The Clear-Eyed Case for Meta and Alphabet

The Clear-Eyed Case for Meta and Alphabet

These tech giants aren't just participating in the AI revolution—they're writing its constitution

U.S. equity markets have been hit hard over the past few weeks, culminating in the crash and subsequent rally since Liberation Day. But for investors with a longer-term time horizon, the pullback may represent a meaningful opportunity to get long delta exposure in some of the tech sector’s heaviest hitters.

Companies with robust balance sheets and strategic positioning in emerging technology remain appealing, making Meta Platforms (META) and Alphabet (GOOG) prime targets. By examining their free cash flow (FCF) growth, valuation multiples and advances in artificial intelligence (AI), we can assess their potential as long-term investments.

Robust free cash flow

Both Meta and Alphabet have demonstrated significant FCF growth, indicative of their operational efficiency and capacity for reinvestment.

• Meta: In 4Q’24, Meta reported a 21% year-over-year increase in revenue, reaching $48.39 billion. This growth was driven primarily by AI-enhanced advertising across its platforms—Facebook, Instagram, and WhatsApp. Despite substantial investments in AI and its Reality Labs division, Meta's net income rose by 49% year-over-year (y/y), with profit margins expanding to 48%. The company projects FCF $56.9 billion for 2024, underscoring its strong cash generation capabilities.

• Alphabet: The company’s diversified revenue streams, including its dominant search engine and Google Cloud services, contribute to its robust FCF. In 4Q’24, Google Cloud delivered growth of 30% y/y to $11.96 billion in revenue, with operating income exceeding $2.1 billion. This growth, exceeding 142% y/y in 4Q’24, is fueled by AI-driven products like Vertex AI that enhance Alphabet's financial performance.

Reasonable price-to-earnings ratios

Valuation assessment is crucial for determining the attractiveness of an investment. Both companies exhibit forward price-to-earnings (P/E) ratios suggesting reasonable valuations relative to their prospects for growth.

• Meta: The company has a forward P/E ratio of 20.4. This valuation is considered reasonable given the company's strong prospects for growth and ongoing investment in AI and metaverse technology. It has averaged a forward P/E ratio of 23.5 over the past five years.

• Alphabet: With a relatively low forward P/E ratio of 16.26, combined with robust financial health and AI initiatives, the companyt may present an attractive investment opportunity. It has averaged a forward P/E ratio of 21.5 over the past five years.

• The S&P 500 has a forward P/E of 19.4, below the five-year average of 19.9.

Strategic advances in AI

Both Meta and Alphabet are making substantial strides in AI by enhancing their product offerings and improving their operational efficiency.

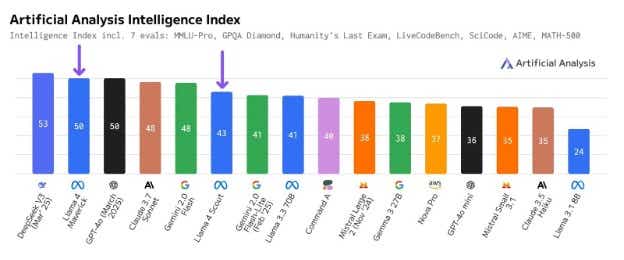

• Meta: Investing in AI has helped Meta develop advanced models like Meta AI and LLaMA that improve the user experiences. They’ve increased the time spent on Facebook by 8% and Instagram by 6%, demonstrating effective user engagement strategies. Independent benchmark testing via Artificial Analysis suggests Meta’s new Llama 4 Maverick is among the best in the world.

• Alphabet: The company’s AI initiatives, including the development of its Gemini language model, enhance Google Search and other services. The company attributed a 10% increase in advertising revenue in 4Q’24 to AI-driven features that boost engagement and make ads more effective. Similar with Meta, Alphabet’s new AI model is among the best in the world.

Both Meta and Alphabet have reasonable valuations, exhibit strong financial performance and are significantly improving their use of AI. All of this aligns with a prudent investment strategy focused on creating long-term value .

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.