Nasdaq 100 Unimpressed by Surge in 50-bps Rate Cut Odds

Nasdaq 100 Unimpressed by Surge in 50-bps Rate Cut Odds

Also 10-year T-note, gold, crude oil and Euro futures

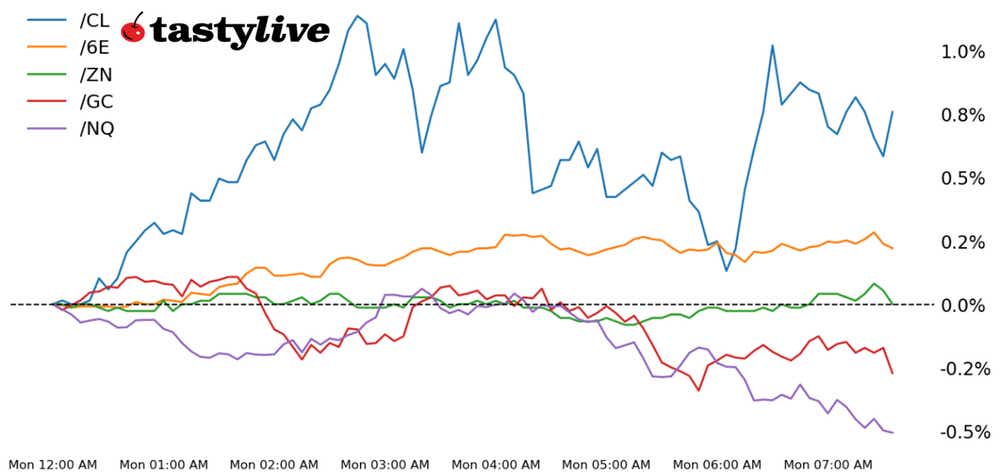

Nasdaq 100 E-mini futures (/NQ): -0.49%

10-year T-note futures (/ZN): -0.03%

Gold futures (/GC): -0.1%

Crude oil futures (/CL): +1.27%

Euro futures (/6E): +0.38%

A whirlwind of news in recent days has led to a surprisingly calm market on this morning. On Friday, a carefully planted and well-sourced op-ed in The Wall Street Journal sparked a dramatic repricing of odds for a 50-basis-point (bps) rate cut by the Federal Reserve this week, which jumped from 13% on Friday to 63% today. And shockingly, on Sunday, there was another assassination attempt on former President Donald Trump. History may be a guide here, however: in 1975, there were two attempts on President Gerald Ford’a life in a 17-day span; U.S. equity markets were down less than 1% in total in the immediate wake of both attempts.

Symbol: Equities | Daily Change |

/ESZ4 | -0.09% |

/NQZ4 | -0.49% |

/RTYZ4 | +0.22% |

/YMZ4 | +0.22% |

Nasdaq futures (/NQZ4) fell this morning following last week’s solid performance. Apple (AAPL) is down 2.5% in pre-market trading after analysts suggested there is light demand for the new iPhone 16, with pre-orders down 12.7% year over year (y/y). Alcoa (AA) rose nearly 5% after announcing it would sell a stake in its Ma’aden mining operation for over $1 billion.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18000 p Short 18250 p Short 21000 c Long 21500 c | 63% | +1630 | -8370 |

Short Strangle | Short 18250 p Short 21000 c | 69% | +5200 | x |

Short Put Vertical | Long 18000 p Short 18250 p | 84% | +620 | -4380 |

Symbol: Bonds | Daily Change |

/ZTZ4 | +0.03% |

/ZFZ4 | 0% |

/ZNZ4 | -0.03% |

/ZBZ4 | -0.05% |

/UBZ4 | 0% |

Bond yields are little changed as traders gear up for this week’s Federal Reserve interest rate announcement. The bank is expected to cut interest rates, which has pushed Treasuries up over the past couple of months in anticipation of the move. The Treasury will auction off 20-year bonds tomorrow, which follows a mixed set of results from 30-year and 10-year auctions last week.

Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 111 p Short 112.5 p Short 118.5 c Long 120 c | 62% | +390.63 | -1109.38 |

Short Strangle | Short 112.5 p Short 118.5 c | 67% | +796.88 | x |

Short Put Vertical | Long 111 p Short 112.5 p | 88% | +187.50 | -1312.50 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.1% |

/SIZ4 | +0.68% |

/HGZ4 | +0.59% |

Gold prices are coming off their best weekly performance since July, with prices advancing nearly 4% last week. A weak dollar is providing a tailwind for the metal as traders prepare for the Fed to start loosening its policy stance. The weekend’s failed assassination attempt of former President Trump helped to fuel some geopolitical risk premium in the metal.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2480 p Short 2495 p Short 2735 c Long 2750 c | 61% | +500 | -1000 |

Short Strangle | Short 2495 p Short 2735 c | 70% | +3080 | x |

Short Put Vertical | Long 2480 p Short 2495 p | 82% | +250 | -1250 |

Symbol: Energy | Daily Change |

/CLX4 | +1.27% |

/HOV4 | -0.13% |

/NGV4 | 0% |

/RBV4 | +1.4% |

Crude oil prices (/CLV4) advanced higher to start the week despite weak economic data out of China. China’s data showed weaker industrial activity along with another monthly drop in fuel exports. Traders are betting that demand in the West will hold up, especially with rate cuts incoming. A positive print from the New York Fed’s Empire State Manufacturing Survey supported positive sentiment for the economy in the United States. Besides the Fed decision, eyes are on tomorrow’s inventory data from the American Petroleum Institute (API).

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 59.5 p Short 61 p Short 78.5 c Long 80 c | 63% | +390 | -1110 |

Short Strangle | Short 61 p Short 78.5 c | 70% | +1760 | x |

Short Put Vertical | Long 59.5 p Short 61 p | 79% | +250 | -1250 |

Symbol: FX | Daily Change |

/6AZ4 | +0.57% |

/6BZ4 | +0.56% |

/6CZ4 | +0.07% |

/6EZ4 | +0.38% |

/6JZ4 | +0.35% |

The sharp repricing in Fed rate cut odds is being felt most meaningfully by FX markets. The U.S. dollar is down across the board, with the Japanese yen (/6JZ4) touching a fresh yearly high (and with USD/JPY spot rates flirting with a break below 140). The more aggressive Fed path stands in contrast to the data dependent, start-and-stop nature of the European Central Bank or even the Bank of England, which is set to meet Thursday; the British pound (/6BZ4) and the euro (/6BZ4) are both less than 0.5% away from their yearly highs.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.075 p Short 1.09 p Short 1.145 c Long 1.16 c | 67% | +400 | -1475 |

Short Strangle | Short 1.09 p Short 1.145 c | 70% | +700 | x |

Short Put Vertical | Long 1.075 p Short 1.09 p | 89% | +200 | -1675 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.