Netflix (NFLX) Q4 Earnings Preview: What to Expect?

Netflix (NFLX) Q4 Earnings Preview: What to Expect?

By:Mike Butler

When does Netflix (NFLX) report earnings?

Netflix (NFLX) has rallied almost 10% from its 2023 opening price of $298.06, and they are set to report their quarterly earnings on Thursday, January 19th after the market closes. With such a strong rally at the end of 2022 and into the beginning of this year, expectations are quite high for the report:

Netflix Q4 earnings: what can traders expect?

Looking deeper into the options market, we can gather information related to the earnings announcement itself. Options prices help us understand the market’s expectation of the binary event, and we can use these options prices for different expirations to determine the implied volatility and expected move of the stock for the earnings announcement.

We can also weigh that expected move to other expiration cycles to determine just how much of an expected move the market is pricing in relative to further-dated cycles:

In the image above, we can see that the options market is pricing in a +-29.78 expected move for the rest of the week, which contains the earnings announcement for NFLX. As we get closer to Thursday the 19th, the expected move that remains in this cycle will be even more concentrated around the earnings announcement. As it stands though, the market expects about a 10% move in either direction for this earnings announcement.

Comparing that to the March monthly expiration cycle, which shows us an expected move of +-48.81, we can see that the market is expecting a lot of the movement over the next 59 days to potentially come from this earnings announcement – in other words, the market is placing a lot of weight on this announcement for stock price movement compared to daily movement without a binary event.

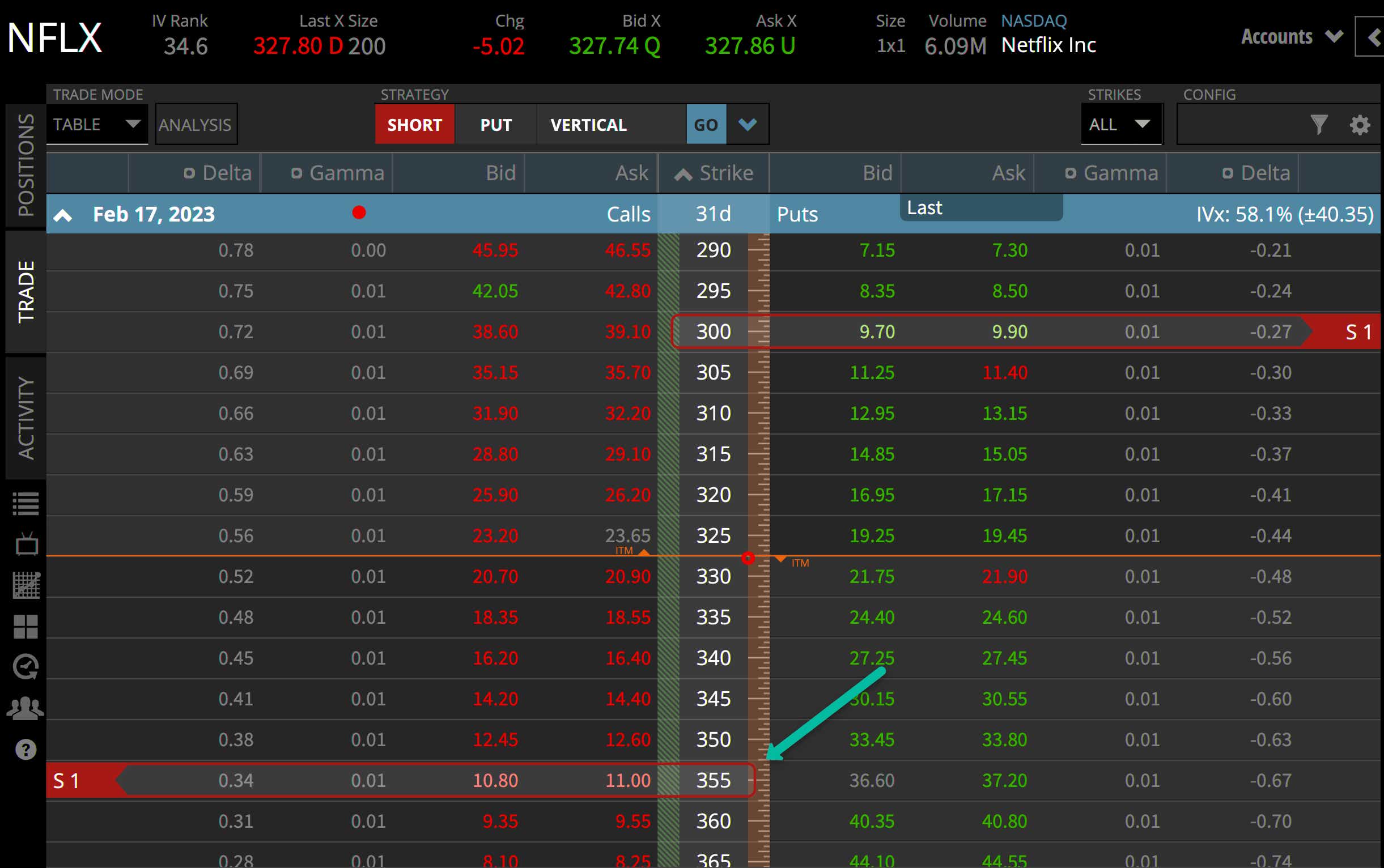

Let’s look at put vs call options in the image below to see if there is any market skew:

SKEW tells us where the market perceives the risk of a high velocity move to be – it doesn’t tell us where the stock is going – we simply cannot know that with certainty until it happens.

With NFLX trading at just under $328, we can go to the 300-strike put and 355-strike call to get an equidistant range from the current stock price of around 28 points. If the market did not exhibit a skew, these options' prices would be very similar.

As we can see in the image above, the 355 call is trading for a mid-price of $10.90, while the 300-strike put is trading for a mid-price of $9.80. The call side is where the skew exists currently, as that is where the higher-priced option is.

This tells us that the market perceives the risk of a high velocity move to be to the upside on an earnings announcement beat, rather than to the downside on an earnings miss. Still though, the market can move in either direction – skew just tells us where the market perceives a high-velocity move to be.

All eyes will be on NFLX on Thursday, January 19th when we finally see what the results of their quarterly earnings are, and how the stock and options markets digest the information.

Tune in to Options Trading Concepts Live at 11am CST daily on tastylive.com or the tastylive YouTube channel for an in-depth breakdown of NFLX earnings strategies prior to the announcement, and for a post-announcement review of what happens!

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.