The Japanese Yen Will Rise as Central Banks Cut Interest Rates

The Japanese Yen Will Rise as Central Banks Cut Interest Rates

By:Ilya Spivak

With global recession looming, Japan’s currency is becoming an attractive investment vehicle

- The Japanese yen looks set to capitalize as interest rates turn lower globally.

- A hawkish turn at the Bank of Japan is a mirage as demographics hold sway.

- Yen buying will be triggered as the Fed leads to an exit from the “carry trade.”

The Japanese yen seems poised for dramatic gains in the coming months.

The past year has brought a flood of breathless headlines anticipating the now near-mythical possibility that the Bank of Japan (BOJ) will abandon its decades-old fight to lift inflation with an assortment of ultra-dovish monetary policy measures. That’s because price growth picked up globally after the COVID-19 pandemic, and Japan wasn’t spared.

Contrary to these prognostications, the central bank is unlikely to budge in a meaningful way. It has already watered down enforcement of a cap on 10-year Japanese government bond (JGB) yields in ways that suggests a gradual winding up of the effort is afoot. Lifting the BOJ’s target interest rate out of negative territory may follow, but not much more.

Japan’s economy: weak growth, imported inflation

Japan’s economy is plainly weakening. The latest round of gross domestic product (GDP) data reveals output shrank at an annualized rate of 2.1% in the third quarter, the fastest contraction since the first quarter of 2022. Leading purchasing managers’ index (PMI) data shows the downturn deepened in October and November.

Meanwhile, inflation is running hot for all the wrong reasons. The benchmark consumer price index (CPI) measure of inflation showed prices grew 3.2% year-on-year in October. That marked the 19th consecutive month that it exceeded the BOJ target of 2%. Strip out food inflation however, and the number falls to a meager 0.6%.

Japan produces less than 40% of its own food, making the price growth problem an imported one. BOJ Governor Kazuo Ueda and a chorus of other central bank officials have repeatedly stressed that the central bank needs to see the return of sustainable, domestically driven inflation to shift gears in earnest.

Bank of Japan monetary policy: going nowhere fast

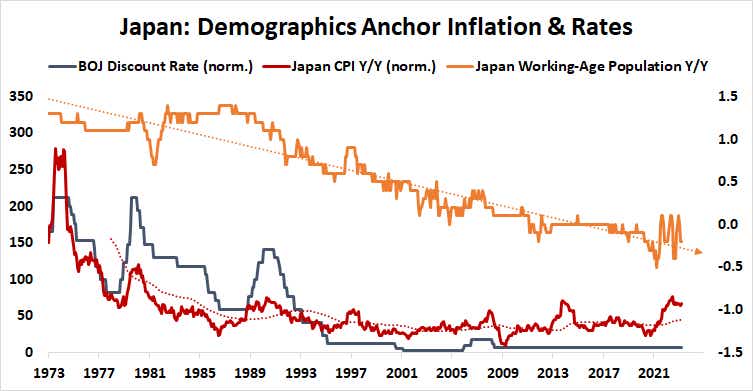

That is probably not on the menu, at least for now. Japan’s persistent disinflationary problem is decades in the making and reflects long-term demographic forces. Price growth and benchmark interest rates have been falling in tandem for nearly 50 years as Japan’s people have aged.

The growth rate of Japan’s working-age population has been trending mercilessly lower since 1988. So far in 2023, it has been shrinking at an average pace of 0.16% year-on-year. As of 2020, the median age in Japan is 48 and rising, making its population the oldest in the world.

This is a potent headwind for demand, and thereby economic growth as well as inflation. Consumption tends to peak between the ages of 35-55, the period when household formation tends to boost spending on rearing children as well as big-ticket items like cars and homes. As demand cools thereafter, the upward pull on prices wanes.

Japanese yen to rise as global interest rates decline

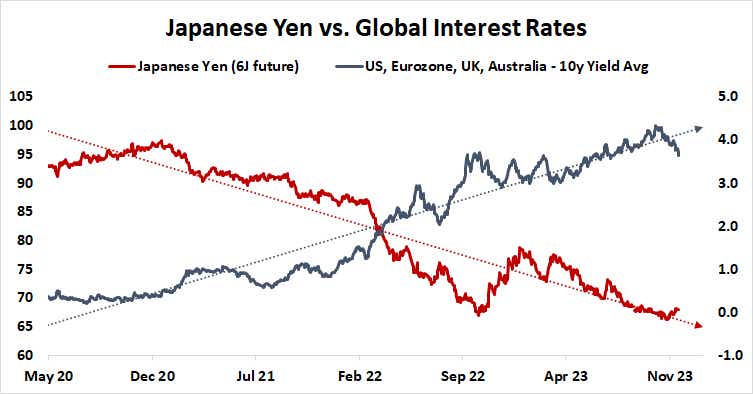

Interestingly, it is because of these demographic forces that the yen looks set to power higher. Decades of ultra-low Japanese interest rates have encouraged investors both foreign and domestic to borrow cheaply in the currency, then trade it for higher-yielding assets outside of Japan. This is called the “carry trade.”

Not surprisingly, the blistering rise in global interest rates from pandemic lows in mid-2020 has been a magnet for this strategy, and the yen has suffered deep losses as a result. Now, the Federal Reserve is seen leading major central banks in the opposite direction as growth slows and the threat of global recession looks increasingly acute.

Yields have already started falling as markets position for incoming interest rate cuts. This is likely to put the carry trade in reverse as investors jettison bets anchored to rising borrowing costs. At least some of the proceeds will then go to buying back yen to pay down the loans that financed these positions in the first place, so the currency will rise.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.