Volatility’s Next Act: Could Recession Fears Finally Push the VIX Through 40?

Volatility’s Next Act: Could Recession Fears Finally Push the VIX Through 40?

Could the “fear gauge” go wild in 2025? The odds are rising.

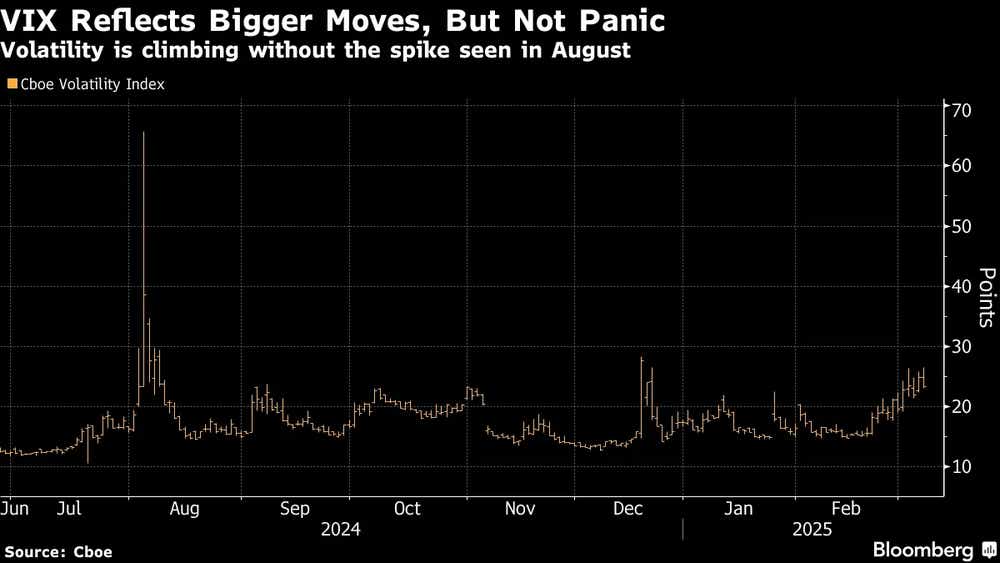

- The VIX is climbing to levels not seen in months, signaling uncertainty in the markets.

- Growing concern over a potential recession is making consumers more cautious.

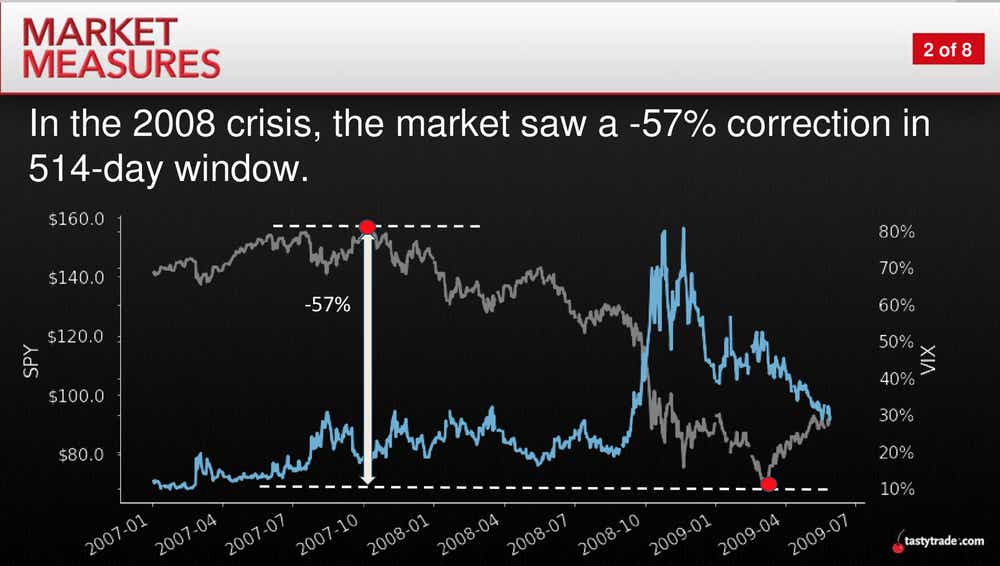

- Historically, recessions have triggered significant stock market pullbacks, suggesting the VIX probably hasn’t peaked.

With market volatility surging this month, the Cboe Volatility Index (VIX) is back in the spotlight, climbing to levels not seen in months. What’s behind the surge? A growing sense of uncertainty, fueled by shifting U.S. government policies, an intensifying trade war and mounting concern over a potential recession.

Investors are beginning to realize the relative calm of the past few years may be coming to an end. Today, we examine the latest jump in market volatility and consider what could finally push the VIX back above 40—something that hasn’t happened in nearly five years.

A jittery market

Market volatility has surged recently, calling attention to the Cboe Volatility Index (VIX) or “fear gauge” as it’s sometimes known. It’s been trading above 20, a level it hadn’t reached since December. The recent uptick is attributed largely to uncertainty surrounding the U.S. government, with job cuts and shifting trade policies triggering market jitters. But those are just the best guesses; There may be something less apparent lurking beneath the surface, waiting to make its presence known.

The spike is certainly notable. Over the last year, the VIX has breached 30 only on a couple of occasions, most significantly when the yen carry trade faltered in August 2024. Even then, the VIX quickly retreated, dropping back into the teens after a brief period of market turbulence. To put this in perspective, the long-term average for the VIX sits between 18 and 19. Through that lens, a jump to 30 is not routine—these moves typically signal something important, like Russia’s full-scale invasion of Ukraine in early 2022.

What’s most striking, however, is the VIX hasn’t closed above 40 since the early stages of the COVID-19 pandemic almost five years ago—a lifetime in the world of financial markets.

This absence of extreme volatility raises the question: What would it take to push the VIX past 40 again? Historically, the VIX tends to move inversely to major market indices. When the S&P 500 drops sharply, the VIX tends to spike, and vice versa. But even with the series of geopolitical crises that have unfolded since 2020—ranging from escalating military tensions in Eastern Europe to instability in the Middle East—the VIX has remained surprisingly subdued. So, what could finally break the calm?

One looming possibility, according to Wall Street’s "wall of worry," is a recession. Recessions have long been powerful catalysts for market corrections. When the economy falters, stock prices usually follow suit—and often, the market starts slumping in anticipation of a downturn. We've seen this pattern before, from the steep market declines ahead of the Great Recession (highlighted below) to the swift, COVID-induced crash in 2020.

If a recession hits in 2025, it's hard to imagine the VIX not spiking above 40. However, other developments could also stir market volatility. For instance, an escalation of hostilities in Eastern Europe or the Middle East could stoke further uncertainty. But this knife cuts both ways: the announcement of a ceasefire between Russia and Ukraine could send the VIX back toward the low teens, quelling market fears—at least temporarily.

The growing threat of an economic downturn

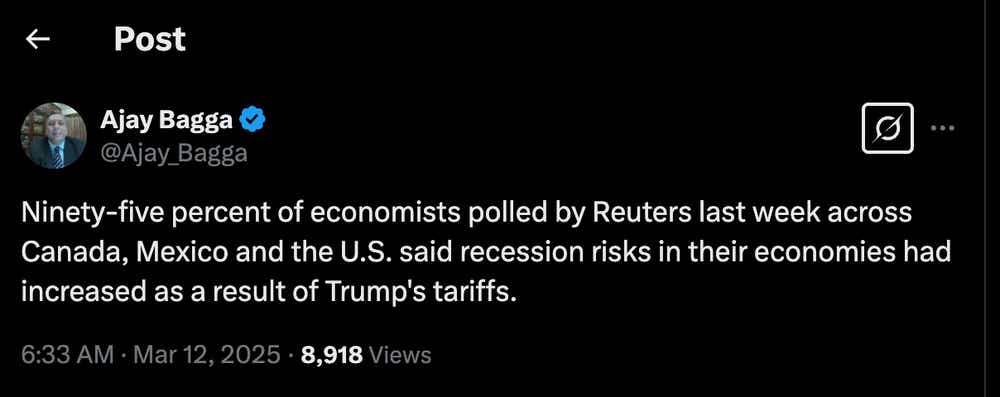

The possibility of a U.S. recession, once a distant concern, is now moving to the forefront of economic discussions. In recent weeks, several high-profile economists have raised the likelihood of a downturn. JPMorgan (JPM), for instance, has increased its recession risk forecast for 2025 from 30% to 40%, citing "extreme U.S. policies" as a contributing factor. Similarly, Goldman Sachs (GS) has raised its own probability to 20%, from 15%, while analysts at Morgan Stanley (MS) have slashed their economic growth projections, now predicting just 1.5% GDP growth for the year. With this mounting data, it’s becoming clearer the economy may be veering off-course.

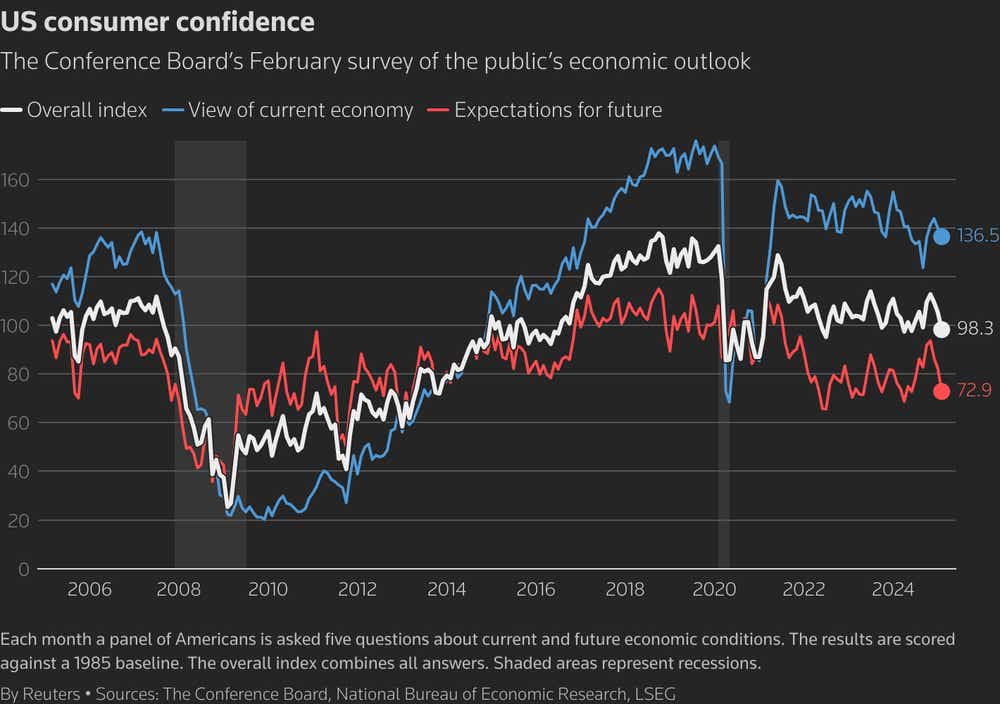

One of the most striking indicators of this growing risk is the sharp decline in consumer confidence. The Conference Board’s latest index reported a notable drop (illustrated below), signaling increasing anxiety about the future. This unease is playing out in real time. Walmart (WMT), in its February earnings report, painted a picture of financially stressed consumers. CEO Doug McMillon observed that “you can see that the money runs out before the month is gone.” He pointed out that shoppers are cutting back, increasingly opting for smaller pack sizes as they stretch their budgets—a stark contrast to last autumn when Walmart reported resilient consumer spending and optimism.

This decline in consumer confidence is also apparent to Delta Airlines (DAL), which has also revised its Q1 revenue forecast downward, citing a “recent decline in consumer and corporate confidence” and “increased macro uncertainty” weighing on demand. The airline’s new forecast of 3%-4% growth, well below its original 7%-9% guidance, signals economic pressures are beginning to spread. And it’s not just retailing or travel that are feeling the pinch—broad swaths of the economy are affected.

The fear of a recession, while grounded in real data, can also become a self-fulfilling prophecy. As consumers grow more cautious, scaling back spending in anticipation of difficult times, they inadvertently contribute to the slowdown. Fear leads to less spending, which weakens demand and creates more uncertainty—further exacerbating the problem. This cycle is of particularly concern given the broader context of skyrocketing credit card debt, which has reached record levels.

Even President Trump, typically optimistic about the economy, recently acknowledged "there could be some disturbance" ahead, referring to potential disruptions caused by his trade policies. Treasury Secretary Scott Bessent has also weighed in, discussing the concept of a “detox recession”—a painful but necessary adjustment as the U.S. moves away from pandemic-era government spending. Both remarks, though cautious, underscore the complexity of the current economic landscape, suggesting considerable challenges could lie ahead.

Should the downturn materialize, the effects on consumers and businesses could be severe, creating widespread economic disruption. This would likely amplify market volatility, with the VIX potentially surging past 40, as investors react to the challenges associated with a prolonged economic downturn.

Takeaways

With economic optimism fading and key indicators pointing toward a slowdown, it’s no surprise the VIX is climbing. Fear of recession, compounded with the self-reinforcing cycle of reduced consumer spending could drive market anxiety to levels not seen in years..

However, market conditions can shift quickly. Whether sparked by a surprise geopolitical resolution or unexpected economic data, the path forward remains unpredictable. Yet one thing is certain: the risk of a significant downturn is no longer a distant possibility. It’s an immediate and pressing concern that could define the trajectory of the markets in the months ahead.

To learn more about trading volatility in the markets, readers can check out this new installment of Options Trading Concepts Live on the tastylive financial network.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.