Nasdaq Futures 26% Down YoY: What Should Traders Expect?

Nasdaq Futures 26% Down YoY: What Should Traders Expect?

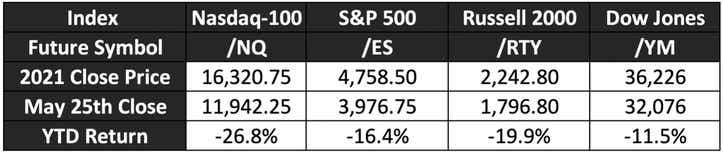

Despite today’s rally, it’s been a rough year for the Nasdaq-100 as we approach the last month of Q2 2022. Nasdaq futures (/NQ) found their recent lows on May 20th at $11,491.25, a price level not seen since November of 2020. The technology-heavy index is taking the worst beating of the four major indices.

Nasdaq Futures YTD Performance

Nasdaq futures are down over 26% year-to-date (May 25th), as higher interest rates and fears around consumer spending, inflation, and dwindling ad revenues batter the tech sector. Time will tell if the last week with some positive movement in the Nasdaq-100 means the lows are in or whether the bears will get to celebrate further selling.

.png?format=pjpg&auto=webp&quality=50&width=1600&disable=upscale)

As might be expected, Nasdaq-100 implied volatility is greater than the other three indices. This gives the Nasdaq the largest expected moves of any index moving forward as the market anticipates continued wide ranges for the index.

.png?format=pjpg&auto=webp&quality=50&width=790&disable=upscale)

Nasdaq Volatility

Interestingly, implied volatility rank for the Nasdaq-100 is also the highest among the four indices. Meaning that not only is raw implied volatility high for the Nasdaq but also it is highest in its range for the past year. Traders looking to hedge or speculate with short Nasdaq options, either in the futures or in the ETF (QQQ), are receiving richer premiums than they would be in the S&P, Russell, or Dow.

.png?format=pjpg&auto=webp&quality=50&width=1600&disable=upscale)

How to Trade Nasdaq Futures & ETFs

As it stands right now, a one-standard deviation strangle for July expiration in QQQ collects $623 in premium requiring approximately $3,000 in a standard margin account. If the trade is managed for a 50% profit, making $311, the return on capital would be over 10%.

For traders looking to scalp futures the micro-Nasdaq contracts (/MNQ) give access to the Nasdaq index at one-tenth the notional value of the larger futures. The micro contract requires about $2,100 in capital to trade. Though traders should keep in mind large movements are still expected for the Nasdaq over the next few weeks. With the futures at $12,210, the expected move through next Friday is ±452 points, ±$904 in profit or loss on a micro contract. Through June expiration on Friday June 17th, the expected range is ±819 points, ±$1,638 for a micro contract.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.