Futures Cheat Sheet

Futures Cheat Sheet

Our Futures Trading Cheat Sheet includes contract sizing, how to leverage risks, and why micro futures like /MNQ matter.

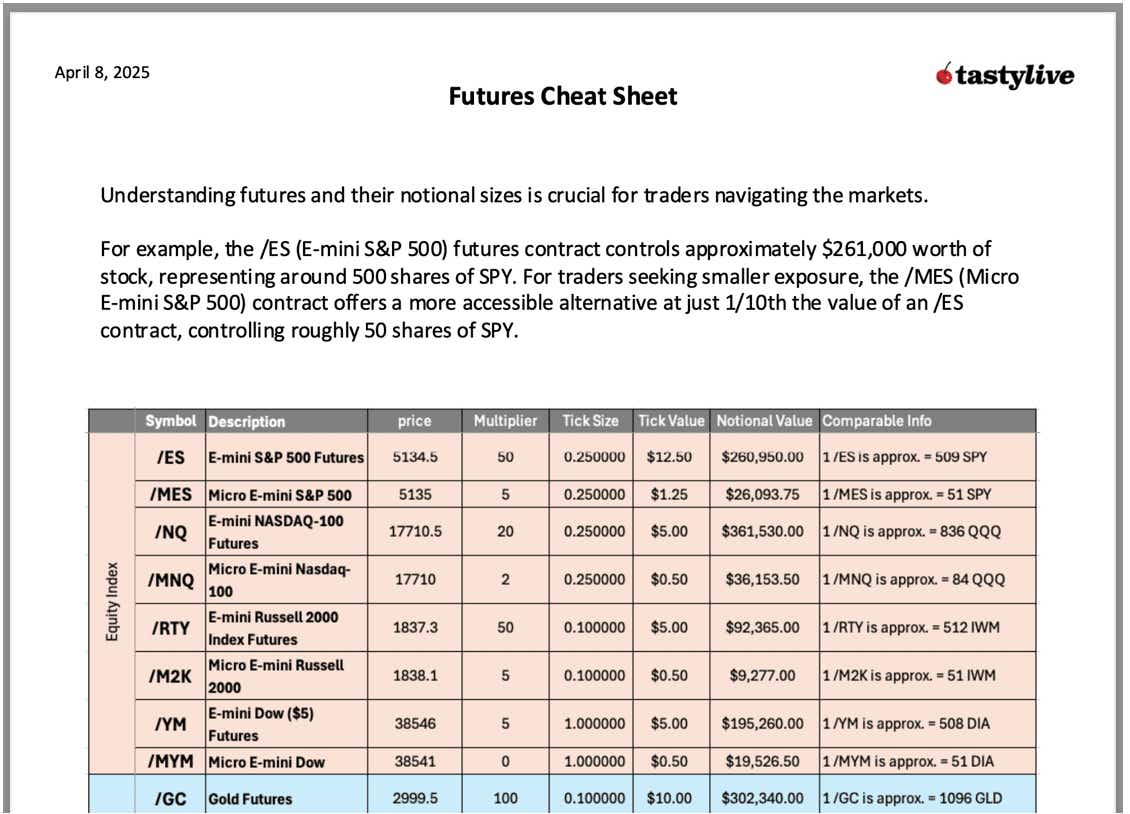

Futures contracts offer exceptional capital efficiency, but their leveraged nature requires careful risk management. Without proper understanding of contract sizes, futures can significantly affect your portfolio if positions are too large relative to your account.

Leverage provides tremendous opportunity but comes with proportional risk. It's crucial to understand the full notional value of each contract you trade. For perspective, many investors who would hesitate to trade 10 shares of gold (GLD) might trade a single /GC (gold) futures contract without realizing both represent similar exposure. Each /GC contract controls 100 ounces of gold—approximately $300,000 in value at current prices.

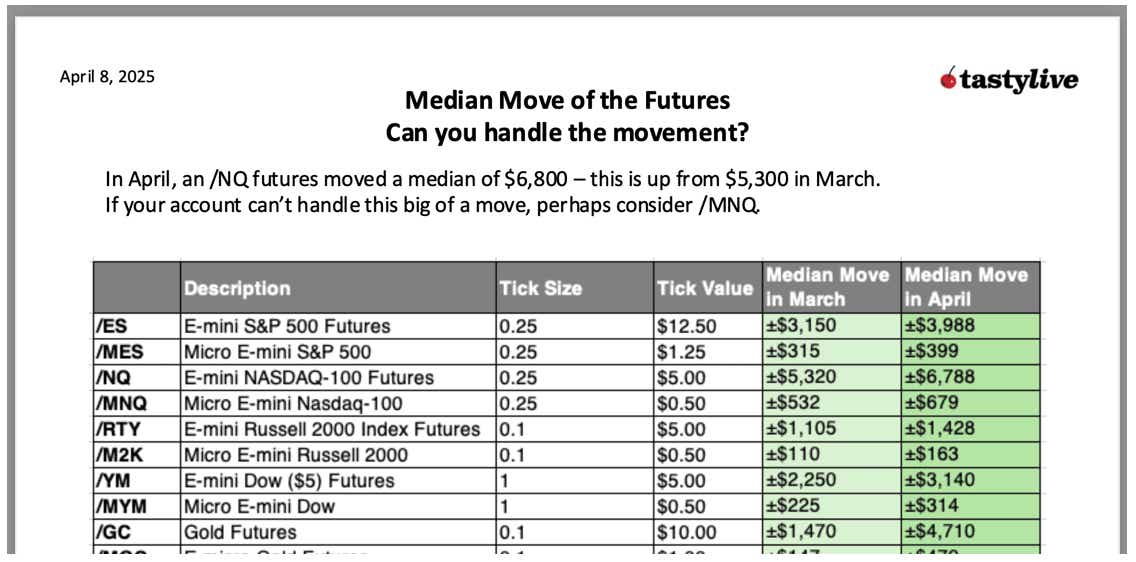

Be mindful of daily price movement. The /NQ (Nasdaq) futures contract typically fluctuates around $7,000 in a single day, creating a potential high-to-low range of $14,000. This volatility exceeds what many trading accounts can safely absorb.

For smaller accounts, consider the micro contracts like /MNQ instead.

Remember: Don't get too big in futures, even if you have enough buying power in your account.

Two Trade Ideas

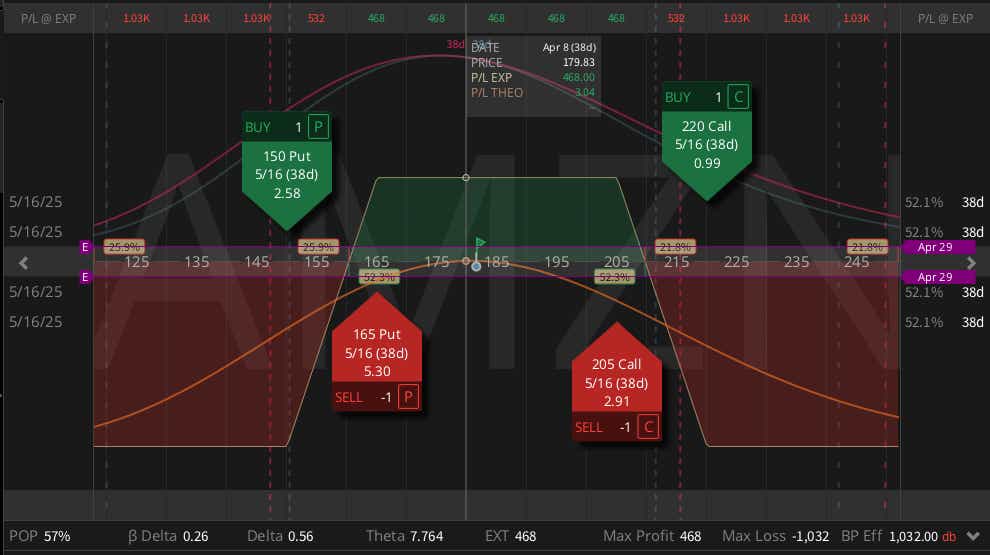

AMZN ($181.34) Iron Condor (MAY) $4.68 Credit

Implied volatility is still very elevated. It's rare to get VIX near 40 for more than a couple of days. If you think it might be near the end of the selling, wide iron condors are a way to stay relatively small but capitalize on high IV. For example, selling the 165/150 put spread and the 205/220 call spread for just under one-third the width of the spreads.

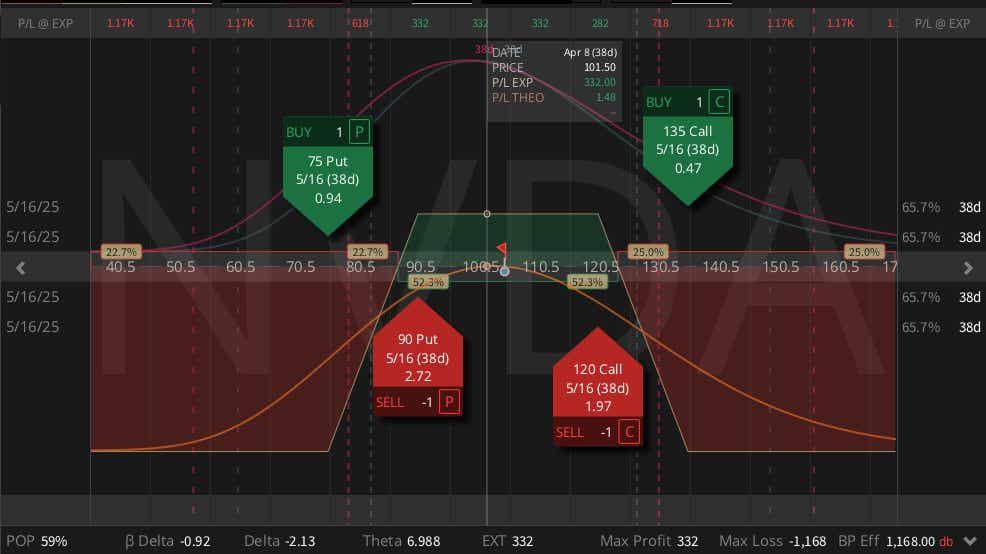

NVDA ($104.41) Iron Condor (MAY) $3.32 Credit

Pick your poison with the Magnificent Seven—all are down significantly but bouncing a bit with volatility still through the roof. If you want to play for realized volatility to be less than implied, wide iron condors are a defined risk way to do so. Selling the 90/75 put spread and the 120/135 call spread trades at around $3.32 credit.

We love new subscribers! We’re OK with grifters, but to be on our good side by subscribing to our newsletter.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.