Netflix (NFLX) Q4 Earnings Review: How the Market Digested the Earnings Report

Netflix (NFLX) Q4 Earnings Review: How the Market Digested the Earnings Report

By:Mike Butler

Netflix Q4 Earnings Data

- Netflix reported a big suprise in the addition of 7.66 million paid subscribers in Q4, which was well over the roughly 4.5 million the market was expecting.

- Earnings Per Share (EPS) came in at 12c per share, well under the projected 45c per share

- Revenue came in as expected at 7.45 billion

- Netflix has introduced an advertising tier, allowing subscribers to pay a lower subscription in exchange for viewing ads

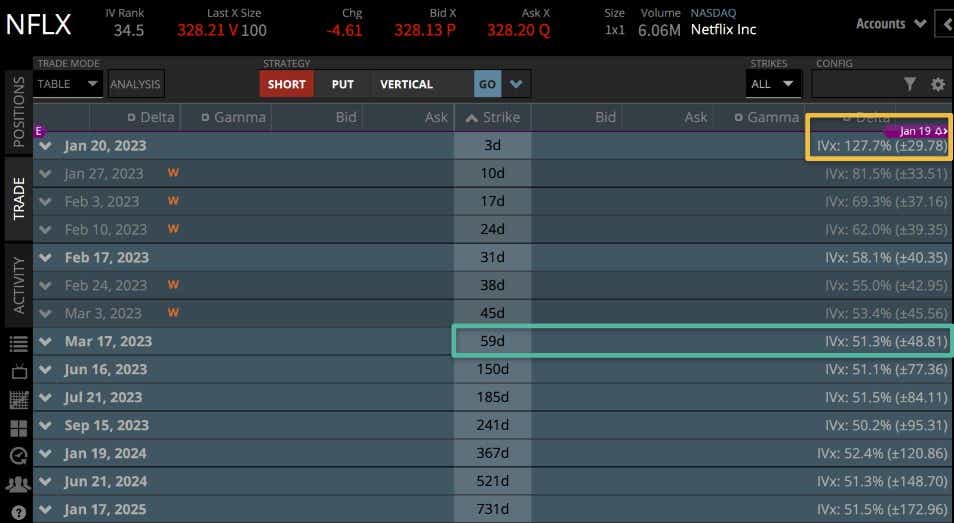

On January 19th Netflix closed at $315.78 and rallied about $20 after the earnings report after-hours, but it was within the expected move of around +-$30 based on implied volatility the previous day:

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Netflix Earnings - Before & After

It’s always interesting to see how the market perceived the earnings report prior to the announcement, and comparing this data to the actual move:

The image above was from the NFLX Earnings Preview article where we analyzed the market perception for this earnings announcement – As of January 23rd NFLX has rallied up to right around $360, continuing its bullish move from the announcement itself:

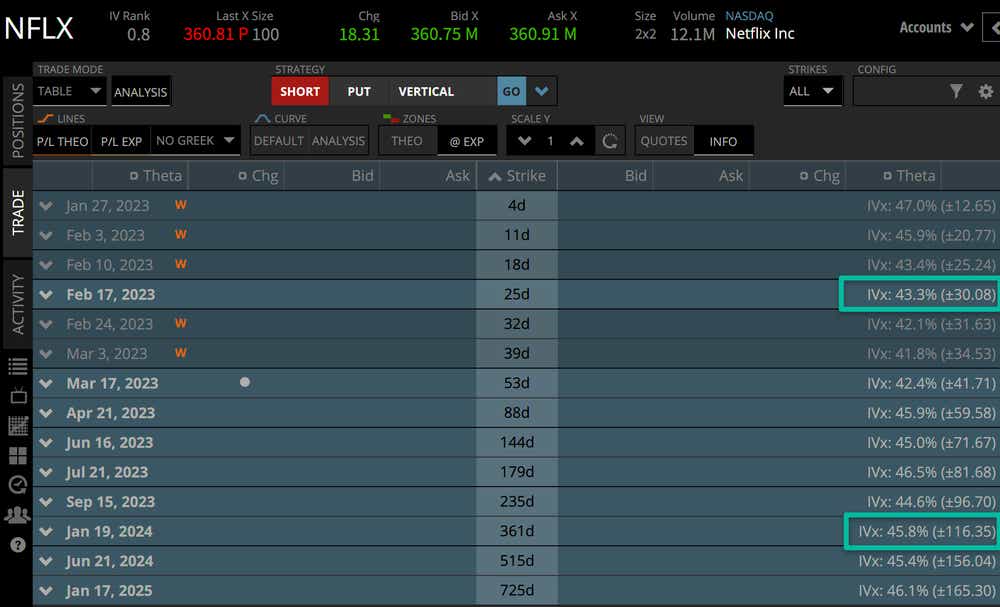

In an astonishing turn of events, NFLX has almost completely recovered from the massacre it realized in April of 2022. NFLX currently has an expected move for the February monthly cycle of +-$30.08 which is just under 10% of the current stock price:

If we go out a bit further in time though, we can see the expected move from now until the anniversary of this earnings announcement on January 19th is well over +-100 points at +-$116.35, which is about 32% of the current stock price.

The implied volatility of the monthly cycles also came down to around 45% from the earnings environment of around 50%, which is typical after an earnings announcement is made.

With an extremely low IV Rank reading at 0.8, the market is telling us that the current implied volatility levels are at the low of the previous 52 week period – this means that the market is not expecting too much turbulence in the stock as of now. Still, we’re seeing big chunk moves every day regardless.

Tune into Options Trading Concepts live daily at 11am CST for more day-to-day analysis of stocks like NFLX, and other big name players that are announcing earnings in the near future!

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.