Federal Reserve (FOMC) Meeting Minutes and Global PMI Data: Macro Week Ahead

.jpeg?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

Federal Reserve (FOMC) Meeting Minutes and Global PMI Data: Macro Week Ahead

By:Ilya Spivak

Is the stock market sleepwalking into global recession as U.S. growth slows?

- Bonds are seesawing as the markets digest U.S. CPI and PPI inflation data.

- Worries about slowing U.S. growth may take center stage from here.

- FOMC meeting minutes and the S&P Global PMI update are in focus next.

There was much fire and fury in the bond market as January’s U.S. consumer price index (CPI) data revealed inflation unexpectedly picked up last month. Bonds sank and yields shot higher as traders reconsidered the likely path for interest rate cuts at the Federal Reserve.

Equities and currencies were more circumspect, however. Stocks fell on Wall Street and the U.S. dollar rallied as the CPI data appeared, but these moves were mostly erased by the end of the trading day. This may have reflected conflicting cues in the report’s internals, suggesting temporary forces were hiding a cooldown in the service sector.

This patience was rewarded as producer price index (PPI) data offered a more measured view, pulling bonds sharply higher to reverse nearly all of the previous day’s selloff. The headline reading came in at 3.5% year-on-year. That was higher than the 3.2% expected by analysts but also unchanged from an upwardly revised December figure.

Has the bond market found a lasting bottom?

The core PPI gauge that excludes volatile food and energy prices painted a similar picture. The reported rise of 3.6% year-on-year topped forecasts calling for 3.3% but also marked a step lower from a revised 3.7% previously. On balance, traders seemed to conclude that wholesale inflation was no worse in January than the month before.

Treasury yields’ retreat was greeted favorably by stock markets, with all of the major U.S. equity indexes recording gains in the PPI report’s wake. Comments from President Trump and Commerce Secretary Lutnick suggesting their plan for broad “reciprocal” tariffs won’t materialize earlier than April helped buoy sentiment. The U.S. dollar fell.

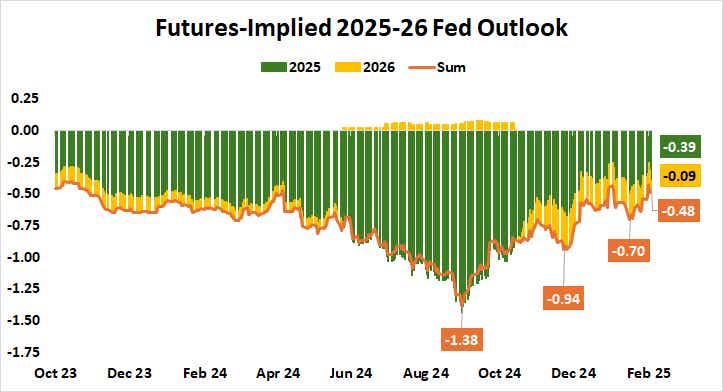

All this commotion notwithstanding, the Fed rate cut outlook priced into benchmark Fed Funds futures has barely budged. The week began with traders betting on 36 basis points (bps) in easing this year. The tally inched a bit lower to 31bps after the PPI release, having fallen as low as 26bps following the CPI print. It is ending the week at 39bps.

With only one standard-sized 25bps cut thus firmly on the menu, the markets may have a hard time getting more hawkish without some sense of a holistic rethink at the Fed. As long as policymakers’ loudly stated intent remains to lower rates in 2025, there seems little speculative room to dilute expectations further.

FOMC meeting minutes, global PMI data now in focus

The next Federal Reserve policy meeting is far removed in March, so minutes from January’s meeting of the rate-setting Federal Open Market Committee (FOMC) may be the next best opportunity to size up officials’ thinking. If they are generally committed to a stimulus agenda, the priced-in path is already so stingy that yields may have topped in earnest.

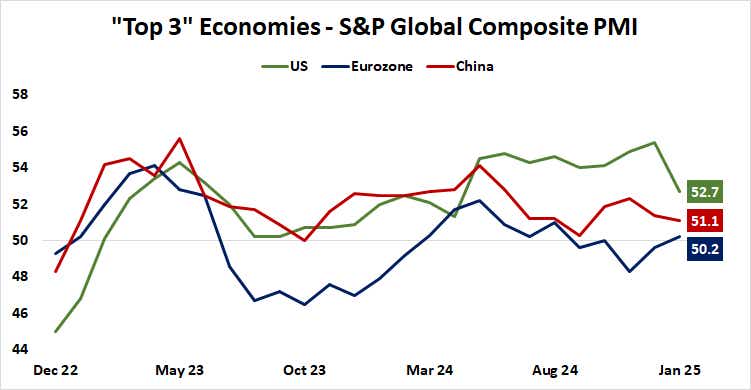

Meanwhile, February’s purchasing managers’ index (PMI) data from S&P Global will help determine if last month’s shocking downturn was a fluke or the start of a broader trend for economic activity growth. If it continues to cool as momentum in the other key economies—the Eurozone and China—remains absent, a global recession may follow.

The possibility of such a scenario found additional support in the latest round of U.S. retail sales data, which proved to be disappointing (as expected). Receipts fell 0.9% in January, whereas median forecasts anticipated a narrow 0.1% decline. Bonds may power higher if growth concerns take root, while stocks and the dollar are on weaker footing.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.