Here’s how to cope with the “Liberation Day” Market correction

Here’s how to cope with the “Liberation Day” Market correction

By:Kai Zeng

Investors can protect themselves by diversifying their portfolios and carefully managing risk

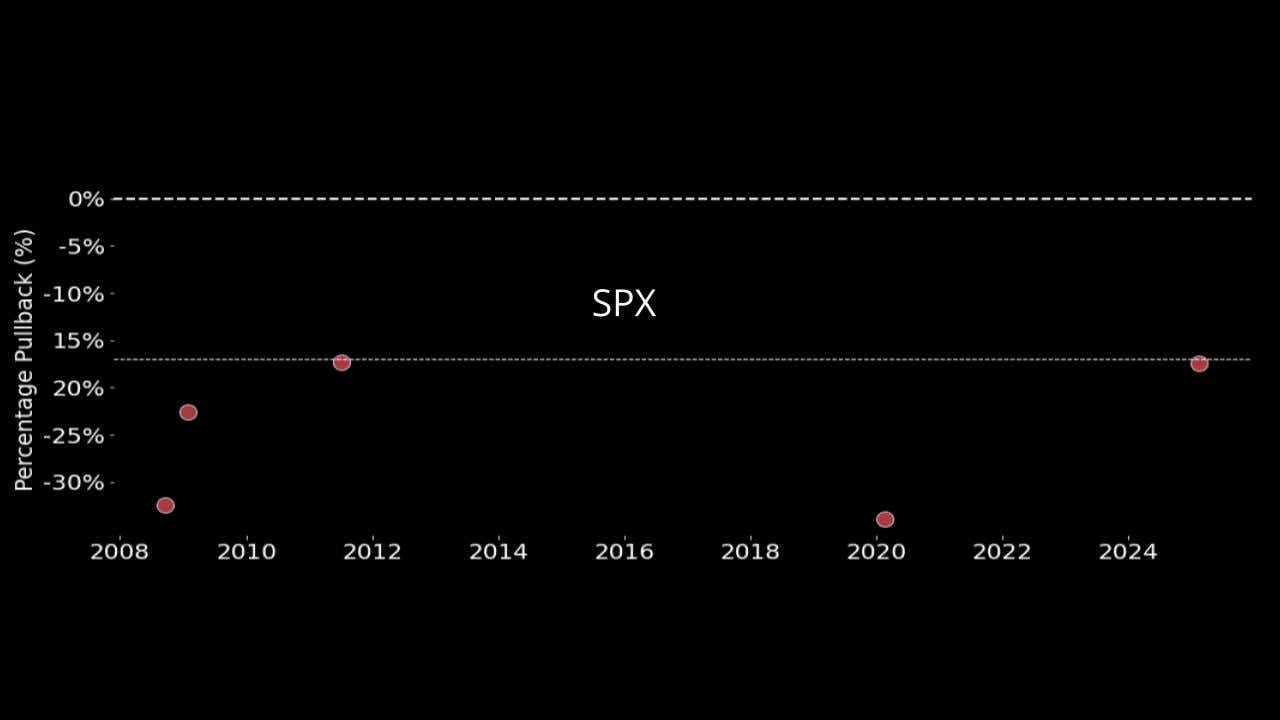

- The current downturn ranks among the strongest in decades—it’s behind only 2008 and 2020.

- Friday's extreme jump in the VIX was the sixth largest single-day increase in the past 20 years.

- Diversifying assets becomes more important during market corrections, but rising correlations may temporarily reduce its effectiveness.

- Risk management should be the top priority during market turmoil.

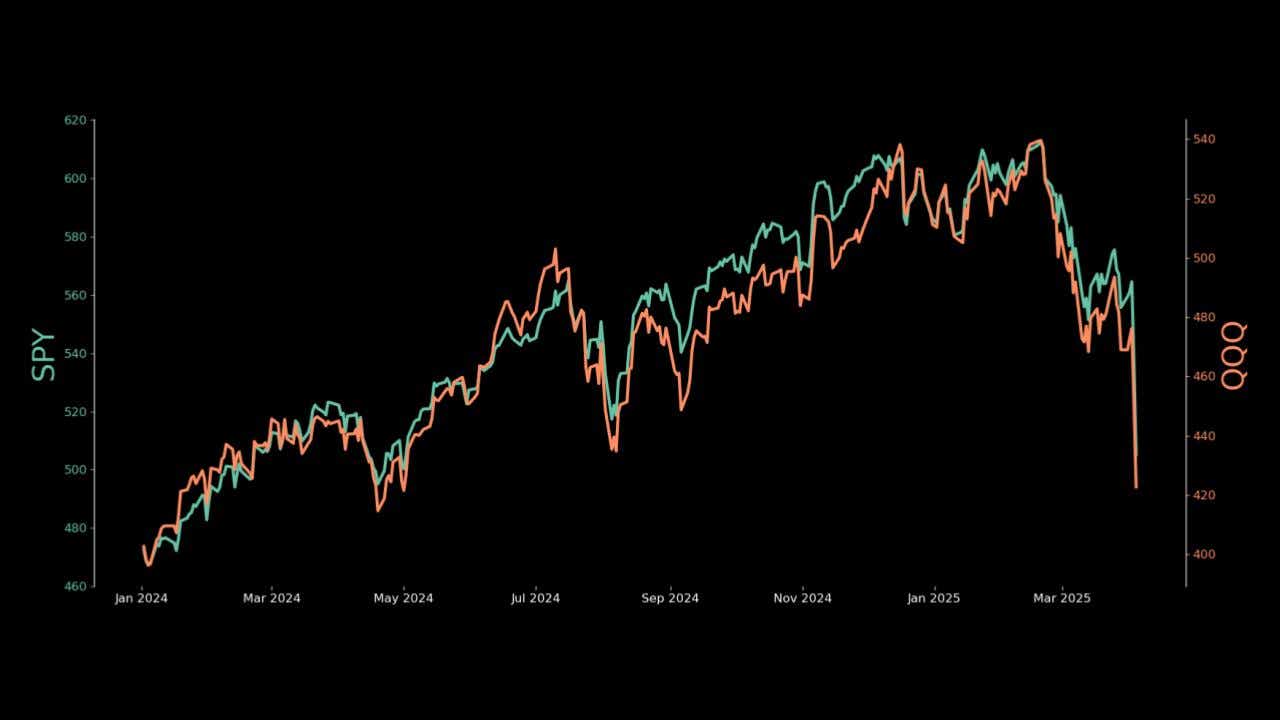

In the past 44 days, the S&P 500 and Nasdaq have dropped 17% and 22%, respectively, a decline not seen since the COVID-19 crisis. This rapid deterioration has shocked investors who had grown accustomed to relatively stable conditions throughout early 2025.

Historically, there have only been 11 instances when Nasdaq dropped 22% or more in a 45-day period, and only five when the S&P dropped 17% or more. This places the current market decline among the most significant in history. Such moves typically coincide with major economic or geopolitical events, making the post-"Liberation Day" reaction particularly noteworthy.

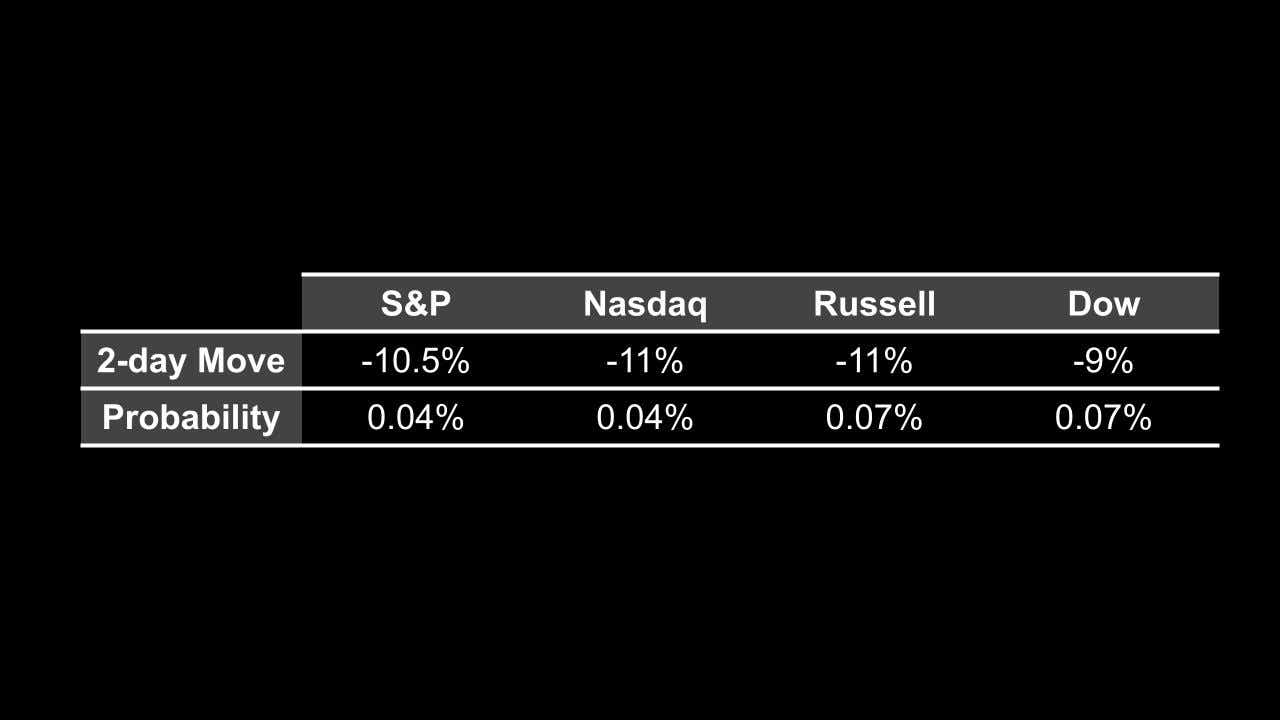

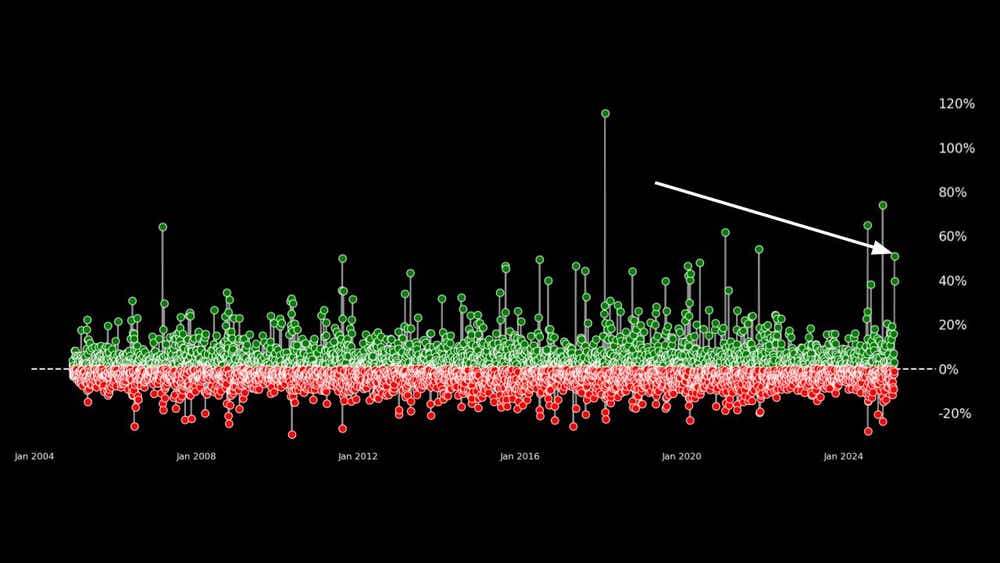

There was a more than 10% drop in the S&P 500 over just Thursday and Friday. All other indices saw similar declines. Such dramatic two-day moves have occurred less than 0.1% of the time for all indices historically. The velocity of this decline caught even seasoned traders off guard, leading to forced liquidations and margin calls across numerous trading desks.

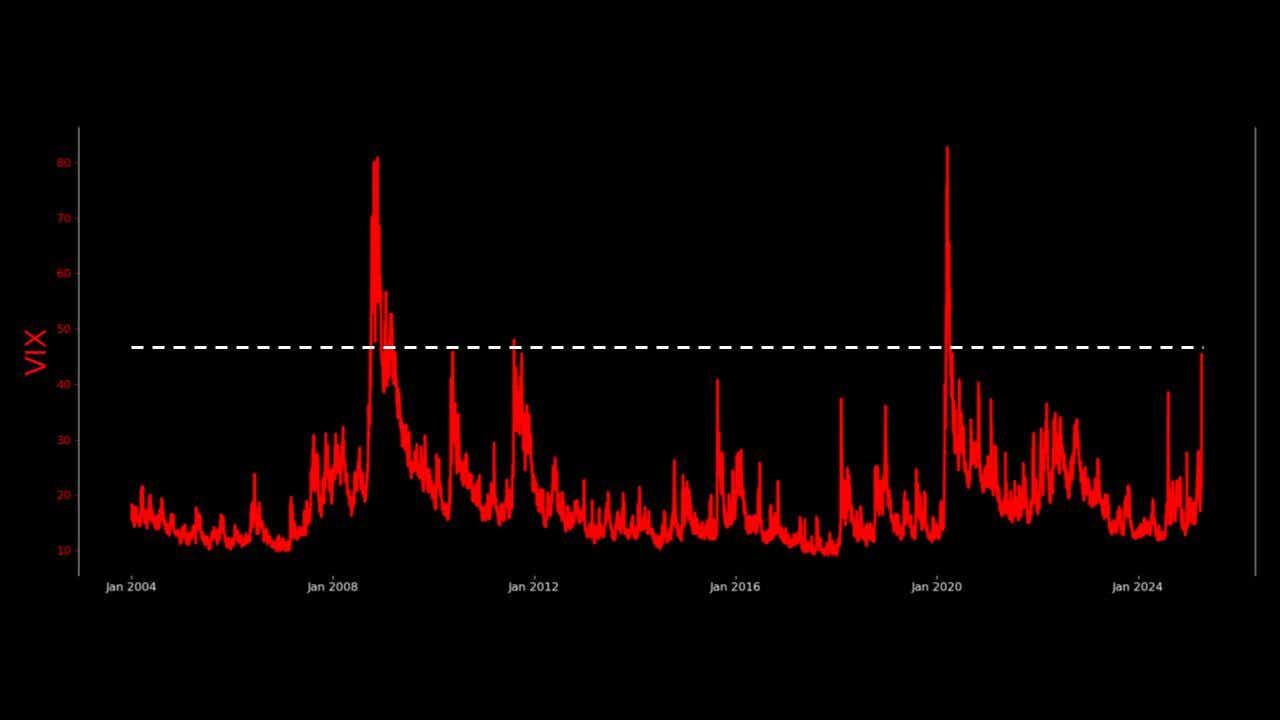

The VIX climbed above 45 on Friday, a level also not seen since COVID. In the past two decades, the VIX has finished above 45 on fewer than 2% of trading days. This extreme reading reflects the market's heightened uncertainty following the "Liberation Day" events and subsequent policy responses.

Besides this, the VIX had an even more substantial single move, jumping to 45 from 30 in just one day, the sixth largest single-day jump. The magnitude of this volatility spike suggests most investors were caught significantly off-guard by recent developments.

The following table shows the top six largest VIX upside moves since 2004 and their causes:

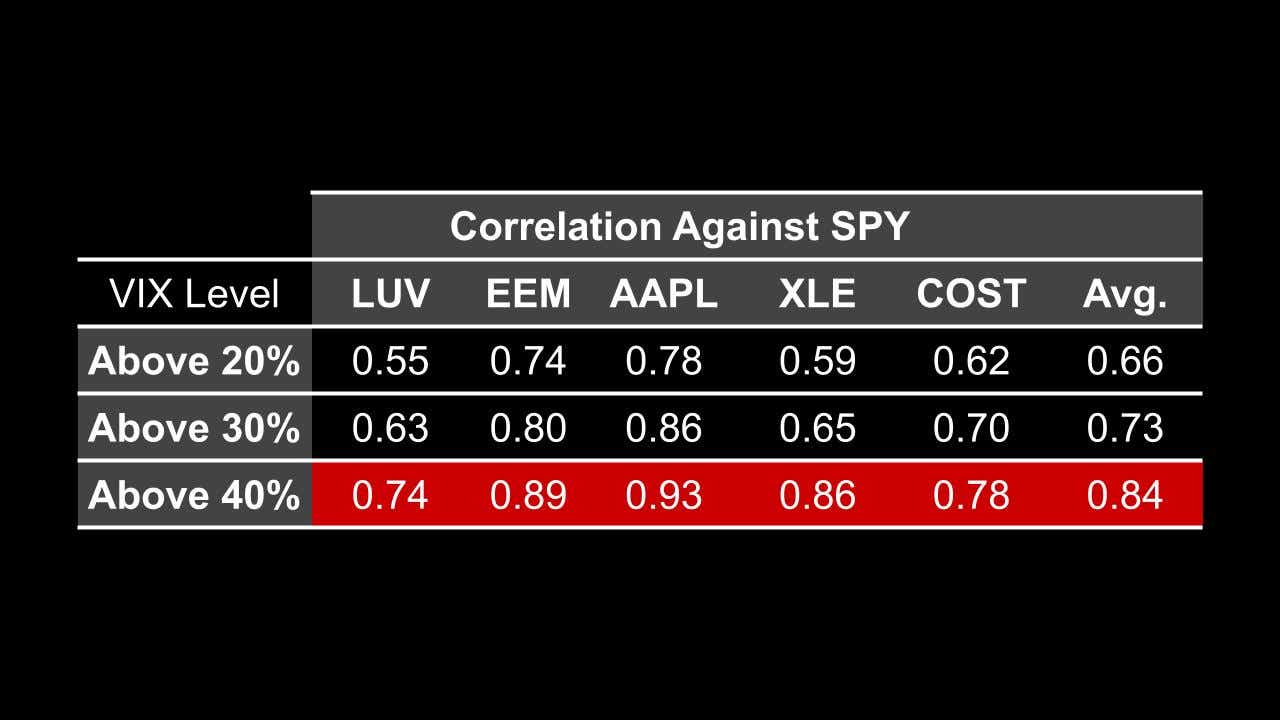

Asset diversification is critical during market corrections, though it becomes more challenging. When volatility spikes, correlations between assets typically increase, meaning most investments tend to fall in unison with the broader market. Traditional safe havens like gold and Treasury bonds have provided some, but not complete, protection during this correction

For options traders, selling richer premium offers more opportunity when volatility spikes. However, realized volatility increases too. The VIX futures curve has moved into steep backwardation, reflecting expectations that current extreme volatility will normalize over time.

Risk management must be the top priority—using defined-risk strategies and higher probability of profit approaches works better for premium sellers trying to capture higher credits. Position sizing becomes especially crucial, as larger-than-normal price swings can quickly exhaust margin requirements and lead to unfavorable early exits.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.