Boeing’s New Flight Plan: Minor Gains Today, Major Recovery Tomorrow

Boeing’s New Flight Plan: Minor Gains Today, Major Recovery Tomorrow

The company’s woes have enabled Airbus to leapfrog into the industry’s top spot, but the contest isn’t over

Boeing and Airbus are locked in a competitive duopoly, with Airbus in the lead because Boeing's recent struggles. But Boeing’s potential recovery could shift the balance.

Boeing is working to enhance the safety, quality and reliability of its aircraft, leading to a recent rebound in orders and deliveries.

Valuation scenarios suggest Boeing’s stock could rally if the company meets its ambitious financial targets.

Boeing (BA) has been weathering a relentless storm, a stark reminder of the adage that “when it rains, it pours." The aerospace giant has encountered one daunting challenge after another, eroding the company’s once-unshakeable standing in the industry.

At the heart of Boeing’s troubles is the 737, one of its flagship models, which has seen production slow to a crawl in the wake of two tragic crashes less than five months apart in 2018 and 2019. Those tragedies sent shockwaves through the aviation world and grounded the planes.

And the lingering anxieties around the 737 were only heightened earlier this year when an Alaska Airlines 737 Max 9 suffered a door plug failure mid-flight, prompting the Federal Aviation Administration (FAA), to ground some of the planes again for inspection.

Meanwhile, Boeing’s ambitions in space exploration have also stumbled, with its Starliner spacecraft deemed unfit to return two astronauts from the International Space Station, casting doubt on the company’s ventures beyond Earth’s atmosphere.

Unfortunately, the setbacks don’t end there. A recent review by the FFA uncovered numerous compliance issues in Boeing’s supply chain, further straining the company’s credibility.

In response, Boeing has turned to a new CEO, Robert Ortberg, who now bears the heavy responsibility of restoring faith in the safety and quality of Boeing’s products. His leadership will be critical in rebuilding the company’s reputation—and, ultimately, its stock price.

However, no storm lasts forever. Boeing remains a cornerstone of the global aerospace industry, and while Airbus (EADSY), its primary competitor, has gained from Boeing’s misfortunes, it has faced its own set of challenges.

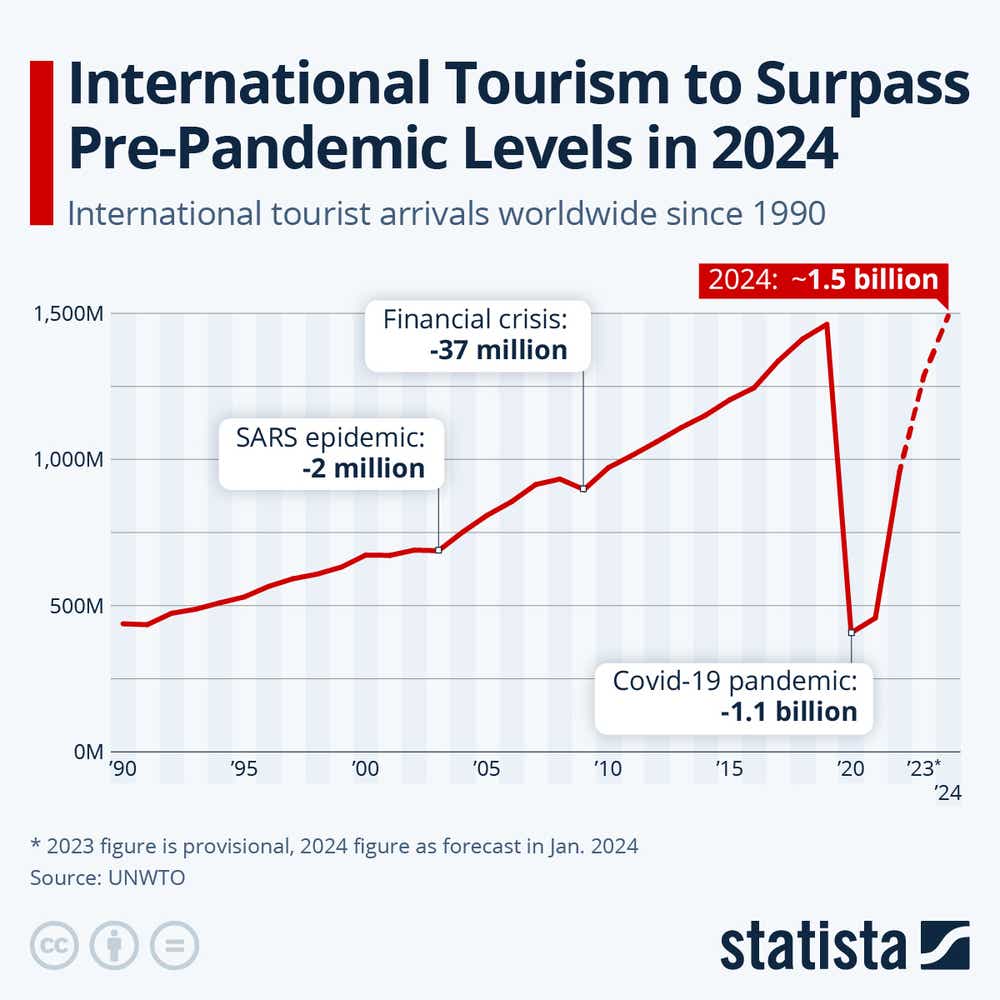

With global air travel finally climbing back above pre-pandemic levels, the broader industry landscape appears favorable for Boeing’s recovery. As such, the sharp pullback in Boeing’s stock may represent a unique opportunity for investors, particularly those with a long-term perspective.

Boeing: a glass half-full?

The challenges Boeing has faced have been covered extensively, with headlines dominated by the 737 MAX, production delays, and corporate mismanagement. While it’s easy to focus on the negatives, these setbacks don’t tell the whole story. In fact, several trends suggest Boeing might be poised for a rebound.

One of the most positives is Boeing’s dominant position in China—one of the world’s largest and fastest-growing aviation markets. China’s commercial fleet is expected to more than double in size by 2043, climbing from 4,300 to 9,700 planes. And despite recent friction with the U.S. government, China continues to rely heavily on Boeing-branded aircraft, particularly in the single-aisle category where the 737 has long been a dominant player.

The resumption of 737 MAX deliveries to China in 2022 marked a critical step forward, signaling renewed confidence in the company. This was a major win for Boeing because Chinese airlines are expected to drive a large portion of global aircraft demand in the coming years.

Beyond China, there’s also been a broader recovery in global air travel (illustrated below). Over the last couple of years, global airlines have scaled up operations to meet rising passenger demand, leading to an increase in aircraft orders and deliveries. The 737 MAX, now recertified and back in service, is seeing a rebound in orders, with airlines eager to capitalize on its fuel efficiency and range.

Additionally, Boeing’s strong defense and space divisions, while not without their own challenges, continue to provide a steady stream of revenue, helping to offset some of the turbulence in the commercial sector.

In short, while Boeing’s recent past has been rocky, the company’s future may hold promise. The recovery in global air travel, combined with strong demand from key markets like China, and a rebound in 737 MAX orders, all point to a potential turnaround. For investors willing to look beyond the immediate challenges, Boeing’s long-term health may be better than the headlines suggest.

Airbus vs. Boeing

Airbus has unquestionably reaped the benefits of Boeing’s misfortunes, a reality reflected in the aircraft delivery figures from both companies. The numbers tell the story of a shift in the global aerospace market.

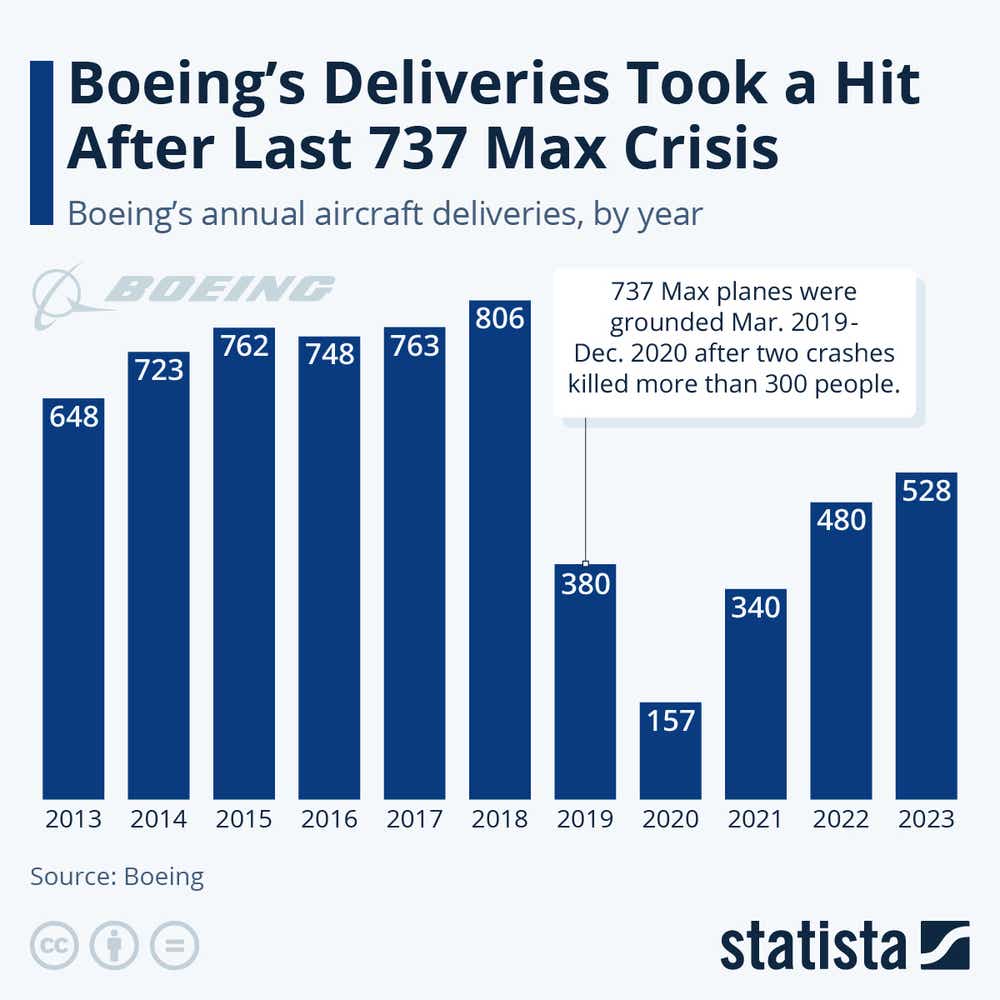

In 2018, before the onset of the COVID-19 pandemic and before the first grounding of the 737 Max, Boeing was riding high, delivering a remarkable 806 jets. But just a year later, as safety concerns grounded the 737 Max, Airbus seized the moment and set its own record, delivering 863 aircraft—a high-water mark that underscored its growing dominance.

The year 2019 marked a turning point. For the first time since 2012, Airbus delivered more aircraft than Boeing, breaking Boeing's seven-year streak as the industry leader in annual deliveries. From 2012 to 2018, Boeing had consistently outpaced Airbus, a testament to its once-unchallenged position at the top. But the combination of the 737 Max crisis and the subsequent pandemic created an opening Airbus was quick to exploit.

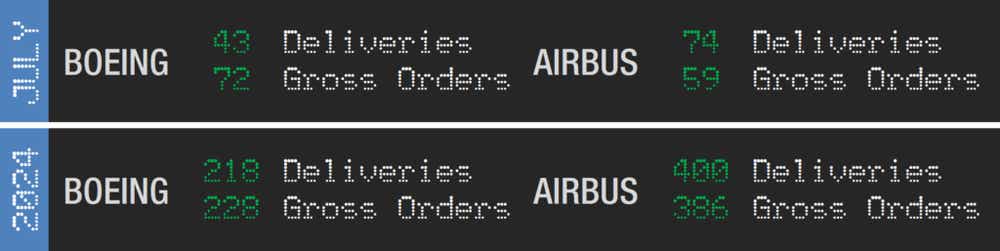

Fast forward to the present, and Airbus’s lead over its American counterpart has solidified. In 2023, while Airbus’s 735 deliveries fell short of its pre-pandemic peak, but it still outstripped Boeing’s 528 deliveries. The streak has continued into 2024, with Airbus maintaining its advantage. Through the first seven months of the year, Airbus has already delivered 400 aircraft, nearly doubling Boeing’s 218 deliveries, as shown below.

Part of Boeing’s delivery lag can be attributed to the FAA’s decision to cap the company’s monthly 737 deliveries at 38 units. This cap was imposed after the Alaska Airlines door plug incident to ensure Boeing prioritizes quality over quantity, a step the agency considered necessary given the safety concerns that have plagued the 737 Max.

The eventual lifting of this cap will be a pivotal moment for Boeing—a clear signal the company has successfully addressed the critical issues that have hampered its production. This development would not only mark a milestone in Boeing’s turnaround but also position the company to close the gap with Airbus, potentially reigniting the fierce competition that once defined their rivalry.

Besides, Boeing’s chief rival has faced challenges, too.

Airbus setbacks

As evidenced by the recent delivery data, Airbus has undeniably capitalized on Boeing's struggles, particularly as airlines sought alternatives to the 737 MAX during its groundings. The A320 family, Airbus's flagship in the single-aisle market, gained traction during this period, enabling Airbus to capture a larger share of the market.

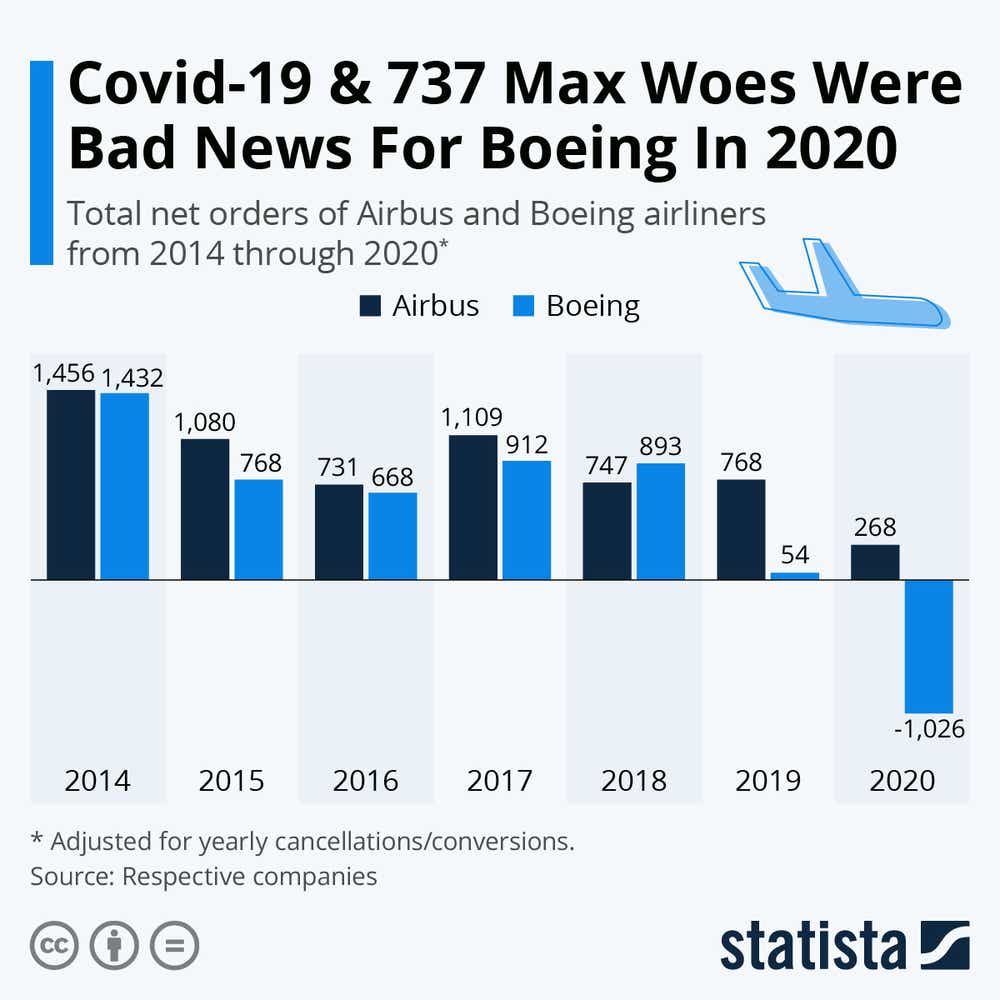

Boeing’s problems began to escalate in late 2018 and early 2019, following two fatal crashes involving 737 MAX 8 airplanes—Lion Air Flight 610 in October 2018 and Ethiopian Airlines Flight 302 in March 2019. These tragedies led to the global grounding of the 737 MAX in March 2019, causing a sharp decline in Boeing’s orders that year.

The situation deteriorated further with the onset of the COVID-19 pandemic. People weren’t traveling much, which caused airline to reduce orders for planes and thus push new orders into negative territory, as illustrated below.

While Airbus undoubtedly has benefited from Boeing’s struggles, the company is facing its own set of challenges, which have negatively affected operational performance and investor confidence.

In a recent financial update, Airbus revised its 2024 outlook, lowering its expected production target from 800 to 775 aircraft. The company also postponed its goal of producing 75 A320s per month, pushing the timeline out to 2027. These revisions reflect operational challenges and demonstrate Airbus is not immune to industry-wide disruptions.

One of the critical issues Airbus faces is the delay in engine deliveries—a problem that has resurfaced despite assurances from management that it wouldn’t happen. Engine suppliers like CFM International and Pratt & Whitney, which are vital to Airbus’s production plans, have struggled to meet delivery schedules, forcing Airbus to adjust its output forecasts.

Additionally, some Pratt & Whitney engines have required re-inspection because of safety concerns, further compounding the delays. These disruptions not only affect Airbus’s production timeline but also risk tarnishing its reputation for reliability.

Compounding these challenges, some global airlines have reportedly begun deferring deliveries of new airplanes—a development that could be particularly problematic for Airbus, considering its steady expansion of production capacity in recent years. These setbacks have contributed to downward pressure on Airbus’s stock in 2024.

Following the June financial update, shares of Airbus dropped roughly 12%, reflecting investor concerns over the company’s ability to navigate its challenges. Over the last five years, Airbus’s stock has risen only 11.5%, a relatively modest return compared to the S&P 500's 93% gain over the same period. However, in comparison to Boeing, which has seen its shares plummet by more than 50% in the last five years, Airbus’s performance looks decidedly stronger.

Boeing’s turnaround scenarios

As demonstrated by the meteoric rise of Nvidia (NVDA), corporate earnings are often the driving force behind a stock’s trajectory. Boeing is no exception to this rule, and its financial performance continues to play a critical role in shaping investor sentiment.

The COVID-19 pandemic dealt a severe blow to the aviation industry, and it’s no surprise both Boeing and Airbus saw their financial positions deteriorate during 2020 and 2021. However, while Airbus has managed to stabilize, Boeing’s earnings challenges have persisted—largely because of issues related to the 737 Max, production slowdowns and broader mismanagement of the company.

In late July, Boeing reported a Q2 net loss of $1.44 billion, or $2.90 per share, on revenues of $16.9 billion, missing consensus estimates. Much of the financial strain is due to the company's continued efforts to address safety and quality issues, which have led to significant cash burn.

In Q2 alone, Boeing’s cash outflow totaled $4.3 billion, contributing to the quarterly loss. The good news is Boeing remains optimistic about its long-term prospects, indicating it expects to generate up to $10 billion in positive free cash flow by 2025 or 2026—a dramatic turnaround from its current state.

Should Boeing reach that target, a return to positive net income would likely follow, reversing the recent trend of net losses. Additionally, Boeing aims to raise its annual aircraft deliveries back to around 700 in the same timeframe.

Achieving these goals would not only restore Boeing’s financial health but also provide a much-needed boost to its underlying valuation. Currently, Boeing is valued at roughly $107 billion, with a share price hovering around $175.

Boeing’s market capitalization could soar to $200 billion if it meets its ambitious free cash flow targets, according to Lee Samaha, an analyst at The Motley Fool. Under that scenario, the stock could rise to around $320 per share, nearly doubling its current value.

Even with a more conservative forecast—assuming Boeing achieves 75% of its cash flow target, or $7.5 billion—the company’s market cap could rise to approximately $150 billion, translating to a stock price of $245/share. That’s 40% higher than where Boeing shares trade today, offering upside potential for investors with a long-term outlook.

Investment takeaways

Predicting the success of Boeing’s turnaround effort over the next 12 to 18 months is no easy task, but the estimates discussed here offer a glimpse of how the company’s stock could respond in a favorable scenario. These projections align closely with current analyst sentiment, providing a more grounded view of Boeing’s potential.

At present, 30 analysts cover Boeing, with an average price target of around $216 per share. This target reflects a cautious optimism about the company’s future, as analysts weigh the potential for a successful turnaround against the challenges Boeing continues to face.

Of these 30 analysts, 15 have issued a buy rating, signaling confidence in the company’s recovery. Additionally, three analysts rate the shares as overweight, and 10 have opted for a hold rating, indicating a more measured approach. On the bearish side, one analyst rates the shares a sell, and another classifies them as underweight.

For investors, Boeing’s stock presents both an opportunity and a challenge. The potential for upside is clear, particularly if the company can meet its ambitious free cash flow and delivery targets. However, this potential is tempered by the uncertainties surrounding the turnaround effort, as well as broader market conditions.

Whether Boeing is a compelling investment will therefore depend largely on an individual’s outlook on the company’s recovery, and their patience for positive developments to unfold. Notably, a recent Forbes article deemed Boeing a better overall investment than Airbus. And as shown below, Boeing does appear to be trending in the right direction, at least in terms of annual deliveries.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.