Walmart Earnings Preview —4% Stock Price Move Expected

Walmart Earnings Preview —4% Stock Price Move Expected

By:Mike Butler

The company’ a strong track record for earnings may keep volatility low

Walmart will report quarterly earnings before the market opens on Aug. 15.

The retail giant has exceeded earnings-per-share (EPS) and revenue estimates four quarters in a row.

This quarter, Walmart is expected to report an EPS of $0.65 on $167.38 billion in revenue.

Walmart Earnings Preview

Walmart (WMT) stock has had a strong 2024 after opening the year at $52.42 per share and trading as high as $71.33 a few weeks ago. The stock currently hovers around $69 per share.

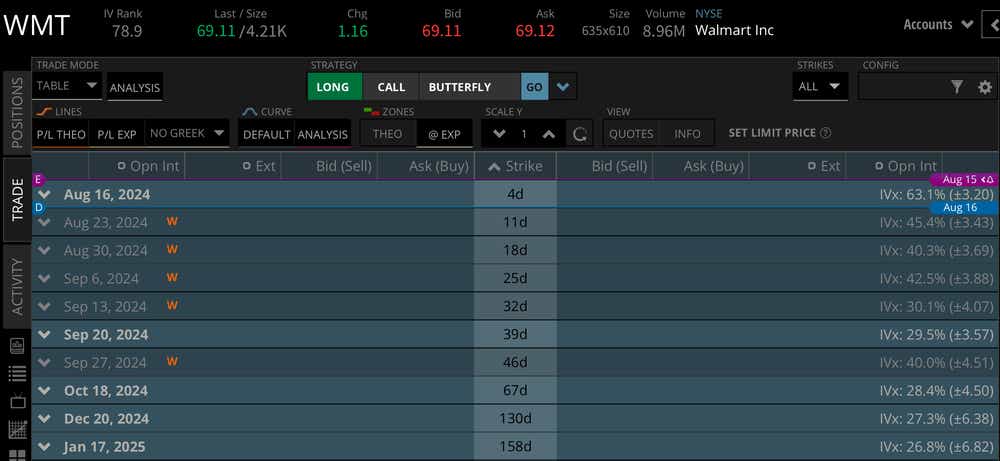

Walmart has had a strong track record when it comes to earnings, which may be why implied volatility is relatively low for this quarter. Not too much uncertainty is being priced into this earnings call, with just a 4% stock price move being priced into the weekly options cycle.

The latest Walmart press release offered strong positive guidance for the rest of FY ’25: ”Looking ahead, the Company issues guidance for the second quarter and expects net sales to increase 3.5% to 4.5% and operating income to grow 3.0% to 4.5%, in constant currency (cc). The Company now expects to be at the high-end or slightly above its previous guidance (cc) for net sales growth of 3.0% to 4.0% and operating income growth of 4.0% to 6.0% for FY ’25."

Walmart has an expected stock price move of +/- $3.20, based on current implied volatility. This is on the lower end, considering other stocks have moved over 10% after earnings this quarter.

With that said, there's only a +/- $6.82 expected move through the January 2025 options cycle, which means this earnings announcement makes up for about half the expected move through the rest of the year and then some. This could be seen as implied volatility being inflated for earnings, or just generally low implied volatility in Walmart stock altogether.

Bullish on Walmart for earnings

It will be interesting to see how the recent market sell-off may affect what is said on the earnings call because many consumers are looking to pinch pennies in uncertain times and that could benefit the sentiment around Walmart the rest of the year. Bullish Walmart traders are looking for another earnings beat, with a sprinkle of positivity for the rest of the year. Any sort of raised guidance could be beneficial for the stock price, especially if Walmart exceeds expectations in a big way.

Bearish on Walmart for earnings

Traders and investors that are bearish on Walmart earnings are looking for the first earnings miss in four quarters. If the retail giant cannot meet or exceed expectations, we could see some selling pressure in the stock price. Especially with implied volatility so high in the rest of the market, investors could be more conservative with capital if things don't go swimmingly for Walmart in a few days.

Be sure to tune in to Options Trading Concepts Live at 11 a.m. CDT on Wednesday. The last time to trade Walmart earnings is Wednesday before the market closes because the announcement will take place Thursday morning before the market opens.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.