Nasdaq 100 Rallies Amid Market Turmoil and Tariff Jitters

Nasdaq 100 Rallies Amid Market Turmoil and Tariff Jitters

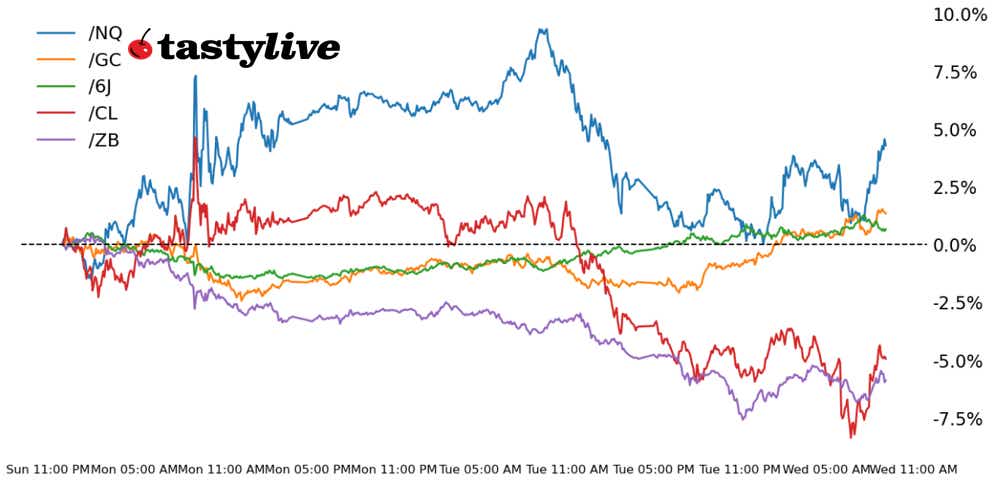

Also, 30-year T-bond, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): +0.71%

- 30-year T-bond futures (/ZB): -1.3%

- Gold futures (/GC): +3.19%

- Crude oil futures (/CL): -3.52%

- Japanese yen futures (/6J): +1.1%

What has already been a remarkable week of trading has continued into today with new fissures emerging. Extreme volatility in U.S. equity markets has historically led to a demand for the safety of U.S. Treasuries, but that hasn’t happened this time around. Fear of China selling U.S. debt to weaken the Yuan may or may not be legitimate. The same goes for concern regarding hedge funds liquidating basis trades. But U.S. swap rates are behaving in a manner seen only around the 1998 LTCM episode and the start of COVID in March 2020. The Trump administration has levied a 104% tariff on China, which has responded by imposing an 84% retaliatory duty on the United States.

Symbol: Equities | Daily Change |

/ESM5 | +0.02% |

/NQM5 | +0.98% |

/RTYM5 | -0.48% |

/YMM5 | -0.37% |

Nasdaq futures (/NQM5) jumped this morning following a volatile session yesterday when traders pushed equity prices into the red late in the trading session. Nasdaq 100 futures (/NQM5) were up 0.86% in early trading. The dark cloud of tariffs continues to loom over the market, with escalations mounting in recent days. Pharmaceutical stocks dropped after President Trump said the U.S. would shortly announce tariffs on pharmaceuticals. AbbVie (ABBV) fell 5% in early trading. Walmart (WMT) reversed early losses to trade positive after the company said it would pull its outlook for operating income because of tariffs. Other retailers, including Home Depot (HD), fell as traders worried about the impact of tariffs on prices for consumers.

Strategy: (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 14000 p Short 14250 p Short 20750 c Long 21000 c | 67% | +880 | -4120 |

Short Strangle | Short 14250 p Short 20750 c | 71% | +6730 | x |

Short Put Vertical | Long 14000 p Short 14250 p | 83% | +615 | -4385 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.03% |

/ZFM5 | -0.26% |

/ZNM5 | -0.6% |

/ZBM5 | -1.43% |

/UBM5 | -1.22% |

Treasuries fell across the curve as trade war tensions rose overnight following a Chinese retaliation. 30-year T-bond futures (/ZBM5) fell 1.3%. The underlying yield briefly traded at the highest levels since November 2023 overnight. The deeper losses were trimmed after China signaled it would be willing to negotiate on tariffs. However, the trade war puts the U.S. economy in a precarious position, and traders currently don’t see bonds as a haven. Moreover, concern that the fabled “basis trade” (long cash bonds and short bond futures) is blowing up may be contributing to the malaise. The upside pressure on yields could put equity prices in a more fragile state. Bond traders have their eyes on a 10-year Treasury note auction today.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 104 p Short 107 p Short 123 c Long 126 c | 67% | +562.50 | -2437.50 |

Short Strangle | Short 107 p Short 123 c | 71% | +1343.75 | x |

Short Put Vertical | Long 104 p Short 107 p | 83% | +328.13 | -2671.88 |

Symbol: Metals | Daily Change |

/GCM5 | +3.5% |

/SIK5 | +2% |

/HGK5 | +1.88% |

Gold futures (/GCM5) surged over 3% higher in early trading despite higher Treasury yields. Prices fell sharply over the past few trading sessions, but the escalating trade war is providing some support to the metal. A rise in rate cut bet odds also gave some support to bullion, as traders priced in a nearly 50% chance of a cut in May. A rebound from the psychologically important 3,000 level also sent a signal that gold’s technical structure remains intact.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3035 p Short 3040 p Short 3165 c Long 3170 c | 24% | +380 | -120 |

Short Strangle | Short 3040 p Short 3165 c | 64% | +13700 | x |

Short Put Vertical | Long 3035 p Short 3040 p | 62% | +220 | -280 |

Symbol: Energy | Daily Change |

/CLK5 | -3.52% |

/HOK5 | -3.67% |

/NGK5 | +0.46% |

/RBK5 | -3.31% |

Crude oil futures (/CLK5) fell over 3% to trade below $57 per barrel for the first time since February 2021. The commodity is moving as fear about demand quickly escalates. The trade war expected to subdue the global economy, which means less demand for oil. Meanwhile, OPEC+ is expected to push ahead with plans to push more supply onto the market. The Energy Information Administration (EIA) said crude oil stocks rose 2.55 million barrels, which exceeded estimates calling for a 2.2 million barrel increase.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 54 p Short 54.5 p Short 59.5 c Long 60 c | 27% | +400 | -100 |

Short Strangle | Short 54.5 p Short 59.5 c | +70% | +6210 | x |

Short Put Vertical | Long 54 p Short 54.5 p | 56% | +190 | -310 |

Symbol: FX | Daily Change |

/6AM5 | +1.23% |

/6BM5 | -0.08% |

/6CM5 | +0.56% |

/6EM5 | +0.87% |

/6JM5 | +1.1% |

The Japanese yen (/6JM5) rose on haven demand as traders shun the U.S. dollar amid the escalating trade war. Yen prices (/6JM5) briefly hit the highest levels traded since early October. Traders see the Yen as one of the currencies to help hide from a protracted trade war. U.S. interest rates are expected to fall, and Japan’s fiscal policy has loosened recently, offering traders with some assurances the Yen can withstand a global recession.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0068 p Short 0.00685 p Short 0.0071 c Long 0.00715 c | 34% | +425 | -200 |

Short Strangle | Short 0.00685 p Short 0.0071 c | 64% | +2650 | x |

Short Put Vertical | Long 0.0068 p Short 0.00685 p | 68% | +262.50 | -362.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.