Will Downbeat PMI Data Sour the Chipper Mood in Global Markets?

Will Downbeat PMI Data Sour the Chipper Mood in Global Markets?

By:Ilya Spivak

Optimism rules financial markets one day after the Fed started rate cuts. Will it last?

- Financial markets cheered after traders took the time to digest the Fed action on interest rates.

- Stock price action hints at rate cuts as jet fuel, not a lifeline for the economy.

- Global PMI data may bring another seesaw if a lack of growth disappoints investors.

Initially, financial markets offered a circumspect response as the Federal Reserve appeared to deliver on all their dovish dreams with this week’s much-anticipated policy announcement. The central bank opted for a double-sized 50-basis-point (bps) rate cut and endorsed priced-in forecasts for at least 100bps in further easing in 2025.

Stock market and gold prices burst higher and the U.S. dollar tumbled at first, seemingly marking the dovish tilt in the Fed’s offering, then rapidly reversed course. Wall Street finished the day with narrow losses for the major equity indexes, as did precious metals. Interest rates edged up along the curve and the greenback closed little changed.

Financial markets whipsaw as traders digest Fed rate decision

On balance, this seemed reflective of the markets shedding speculative interest in an outcome that delivered squarely in line with expectations, no more nor less. Having been given what they wanted, traders appeared to have concluded that a near-term narrative had ended and moved to unwind exposure accordingly.

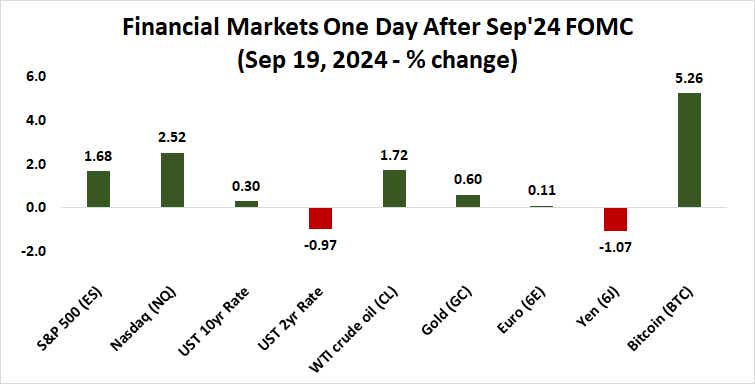

The mood has brightened markedly since then. A risk-on rethink seems to be evident across the major asset classes. U.S. stocks are roaring higher, gold is up, the dollar is shedding ground against all its major counterparts save for the Japanese yen, and a steepening of the 10-to-two-year U.S. Treasury yield curve speaks to reflation.

Taken together, this paints a picture of unmistakable confidence. Investors seem to be saying a near-global easing cycle now joined by the most influential of central banks has come at a time when growth is strong enough that cheaper credit will amount to jet fuel instead of a lifeline for the world economy.

Global PMI data to signal if markets are right about global growth

Testing the markets’ faith in this rosy vision will come by way of September’s round of purchasing managers’ index (PMI) data from S&P Global. Economists’ projections appear to be generally benign, with mild slowing envisioned in the U.S. and Japan alongside steady conditions in Europe and Australia.

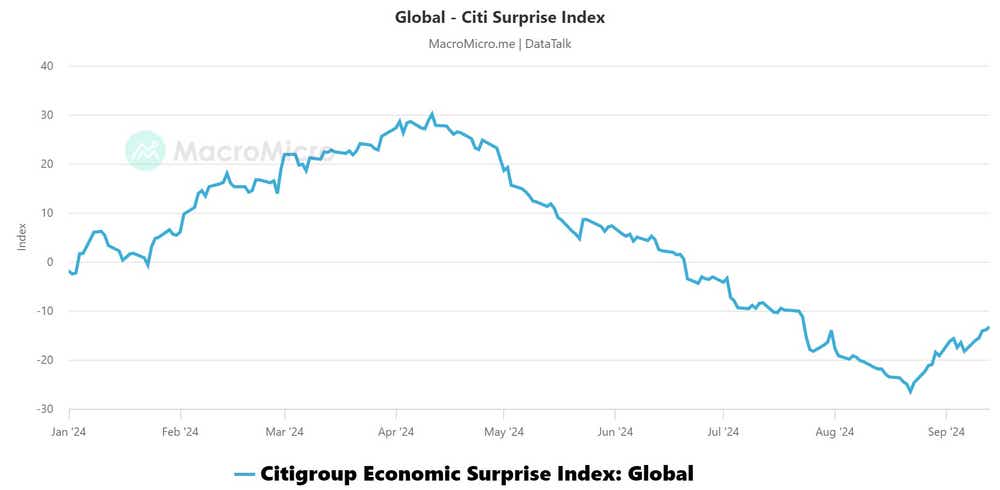

However, analytics from Citigroup warn that global economic data outcomes continue to be biased toward disappointment relative to consensus forecasts. A dismal data set signaling that global growth is on weaker footing than anticipated may push against a pillar of the markets’ newfound optimism, triggering yet another seesaw.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.