Nasdaq 100: NQ Fresh Yearly Lows Before the Fed Steps to the Plate

Nasdaq 100: NQ Fresh Yearly Lows Before the Fed Steps to the Plate

NASDAQ 100, NQ, NDX TALKING POINTS:

- Big tech has seen a big pullback so far in 2022 trade and that bearish theme has heated up as the door has opened into Q2.

- The big push point is this Wednesday’s FOMC rate decision where the bank is expected to dial up the hawkishness with a 50 basis point rate hike along with some communication around their plans for the balance sheet.

- I looked at bearish US equities as my Top Trade for Q2 and I wasn’t alone on the DailyFX team, as Messrs Paul Robinson and Daniel McCarthy also had bearish outlooks for the S&P 500. Download the full Top Trades installment from the link below:

It’s been another week of pain for US stocks even with a wide swath of big tech reporting earnings last week. Apple beat but, a few days later price is still down, and that’s a fairly bearish factor because when we’re in a market that shrugs off good news, look out below.

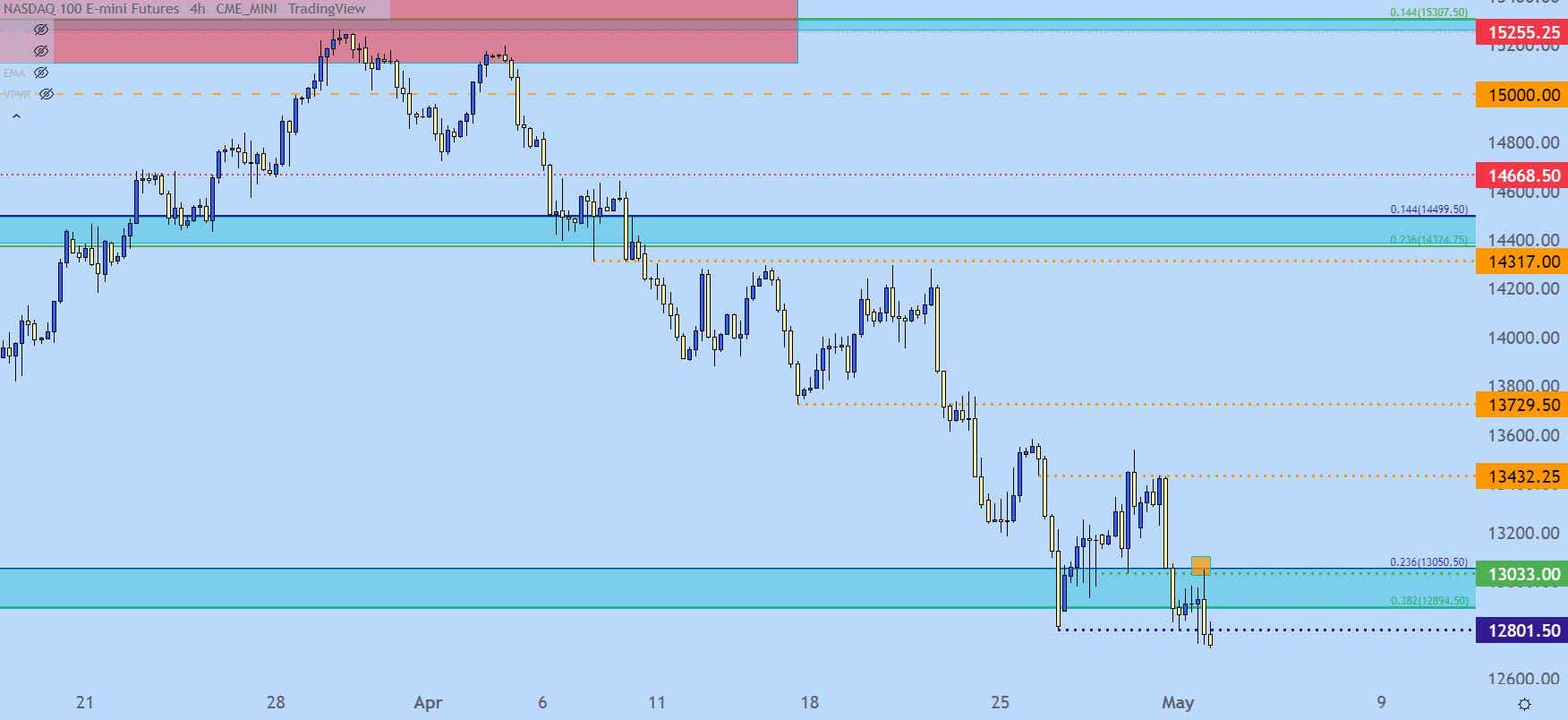

As I had looked at last week, the Nasdaq 100 has breached support in a double top formation and that might lead to a much more pronounced bearish drive. Price started the week by pushing down to yet another fresh yearly low and through mid-day on Monday trade that theme continues to take-hold.

The Friday session was especially brutal, with sellers pushing all the way into the close and the quick bounce that developed after the US open this morning was soundly faded, with the index setting yet another fresh yearly low.

But, on the below chart, notice what happened shortly after that low was set earlier this morning and just after the US open. I’ve added an orange box on this portion of the chart.

NASDAQ 100 HOURLY PRICE CHART

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

The item of interest from earlier this morning was a quick resistance test after the open – and that resistance came in right at a spot of prior support, plotted from around 13,033 up to 13,050. The former price is simply last Thursday’s swing-low but the latter price is a Fibonacci retracement that I’ve been following in these articles as part of the long-term support that’s been in-play of recent.

But, the takeaway here is that traders can try to exercise patience in the effort of finding resistance. This would be an alternative to chasing a fresh breakdown and just hoping that the move continues to print in that direction. And there’s a couple of other spots where something similar may come into play, such as the 12,801 prior support swing or perhaps the bottom of that support zone which I have plotted at 12,895.

The key here would be letting price breakdown to a fresh low first, after which a corresponding pullback can open up the potential for lower-high resistance to post at either of these areas.

Nasdaq 100 Four-Hour Price Chart

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

NASDAQ 100 LONGER-TERM

It can be hard to keep in scope just how aggressive the run-up in 2020 and 2021 was but, at this stage, the Nasdaq 100 has retraced a mere 38.2% of that major move.

As a matter of fact, that 38.2% retracement was the 12,895 level that I was speaking of above. And, from the Daily chart below, we can see where that recent trend does not look very healthy at all.

The next major spot of support on my chart spans an area that was last in-play in March of 2021, plotted from 12,207 up to 12,465. Below that, the 50% marker of the pandemic trend shows up at around 11,700, and the last major zone on the below chart is a big one, running from 10,501-10,751.

If the double top formation in the Nasdaq 100 continues to fill-in, that latter target can remain as a projected area of possible support, as I had looked at last week.

Nasdaq 100 Daily Price Chart

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

- Written by James Stanley, Senior Strategist for DailyFX.com

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.