S&P 500 Slumps as Reality of New Tariff Regime Hits Sentiment

S&P 500 Slumps as Reality of New Tariff Regime Hits Sentiment

Also, 10-year T-note, gold, crude oil and Japanese yen futures

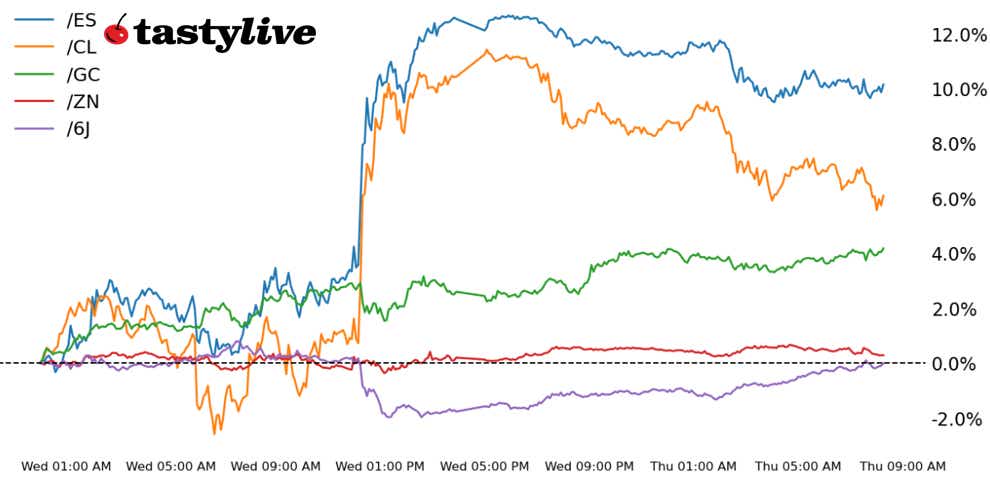

- S&P 500 E-mini futures (/ES): -2.21%

- 10-year T-note futures (/ZN): +0.55%

- Gold futures (/GC): +2.3%

- Crude oil futures (/CL): -4.22%

- Euro futures (/6E): +1.66%

Yesterday’s rally in U.S. equities is one for the ages—the third-best ever for the S&P 500. But there’s a funny thing about those “best days ever” lists: the dates are littered around crises. While President Donald Trump’s 90-day pause announcement spurred a dramatic turnaround, the reality is the U.S. economy is not out of the woods just yet. Why? By reducing rest of world’s tariffs to 10%, keeping non-USMCA goods from Canada and Mexico at 25% and lifting China to 125%, the Trump administration has left in place the highest effective tariff rate in over 100 years: down from 27% to 24%, according to calculations from Bloomberg Intelligence and The Budget Lab at Yale.

Elsewhere, the March U.S. inflation report came and went this morning without leaving much of an imprint on price action beyond the initial wiggle. That said, inflation rates came in at their lowest level in five years, but a look at the subcomponents should pique everyone’s interest: Declines in airfares, car rentals and hotel prices suggests consumption (travel, for both business and leisure) is receding. Does the report give the Federal Reserve room to cut rates in May? Unlikely.

Symbol: Equities | Daily Change |

/ESM5 | -2.21% |

/NQM5 | -2.55% |

/RTYM5 | -2.7% |

/YMM5 | -1.73% |

Wednesday’s elation in the stock market reversed overnight, with S&P 500 futures trading over 2% lower early this morning. Despite the pause on tariffs, investors still expect some damage to the economy, which is being reflected in equity prices and the oil market this morning. A 125% tariff rate remains on China, which is one of the largest trading partners for many countries around the globe. Economic indicators show the economy is already slowing. Inflation data came in at a 2.4% year-over-year rate this morning, which was slightly below estimates. U.S. Steel (X) fell over 7% after President Trump said he didn’t want the steel maker to go to Japan. Carmax (KMX) fell over 17% after announcing a disappointing quarter.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4400 p Short 4500 p Short 6300 c Long 6400 c | 66% | +352.50 | -4647.50 |

Short Strangle | Short 4500 p Short 6300 c | 68% | +2362.50 | x |

Short Put Vertical | Long 4400 p Short 4500 p | 82% | +350 | -4650 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.18% |

/ZFM5 | +0.42% |

/ZNM5 | +0.55% |

/ZBM5 | +0.25% |

/UBM5 | +0.03% |

Bonds maintained their overnight gains, with 10-year T-note futures (/ZNM5) rising 0.84% in early trading. An unusually strong auction for the notes helped to bolster sentiment for buyers, and this morning’s inflation data gave the Federal Reserve more room to maneuver on policy. The Treasury will auction 30-year bonds today, which will provide insight into bond demand following the tariff pause announcement.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 107.5 p Short 114.5 c Long 116 c | 64% | +234.38 | -1265.63 |

Short Strangle | Short 107.5 p Short 114.5 c | 68% | +484.38 | x |

Short Put Vertical | Long 106 p Short 107.5 p | 87% | +93.75 | -1406.25 |

Symbol: Metals | Daily Change |

/GCM5 | +2.3% |

/SIK5 | +1.61% |

/HGK5 | +3.77% |

A falling dollar and lower Treasury yields helped to support precious metals prices this morning. Gold futures (/GCM5) rose nearly 3%, with strength extending into the New York open. Concern over the economy is helping the safe-haven commodity as equity prices fall and investors look for protection. The gold/silver spread traded at its highest level since May 2020 overnight as gold prices outpaced silver, but the ratio is pulling back as silver gains some momentum.

Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2875 p Short 2900 p Short 3425 c Long 3450 c | 67% | +540 | -1960 |

Short Strangle | Short 2900 p Short 3425 c | 73% | +3710 | x |

Short Put Vertical | Long 2875 p Short 2900 p | 85% | +240 | -2260 |

Symbol: Energy | Daily Change |

/CLK5 | -4.22% |

/HOK5 | -3.37% |

/NGK5 | -4.43% |

/RBK5 | -3.93% |

The bounce in crude oil prices (/CLK5) following yesterday’s tariff pause announcement wasn’t enough to keep oil bulls on the offensive into today. Prices retreated over 4% to trade below the $60 per barrel level, as fear of an economic slowdown keeps the demand outlook subdued. The tariffs remain in place for China, a major oil consumer, which is keeping sentiment down. Meanwhile, the Caspian Pipeline Consortium started processing oil again at two Black Sea moorings following a court action that stopped restrictions from a Russian entity.

Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 44 p Short 46 p Short 72 c Long 74 c | 66% | +310 | -1690 |

Short Strangle | Short 46 p Short 72 c | 69% | +1390 | x |

Short Put Vertical | Long 44 p Short 46 p | 82% | +210 | -1790 |

Symbol: FX | Daily Change |

/6AM5 | +0.78% |

/6BM5 | +0.7% |

/6CM5 | +0.37% |

/6EM5 | +1.35% |

/6JM5 | +1.6% |

Japanese yen futures (/6JM5) reversed losses following yesterday’s tariff pause announcement. Traders are moving back into safe-haven currencies as uncertainty around trade remains despite the pause by the United States. Trade barriers remain in place, which could hurt the U.S. economy. The drop in Treasury yields posed another headwind for the dollar. Economic uncertainty will likely support the yen, but focus will also shift back to the monetary policy lens for the U.S. and Japan in the coming weeks and months.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00645 p Short 0.0066 p Short 0.0073 c Long 0.00745 c | 65% | +375 | -1500 |

Short Strangle | Short 0.0066 p Short 0.0073 c | 70% | +875 | x |

Short Put Vertical | Long 0.00645 p Short 0.0066 p | 85% | +150 | -1725 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.