Stocks Look Shaky as Wall Street Resists a Global Cheer for China Stimulus

Stocks Look Shaky as Wall Street Resists a Global Cheer for China Stimulus

By:Ilya Spivak

Rising U.S. inflation may not go down well for stocks struggling to stay happy even as China rides to the rescue

China signals it is embracing fiscal stimulus, triggering a global equities rally.

U.S. markets seesaw as Wall Street meets global optimism with heavy selling.

Rising U.S. PCE inflation may cool Fed rate cut bets for 2025, stinging stocks.

Wall Street was in for a wild ride amid hopes for long-awaited fiscal stimulus in China. The official Xinhua News Agency reported that the Politburo—a core group of 24 officials including President Xi Jinping—pledged to deploy government spending and make the beaten-up real estate market “stop declining.”

Details of specific measures were not on offer. However, a Reuters report making the rounds across newswires and citing “people familiar with the matter” suggested the Ministry of Finance (MOF) is planning a 2 trillion yuan ($285 billion) special sovereign bonds issue this year.

Wall Street seesaws as China signals fiscal stimulus embrace

Futures tracking the benchmark S&P 500 stock index surged 0.9% overnight as China’s CSI 300 (ETF: ASHR)—an index of the top stocks on the Shanghai and Shenzhen exchanges—jumped 4.23% and triggered a wave of buying across Asia Pacific and European bourses. However, the rally was met with forceful selling at the U.S. cash equity open, cutting it by more than half.

Investors have pined for China to loosen the government’s purse strings to generate demand. The world’s second-largest economy has been stuck in a deflationary spiral for the past five quarters as cash piled up in bank accounts and investment outlays plunged. A dose of robust spending has been badly needed.

This made the announcement of another dose of monetary stimulus from the People’s Bank of China (PBOC) seem like a let-down earlier this week. Successive rounds of loosening credit conditions had failed to jump-start the economy. Looser borrowing terms are an inducement, but they don’t generate demand by themselves.

U.S. PCE inflation data is a risk for shaky stock markets

It seems entirely sensible for markets to cheer if China is finally prepared for large-scale fiscal stimulus. With Europe’s economy in dire straits and China unable to find footing after the COVID-19 pandemic, two of the world’s top three growth engines have been misfiring. If the U.S. were to stumble, there’d be no offset to prevent a global recession.

If Beijing’s newfound appetite for government largesse was truly to revive the world’s second-largest economy, the risk of such an outcome would appear to be significantly lower. With that in mind, it is curious to see a global equities rally driven by such lofty prospects get stopped dead in its tracks once Wall Street entered the fray in earnest.

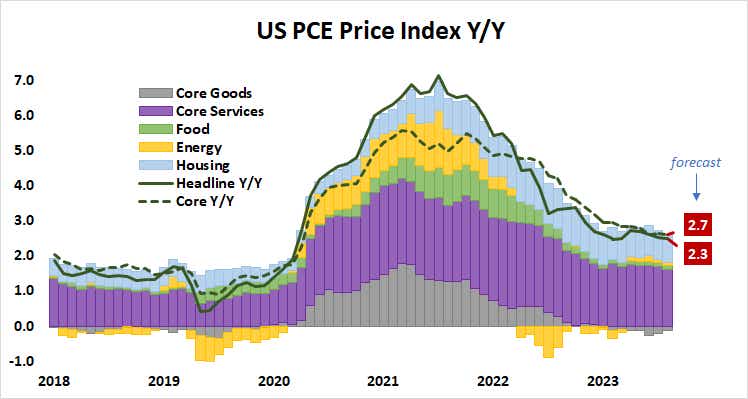

This makes for an ominous backdrop as the spotlight turns to Federal Reserve’s favored measure of inflation, the U.S. personal consumption expenditure (PCE) gauge. It is expected to show that price growth continued to cool in August, falling to 2.3% year-on-year, the lowest since February 2021.

However, the core measure excluding volatile food and energy prices—the focus for central bank officials—is expected to rise to 2.7%. That is eye-catching divergence. If forecasts are met, that would amount to the highest reading on core inflation in four months and the largest rise in the 12-month growth rate since September 2022.

Such a result might work against next year’s Fed rate cut expectations. If risk appetite is struggling to make good on China’s fiscal stimulus embrace and the U.S. central bank looks less likely to rain rate cuts in 2025, stock markets appear vulnerable. The U.S. dollar may head higher as sentiment sours and yield spreads shift in the greenback’s favor.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.