Nasdaq 100 Tries to Break Bearish Momentum, Gold Tops 3000

Nasdaq 100 Tries to Break Bearish Momentum, Gold Tops 3000

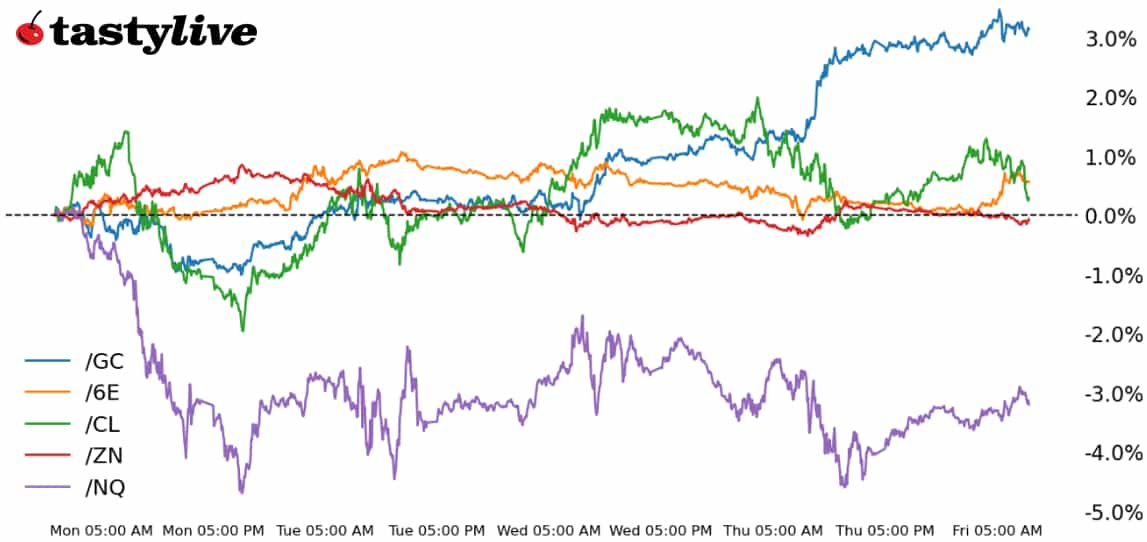

Also, 10-year T-note, gold, crude oil and euro futures

- Nasdaq 100 E-mini futures (/NQ): +1.66%

- 10-year T-note futures (/ZN): -0.18%

- Gold futures (/GC): +0.32%

- Crude oil futures (/CL): +0.38%

- Euro futures (/6E): +0.88%

Concern over a U.S. government shutdown appears overblown after Democratic Senate Minority Leader Chuck Schumer signaled his willingness to support legislation to keep the lights on. Not that government shutdowns affect markets: Since 1971, a government shutdown has averaged nine days producing a 0.3% gain for the S&P 500 (which is to say, indifferent impact). But that’s enough for stocks, which are desperately trying to break their multi-week downtrends that have produced a -10% move off of February’s highs. Elsewhere, a rebound in stocks is giving traders room to exit bonds, and a softer U.S. dollar has helped gild the path for gold to top 3000 in the futures market.

Symbol: Equities | Daily Change |

/ESH5 | +1% |

/NQH5 | +1.66% |

/RTYH5 | +1.25% |

/YMH5 | +0.41% |

U.S. stock rose today as the end of a volatile week of trading moves into sight. Nasdaq 100 futures (/NQH5) rose 1.66% in early trading. The threat of a government shutdown in the United States receded, which removed some uncertainty from the market. Still, the Nasdaq is on track to record its fourth weekly loss, as the threat of tariffs remains on investors’ minds. Ulta Beauty (ULTA) rose 8% in early trading after the retailer beat estimates yesterday in an earnings report after the bell. Chip stocks caught a bid, with Micron Technology (MU gaining 6% this morning.

Strategy: (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 17600 p Short 17800 p Short 21400 c Long 21700 c | 65% | +1280 | -4720 |

Short Strangle | Short 17800 p Short 21400 c | 71% | +5755 | x |

Short Put Vertical | Long 17600 p Short 17800 p | 85% | +510 | -3490 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.04% |

/ZFM5 | -0.12% |

/ZNM5 | -0.18% |

/ZBM5 | -0.43% |

/UBM5 | -0.56% |

U.S Treasury yields rose on today as bond prices dropped. 10-year T-note futures (/ZNM5) fell 0.18%, following the move in European markets. Germany’s Friedrich Merz, chancellor-in-waiting, carved out a deal with the Greens party that will allow the government to move forward with a defense package that will skirt the country’s constitutional brake lever. This morning’s consumer confidence data came in softer-than-expected, potentially complicating the economic outlook that bond traders partly base their bets on.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107.5 p Short 109 p Short 113 c Long 114.5 c | 69% | +390.63 | -1109.38 |

Short Strangle | Short 109 p Short 113 c | 74% | +625 | x |

Short Put Vertical | Long 107.5 p Short 109 p | 86% | +218.75 | -1281.25 |

Symbol: Metals | Daily Change |

/GCJ5 | +0.32% |

/SIK5 | +0.59% |

/HGK5 | -0.61% |

Gold prices (/GCJ5) continue to benefit from the uncertainty in markets as prices sprinted to fresh record highs overnight. The move above 3,000 marks a technical victory for bulls who have been eying the level since the start of February. Additional weakness from the dollar helped to guide precious metals higher as we head into the weekend. Meanwhile, analysts have raised price targets for the metal, with Goldman Sachs (GS) pushing their price target for the year to 3,100.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2825 p Short 2840 p Short 3175 c Long 3190 c | 65% | +400 | -1100 |

Short Strangle | Short 2840 p Short 3175 c | 72% | +3060 | x |

Short Put Vertical | Long 2825 p Short 2840 p | 88% | +150 | -1350 |

Symbol: Energy | Daily Change |

/CLJ5 | +0.38% |

/HOJ5 | -1.82% |

/NGJ5 | -3.14% |

/RBJ5 | +0.1% |

Crude oil prices were trading slightly higher at the start of trading today, but a small loss remains in place for the week. That would mark the eighth weekly loss for the commodity, which has been hammered by the threat of tariffs and their expected impact on global growth. Moscow is reportedly considering a ceasefire deal with Ukraine that is supported by the United States. However, Washington seems eager for Russia to come to the table fully because the administration is reportedly considering placing more restrictions on Moscow’s access to U.S. payment systems. For now, the negotiations remain fragile.

Strategy (62DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 57.5 p Short 59 p Short 75 c Long 76.5 c | 64% | +360 | -1140 |

Short Strangle | Short 59 p Short 75 c | 71% | +1540 | x |

Short Put Vertical | Long 57.5 p Short 59 p | 80% | +220 | -1280 |

Symbol: FX | Daily Change |

/6AH5 | +0.58% |

/6BH5 | -0.1% |

/6CH5 | +0.57% |

/6EH5 | +0.88% |

/6JH5 | +0.44% |

The U.S. dollar’s struggles are continuing today. Having embarked on its worst start to a year since 2008, the greenback is finding no reprieve even as Treasury yields rise and stock markets bounce back. While the Federal Reserve isn’t expected to change rates next week (1% chance per three-month SOFR futures), a new Summary of Economic Projections (SEP) can help reset expectations for traders.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.05 p Short 1.065 p Short 1.12 c Long 1.135 c | 64% | +525 | -1350 |

Short Strangle | Short 1.065 p Short 1.12 c | 70% | +1050 | x |

Short Put Vertical | Long 1.05 p Short 1.065 p | 87% | +237.50 | -1637.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.