Oil Prices Rise Despite EIA Report and Risk-off Wall Street Move

Oil Prices Rise Despite EIA Report and Risk-off Wall Street Move

West Texas Intermediate was about 1.2% higher in afternoon trading on Thursday, which put the benchmark back in the green for January. A risk-off move in equity and bond markets prompted by interest rate fears that started overnight on hawkish commentary from European Central Bank (ECB) President Christine Lagarde failed to weigh on the U.S. oil benchmark. The Dow Jones futures (/YM) traded about 0.4% lower in the last hour of Wall Street trading.

The U.S. Energy Information Administration (EIA) reported a crude oil commercial inventory build of 8.4-million-barrels for the week ending January 13. That saw inventory at about 3% above its 5-year average. Despite rising production, gasoline and distillate fuel stocks remain well below their 5-year averages at 8% and ~20%, respectively.

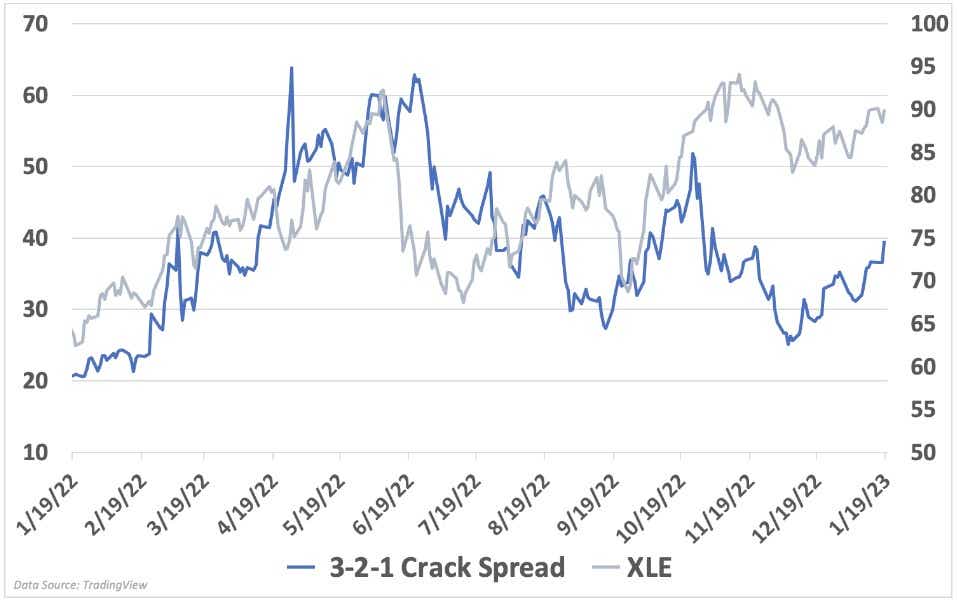

Crack spreads—a theoretical measure of a refiner’s profit margin—surged higher on Thursday. The 3-2-1 spread, representing the theoretical profit a refiner makes from diesel and gasoline from a single barrel of oil, hit 39.42—the highest level since early November. That explains the energy sector’s outperformance on Wall Street today. A rising crack spread provides a somewhat reliable signal that oil stocks will outperform the broader market on risk-off days.

Corporate Earnings May Influence Oil Sentiment

The elevated crack spreads bode well for oil producers, a trend that was present throughout most of 2022. Halliburton (HAL), Chevron (CVX) and Exxon Mobil (XOM) are scheduled to report results on January 24, January 27, and February 7, respectively. Occidental Petroleum (OXY)—a Warren Buffett favorite—will report on February 27.

Despite returning record profits to shareholders and a longer-term shift to renewables, Exxon intends to increase its oil and gas production by 4 million barrels per day over the next five years. Displaced Russian oil is underpinning U.S. export demand. That is encouraging producers to ramp up operations gradually. The upcoming earnings announcements should provide additional guidance for investors.

Crude oil volatility has decreased recently as prices recovered their early-year losses. For those with a bullish bias, a long call vertical spread would be one way to trade prices with a defined risk. Assuming the directional bias is correct, implied volatility should drop further as prices rise, helping the position. The image below illustrates the P/L dynamic of the trade.

IEA Report Paints Bullish Picture for Crude Oil Prices

Despite recession fears, a bullish supply and demand outlook favors further upside for oil prices. On Thursday, the Paris-based International Energy Agency (IEA) forecasted global oil demand to rise to a record high of 101.7 million barrels per day (mb/d) in 2023. Supply growth is expected to moderate from 4.7 mb/d to only 1 mb/d.

China’s reopening and strong jet fuel demand should act as tailwinds for demand growth. Rosy expectations from airlines and strong 2022 results support those views. Michael O’Leary, CEO of Ryanair, recently said he sees “no signs” of slowing economic growth affecting airlines. United Airlines expects a first-quarter capacity increase of about 20% from 2022.

An expected supply drop of about 870,000 barrels per day is expected from OPEC+, with Russia making up the bulk of the losses. A 200,000 barrel per day drop in Russia’s December exports highlighted the impact of Western sanctions, although the report cautions a high degree of uncertainty in its forecast. The IEA expects the United States to lead supply growth in 2023. Overall, oil prices look primed for further upside in the short term.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.