Coinbase’s Valuation is High, But the Future of Crypto Looks Bright

Coinbase’s Valuation is High, But the Future of Crypto Looks Bright

The exchange should benefit from cryptocurrency’s momentum

- The possibility of a U.S. Crypto Strategic Reserve has brought renewed attention to cryptocurrency.

- Coinbase is likely to benefit from crypto’s increased legitimacy, as it did in Q4 when trading volume surged after the November elections.

- Though Coinbase’s valuation appears elevated, crypto’s momentum should drive gains for the company.

Coinbase has been in the spotlight recently, not just for its business performance but also for its role on the regulatory scene. On Monday, President Donald Trump elaborated on plans for the U.S. to create a "Crypto Strategic Reserve," akin to the nation’s existing reserves of gold and oil. The news caused a brief surge in crypto prices, benefiting platforms like Coinbase, which are heavily tied to the health of the broader crypto market. On the day of the announcement, Coinbase shares spiked as high as $235 per share but quickly retreated to around $205 by the end of the session, wiping out most of the day’s gains.

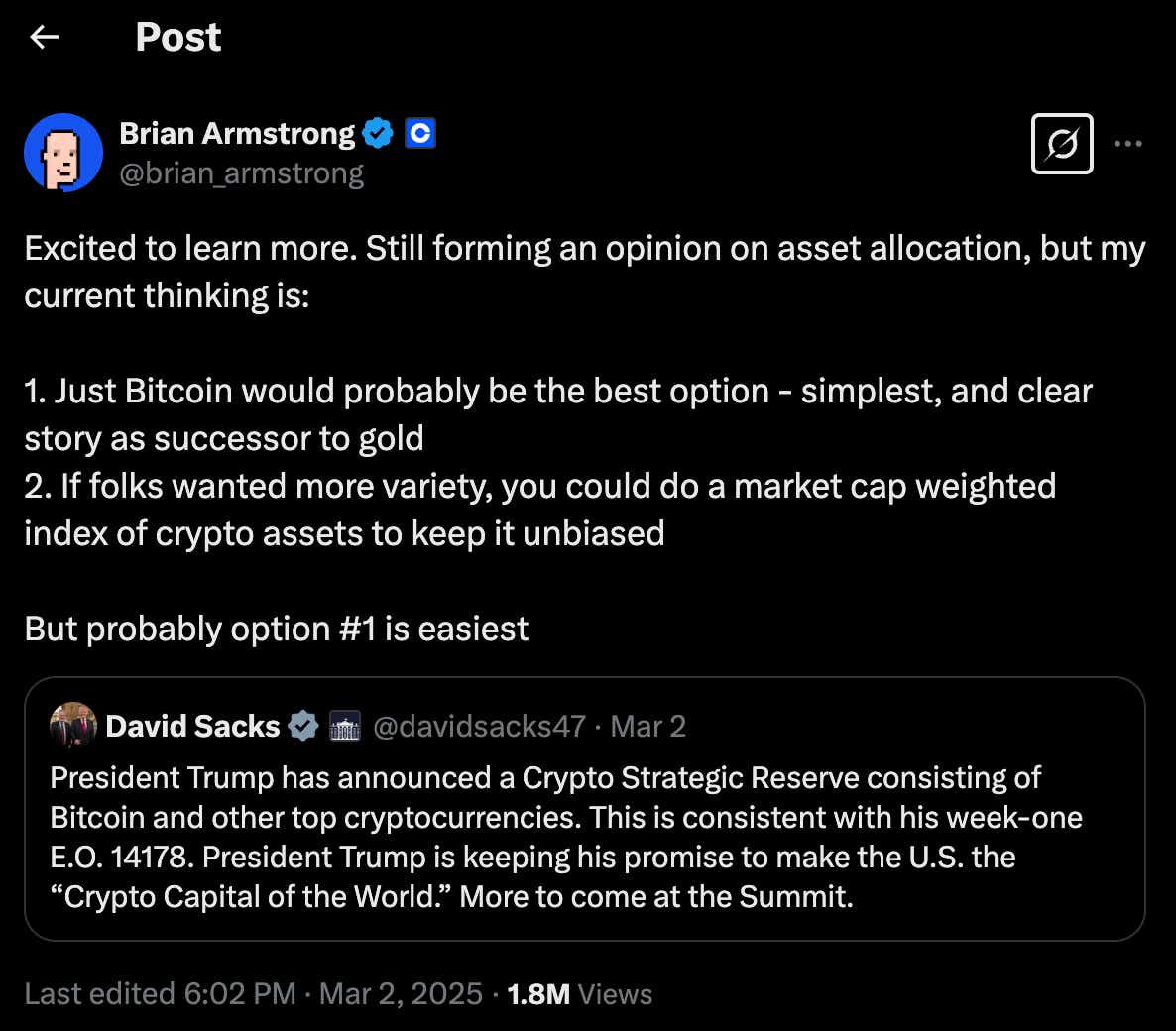

While the plan has brought attention to cryptocurrency and helped legitimize the industry, particularly with the potential backing of stablecoins and other digital assets, it has also sparked spirited debate. Critics argue the plan could be rife with ethical and legal issues, especially if it includes riskier cryptocurrencies, the “altcoins” backed by private entities. Brian Armstrong, CEO of Coinbase, voiced his concern on social media, advocating a more conservative approach focused on Bitcoin, which he views as the most stable asset for a national reserve.

Trump’s crypto reserve proposal has stirred conversation around the role of digital assets in the global economy. For Coinbase, however, the news brings both opportunities and challenges. On one hand, the establishment of a Crypto Strategic Reserve would further legitimize digital assets, potentially driving up demand for platforms like Coinbase. On the other hand, it could intensify competition in the sector as other exchanges and platforms scramble for their share of the growing market. Adding to this complexity is the potential for increased volatility, which could create both risks and rewards for Coinbase because of its reliance on daily trading volume.

With these dynamics in mind, the question remains: Does Coinbase represent a compelling investment opportunity? To explore that, let’s dive into the company’s operations, its recent earnings performance and its valuation.

A new era for Coinbase and crypto

Coinbase operates at the intersection of tech and finance. As one of the largest and most established cryptocurrency exchanges, it’s foundational in the realm of digital assets, providing users with the ability to buy, sell and store cryptocurrencies like Bitcoin, Ethereum and an ever-growing list of altcoins. Besides its core trading platform, Coinbase offers services in staking, custody and even stablecoins. The services place the company not only in finance but also in technology, where it leverages advanced systems to power its operations.

While Coinbase still derives the bulk of its revenue from transaction fees, its efforts to diversify have begun to bear fruit. With services like Coinbase One and staking, the company is working to reduce its reliance on the often-volatile trading fee model. These initiatives have proven successful, as reflected in the most recent earnings report, where Coinbase it saw notable growth in its subscription and service revenue. This signals the company has started to pivot toward a more stable and recurring revenue base.

Robust earnings, but revenue relies on transaction volume

In mid-February, Coinbase reported impressive earnings for Q4 2024, posting revenue of $2.27 billion—a 130% increase from the same quarter the previous year. The company’s net income surged to $1.3 billion, up considerably from the $273 million it earned a year ago in Q4. This growth in revenue was driven by a crypto rally spurred by the surge in activity following the 2024 elections. Because of that frenzy, trading volume increased substantially in Q4, with Coinbase reporting a 185% year-over-year jump to $439 billion. And as you'd expect, transaction-based revenue also surged ($1.56 billion), beating analyst estimates by a wide margin. The company also saw strong growth in its subscription and services revenue.

Despite those robust numbers, the post-earnings rally was short-lived, and Coinbase shares trended lower during the second half of February. With rivals gaining traction and fear of market share erosion, Coinbase’s stock couldn’t hold onto its gains, illustrating weak confidence among investors amid intensifying competition. For example, platforms like Robinhood (HOOD) are carving out a bigger share of the market, drawing users in with lower fees and a sleeker experience. Robinhood’s crypto-related transaction revenue exploded by 700% last quarter, suggesting the company poses a serious threat to Coinbase’s dominance.

Another factor putting pressure on Coinbase’s stock price is the uncertainty surrounding its near-term outlook. Despite the company’s optimism about shifting toward more diversified revenue streams, its forward guidance hints at a potential slowdown in growth. This has led to doubt that the company’s path will be as straightforward as its past success might suggest. As the crypto world evolves and competition ramps up, Coinbase might find its next chapter is more complex than expected. This perspective was underscored by the stock’s post-earnings performance—from mid-February through early March, shares of Coinbase dropped by roughly 30%. As a result of that pullback, Coinbase's market capitalization dropped from nearly $80 billion all the way down to $56 billion.

Momentum could win the day

Valuing Coinbase is no easy task—especially in a rapidly shifting market like digital assets, where both opportunity and volatility run high. Traditional metrics paint a picture of an expensive stock. Coinbase’s P/E ratio of 22 is well above the sector’s median of 13, signaling that investors are betting on bigger, faster growth. Likewise, its enterprise value-to-sales (EV/S) and price-to-sales (P/S) ratios, both hovering around 8, are well above the sector average of 3.

While Coinbase's lofty valuation might seem excessive at first glance, there are solid reasons behind it. The company has firmly entrenched itself as a leader in crypto, bolstered by its market dominance and trusted reputation for security. Yes, competition is heating up—Robinhood is certainly making moves—but Coinbase continues to deliver solid growth, especially in Q4, thanks to its premium offerings. The company’s shift toward diversifying its revenue, particularly with products like staking services and USDC stablecoins, is starting to pay off, providing a more stable footing in a rapidly shifting market.

Analyst opinion provides an important lens for viewing Coinbase’s valuation. Of the 27 analysts covering the stock, only 10 rate it a “buy” or “overweight,” while 17 assign a “hold” or “sell/underweight,” reflecting a generally cautious outlook. However, the average price target of $335 per share—well above its current price of $220 per share—raises an intriguing question. This disconnect between analyst sentiment and price target suggests that, despite the cautious stance, the market may be underestimating Coinbase’s potential, leaving room for considerable upside.

This paradox can likely be attributed to crypto’s momentum since the 2024 elections. With President Trump’s support for the industry and his recent announcement of his plan to create a Crypto Strategic Reserve, digital assets have gained legitimacy. These developments should benefit Coinbase by broadening the adoption of digital assets and expanding the market reach of the sector—providing further justification for the elevated price target. Simply put, it may be momentum in the broader crypto sector, instead of Coinbase's fundamentals, that drives the stock price higher.

Investment takeaways

Announcing the plan for a U.S. Crypto Strategic Reserve generated a lot of buzz but played out as a typical "sell the news" scenario. The initial excitement sparked a brief surge, quickly followed by a pullback, underscoring the inherent volatility of digital assets. While this short-term dip has created some uncertainty, the long-term momentum in cryptocurrency remains undeniable. Digital assets may have lost some ground, but they've also settled at more attractive levels, potentially setting the stage for another round of buying.

And when the next wave of growth arrives, Coinbase is likely to be one of the prime beneficiaries. However, with its elevated valuation, the stock may not be for everyone. If you're a firm believer in the future of digital assets, Coinbase could still be a solid investment despite its premium price tag. On the other hand, if the crypto sell-off continues, a more favorable entry point could emerge, broadening the stock's appeal to a wider range of investors.

At the end of the day, the sector’s exceptional resilience makes it a tough one to bet against, and this extends to Coinbase—one of the most recognized names in the industry.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.