Wheat Prices Fall to 2020 Levels as Additional Downside Threatened

Wheat Prices Fall to 2020 Levels as Additional Downside Threatened

Wheat Prices Slide to Lowest Since 2020

Wheat futures fell to the lowest prices since December 2020 on Wednesday before making an intraday recovery. Still, the grain is on track to close out the month of May with a loss north of 6%, which would mark the eighth monthly loss as macroeconomic factors and weather conditions weigh on its fundamental position.

Crop Progress and Macro Factors Weighing on Prices

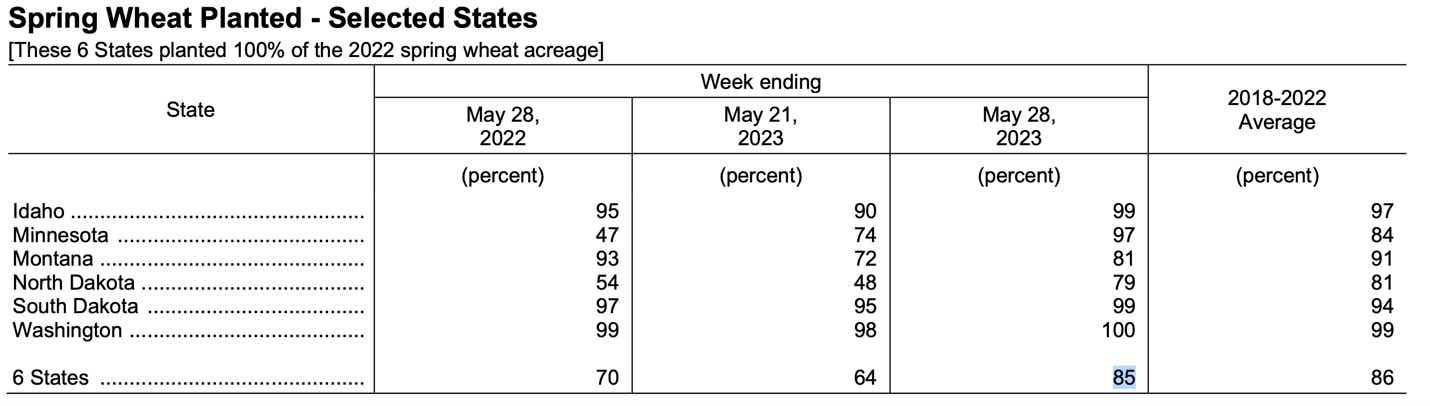

Tuesday’s Crop Progress report from the United States Department of Agriculture (USDA) revealed that spring wheat is 85% planted for the week ending May 28. This is up from 64% in the prior week, and from 70% at the same time last year.

Meanwhile, global demand is being met and a recent extension to the export deal that allows Ukraine to ship grain via the Black Sea was recently extended. The result has been a drop in Russian wheat prices at a time when Russia is exporting a healthy amount of grain.

Elsewhere, weather conditions across the U.S. continue to favor the planting season for farmers, which should help facilitate progress to completing the planting season. A recent revival in U.S. Dollar strength as well as weaker oil prices have also weighed on wheat prices.

The USDA’s upcoming World Agricultural Supply and Demand Estimates (WASDE) report will provide the next major cue for grain prices outside of any significant macro events. A pleasant weather outlook across the primary wheat-growing states also bodes well for lower prices.

Prices Biased Lower But Reversal Chance Appears

Wheat prices have been in a downtrend since the year started, which leaves the current directional bias tilted to the downside. However, a Falling Wedge pattern has taken shape in recent months, which leaves the chance for a reversal to the upside, should prices breach above resistance.

Still, within the wedge, the 26-day Exponential Moving Average EMA) has proven difficult for bulls to maintain prices above. For now, the most likely scenario over the short term is further downside.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.