as the outlook for ongoing interest rate hikes continues to preoccupy global financial markets.

- Markets anxiously await key testimony from Fed Chair Jerome Powell

- At issue is whether February’s hawkish turn in rate hike bets is sufficient

- Bond markets signal inflation is back on the march, beckoning action

Powell testimony: All eyes on the Fed Chair

The markets wait with bated breath as Federal Reserve Chair Jerome Powell gets set for two days of semi-annual testimony on monetary policy to the US Congress. It is a two-day affair, with the central bank chief appearing in the Senate and following that up with a repeat performance in the House. While the prepared remarks for these outings will be difficult to distinguish, the Q&A following each one can veer into unexpected places.

The markets have been utterly preoccupied with where the Fed is steering since mid-2021, when officials decided they had better do something about runaway inflation that then seemed far less “transitory” than expected. Speculation about the amplitude and length of the rate hike cycle that would ensue in early 2022 has been the narrative du jour for most asset classes since then.

Data Source: Bloomberg

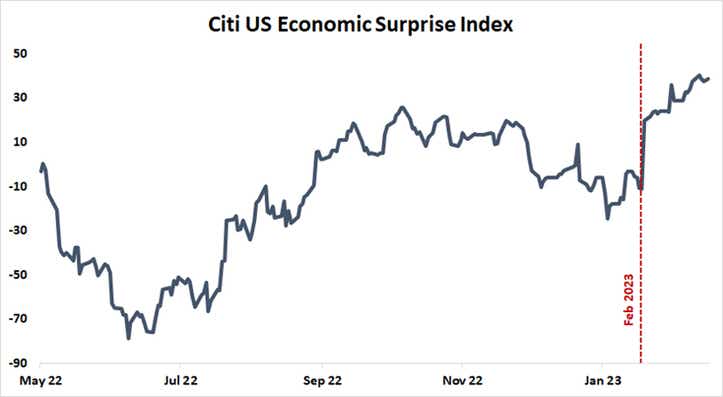

February turned out to be a critical turning point in this story. US economic data began to turn sharply higher relative to baseline expectations, driving rapid re-pricing of the Fed policy outlook to a more hawkish setting. The markets responded as might have been expected: stocks swooned alongside gold prices while the US Dollar rose. The key question now is whether that adjustment is sufficient, or if a larger one must yet be endured.

Inflation is back on the march

The upshift in US economic data has brought with it swelling inflation expectations. The 2-year breakeven rate, a measure of the inflation outlook priced into near-term bond yields, has run up to a 10-month high at 3.4 percent on the eve of the Fed Chair’s testimony. Trends here have tended to lead headline measures of inflation – the common CPI or the Fed’s preferred PCE – by about two months. The latest increase implies the Fed needs to do more to curb price growth.

Data Source: Bloomberg

Data Source: BloombergThat further rate increases are to be signaled seems a given. Indeed, the policy path already implied in Fed Funds interest rate futures already presupposes three 25-basis-point (0.25 percent) rate hikes before the year is out, along with about a 50/50 chance for a fourth. The fireworks may trigger if Mr Powell drives home that policymakers have no attachment to a given peak on rates – including December’s official guess of 5.1 percent – and intend to press on as need be.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.