Tesla & Microsoft Earnings in Sight: What Can Traders Expect?

Tesla & Microsoft Earnings in Sight: What Can Traders Expect?

Microsoft (NASDAQ:MSFT)

Microsoft reports 4th quarter earnings on Tuesday, January 24th at 3:05pm CST just after the closing bell. The stock has been trading rangebound to start the year, opening the year just below $240 and presently trading around that price. As one of the top 5 largest companies in the world, MSFT has seen year over year revenue continue to balloon - to just under 200 billion in 2022. Microsoft did recently announce the layoff of nearly 10,000 employees but parlayed that news with a strategic investment in OpenAI ChatGPT, an AI chat bot that has absolutely exploded in popularity since its launch.

MSFT has a current weekly implied volatility (through Jan27th) of 46.5%, implying an expected move of $10.85 through the week of earnings – a roughly +/- 4.5% expected move in the stocks price.

I’m taking a bullish trade into earning, long the 240 call in the March 17th monthly expiration, and short the 250 call in the January 27th weekly expiration for a net debit of $8.64. This trade is long around 28 delta, with positive gamma so the trade gets bigger the more directionally correct (the more the stock goes up).

Tesla (NASDAQ:TSLA)

Tesla reports 4th quarter earnings on Wednesday, January 25th at 3:05pm CST just after the closing bell. Daddy Elon has been busy – the acquisition of TWTR has been a polarizing subject for both bulls and bears which are fervent on both sides of the isle. Has twitter pulled his focus and attention in the short term? Probably. The stock had a brutal run in 2022, but has seen a slight rally from the lows to start 2023. Tesla also recently slashed prices of their cars, and the retail car market has seen sales drop drastically as interest rates continue to hinder consumers who now face higher financing costs.

TSLA has a current weekly implied volatility (through Jan27th) of 93.5%, which implies a roughly $12.70 expected move through the week of earnings – roughly a +/- 10% move in the stocks price.

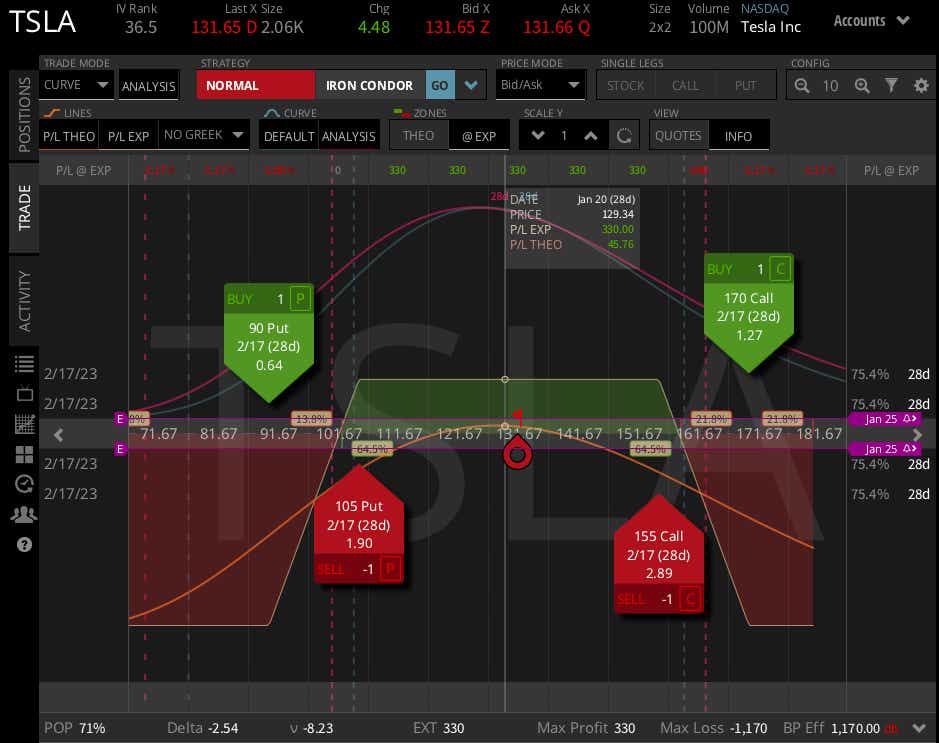

Could there possibly be more bad news for TSLA sentiment? Sure. But I think all the bad news is backed into the current stock price – which is why I’m trading this one directionally neutral. I’m going into the February 17th month expiration, selling the 105/90 short put spread and the 155/170 short call spread for a net credit of $3.30.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.