Recession Fear May Lift Bonds, Hurt the Dollar as the Mood Sours for U.S. Consumers

Recession Fear May Lift Bonds, Hurt the Dollar as the Mood Sours for U.S. Consumers

By:Ilya Spivak

More doom and gloom from U.S. consumers may amplify concerns about incoming recession.

- Recession fears are punishing the markets amid U.S. trade policy uncertainty.

- Cyclical fears are translating into a dovish revision of Fed rate cut expectations.

- Soft U.S. consumer confidence data may lift bonds as yields and the dollar fall.

Recession worries continue to batter the financial markets amid concerns that ongoing uncertainty about U.S. trade policy will sour economic appetites and put the brakes on growth. The bellwether S&P 500 stock index has probed its lowest level in six months. It is on track for the worst four-week selloff since October 2022.

Wall Street has been in a defensive mood since the second half of February, when U.S. economic data began to signal that the mighty service sector began to weakened suddenly at the start of 2025. A sharp dovish repricing of Federal Reserve interest rate cut expectations has understandably followed.

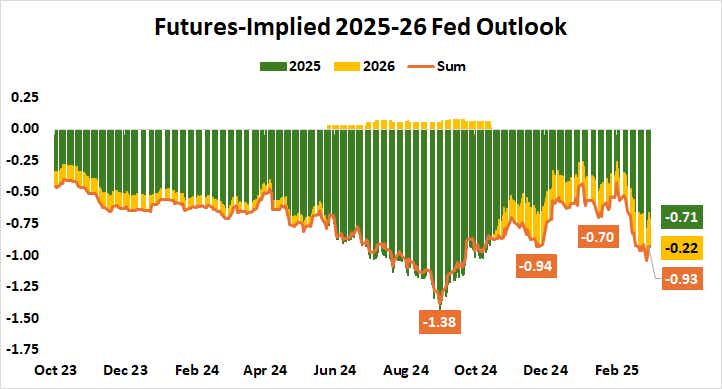

Fed rate cut expectations build amid recession worries

Benchmark Fed Funds futures now price in 93 basis points (bps) in policy easing through the end of 2026. That is a stark contrast from about 50bps on the menu just a month ago. Three standard-sized 25bps rate cuts are favored for this year, followed by one more after the calendar turn. The first reduction in this series is slated for about mid-year, appearing no later than July.

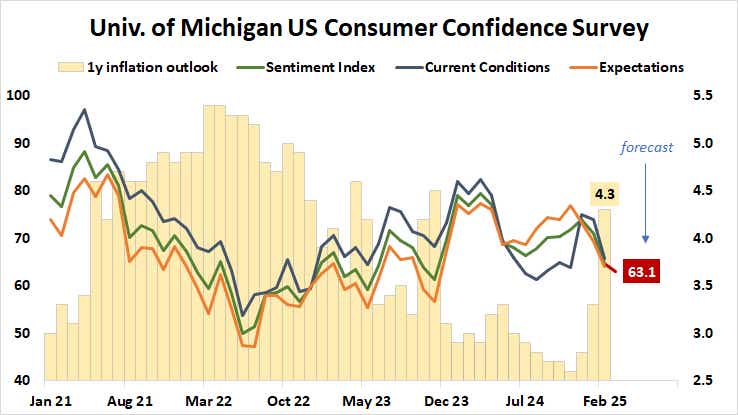

From here, the spotlight turns to U.S. consumer confidence data from the University of Michigan (UofM). February saw the gloomiest reading since November 2023 as uncertainty about tariffs and fiscal policy more broadly pushed inflation expectations sharply higher. The one-year price growth outlook jumped to 4.3%.

Downbeat consumers may lift bonds as yields and the U.S. dollar suffer

More of the same is expected as preliminary figures for this month cross the wires. Economists are penciling in a move down to 63.1 on the headline sentiment index, a new 16-month low. S&P Global sector-tracking purchasing managers index (PMI) data offers ominous reinforcement, showing a steep drop in consumer services growth in February.

Consumption accounts for close to 70% of U.S. gross domestic product (GDP) growth. If the mood darkens, recession fears are likely to build. Against this backdrop, bonds may continue to march higher as Treasury yields and the U.S. dollar fall amid still more dovish Fed policy speculation. If hope for cheaper money lifts stocks remains to be seen.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.